Narratives are currently in beta

Key Takeaways

- Expansion of TTR franchise and CNS pipeline diversification could significantly boost revenue and long-term potential through strategic therapeutic development.

- Strategic focus on global market penetration and metabolic disorders aims to optimize profitability and resource allocation for enhanced earnings growth.

- Rising competition and strategic shifts in R&D priorities could impact revenue growth and margins, with volatility in international markets and increased marketing investment pressures.

Catalysts

About Alnylam Pharmaceuticals- A biopharmaceutical company, focuses on discovering, developing, and commercializing novel therapeutics based on ribonucleic acid interference.

- Alnylam’s potential launch of vutrisiran for ATTR cardiomyopathy in 2025, pending regulatory approval, is expected to expand their flagship TTR franchise significantly, which could increase revenue.

- The robust CNS pipeline, with ALN-HTT02 for Huntington’s disease and mivelsiran for early onset Alzheimer’s, has multiple Phase I studies underway, indicating potential for future revenue growth through diversification of therapeutics.

- Alnylam plans to file proprietary INDs for 9 programs by the end of 2025, aiming to nearly double their clinical pipeline, enhancing long-term revenue potential.

- Their continued global expansion, reflected in regulatory submissions and strong international patient demand, aims to optimize revenue growth and net margins through increased market penetration.

- The company’s strategic focus on sustainable profitability while exploring additional metabolic disorder targets could positively impact earnings by optimizing resource allocation to high-potential areas.

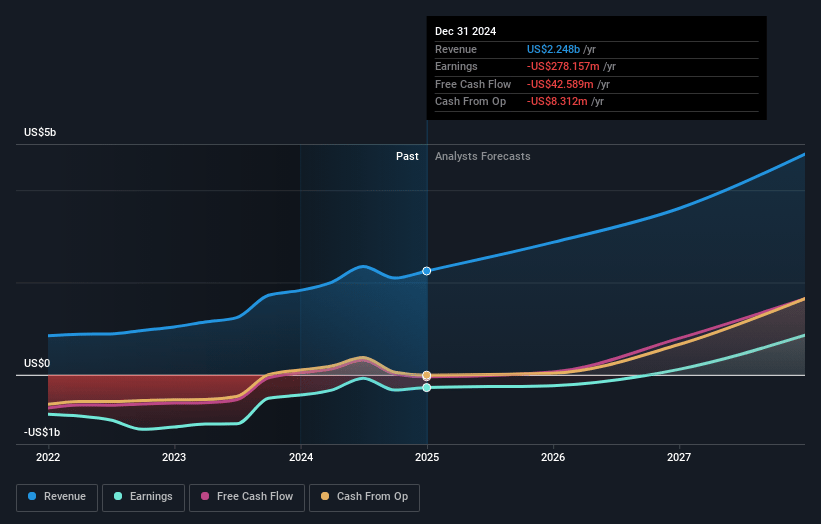

Alnylam Pharmaceuticals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Alnylam Pharmaceuticals's revenue will grow by 25.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -15.9% today to 20.1% in 3 years time.

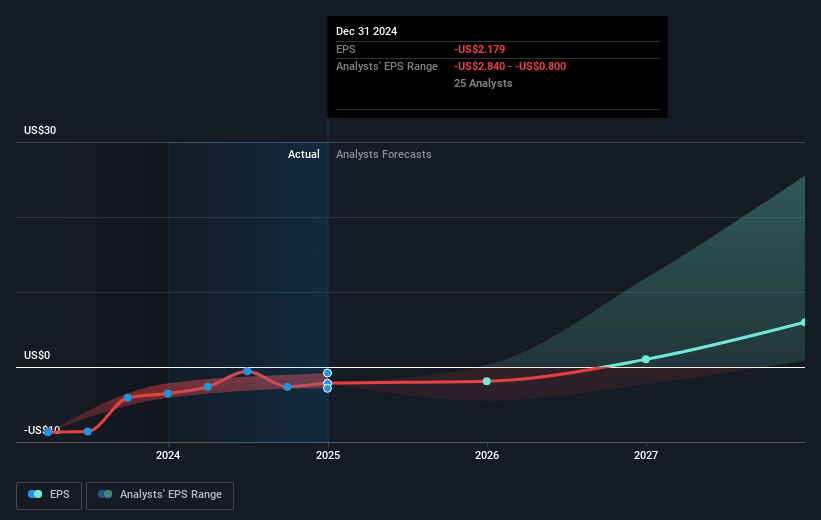

- Analysts expect earnings to reach $830.8 million (and earnings per share of $5.83) by about November 2027, up from $-332.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.2 billion in earnings, and the most bearish expecting $-62.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 61.8x on those 2027 earnings, up from -90.9x today. This future PE is greater than the current PE for the US Biotechs industry at 17.2x.

- Analysts expect the number of shares outstanding to grow by 3.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.27%, as per the Simply Wall St company report.

Alnylam Pharmaceuticals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Competition is increasing, as indicated by stable growth despite new competitors entering the market at the end of 2023, which could pressure Alnylam’s revenue from its TTR franchise.

- International TTR revenue decreased by 9% from the second quarter due to gross to net adjustments and large prior orders, reflecting potential volatility in revenue from these markets.

- Discontinuation of clinical development for ALN-KHK in type 2 diabetes reflects strategic prioritization but could indicate potential risks in pipeline execution and misallocation of R&D resources, impacting future earnings potential.

- A significant decrease in collaboration revenue compared to last year due to non-recurring payments from partnerships (e.g., Roche), which may impact overall company revenue growth if not offset by new collaborations.

- Increasing non-GAAP SG&A expenses due to marketing investments and preparations for potential new product launches could pressure net margins if revenue growth does not keep pace.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $301.21 for Alnylam Pharmaceuticals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $400.0, and the most bearish reporting a price target of just $178.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $4.1 billion, earnings will come to $830.8 million, and it would be trading on a PE ratio of 61.8x, assuming you use a discount rate of 6.3%.

- Given the current share price of $234.27, the analyst's price target of $301.21 is 22.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives