Key Takeaways

- Positive clinical results and safety profile of NK cell engagers boost potential revenue and adoption, enhancing net margins and efficacy.

- Strategic partnerships and capitalization efforts aim to improve financial stability and investor confidence, supporting long-term operations and earnings growth.

- Decreasing cash reserves, minimal revenue, and reliance on strategic partnerships indicate potential financial instability and uncertain future earnings for Affimed.

Catalysts

About Affimed- A clinical-stage biopharmaceutical company, focuses on discovering and developing cancer immunotherapies in the United States and Germany.

- Affimed's three clinical assets have shown clinical proof of concept across both solid tumors and hematologic malignancies, with positive results in monotherapy and combination studies, suggesting potential future increases in revenue from successful product development and market entry.

- The differentiated safety profile of Affimed's NK cell engagers, which reduces the risk of toxicity compared to other treatments, could improve adoption rates and patient outcomes, potentially enhancing net margins through higher efficacy.

- Upcoming key clinical updates at the ASH 2024 conference and future scientific meetings will provide new data that could significantly impact clinical validation and investor confidence, potentially driving future earnings growth as these assets progress towards commercialization.

- Focus on expanding strategic partnerships and collaborations to accelerate development and extend cash runway, which could lead to new revenue streams and improve the financial stability of the company.

- Management's emphasis on improving financial health and securing adequate capitalization indicates a commitment to sustaining long-term operations and strategic focus, which could enhance investor confidence and facilitate future investment, improving net earnings.

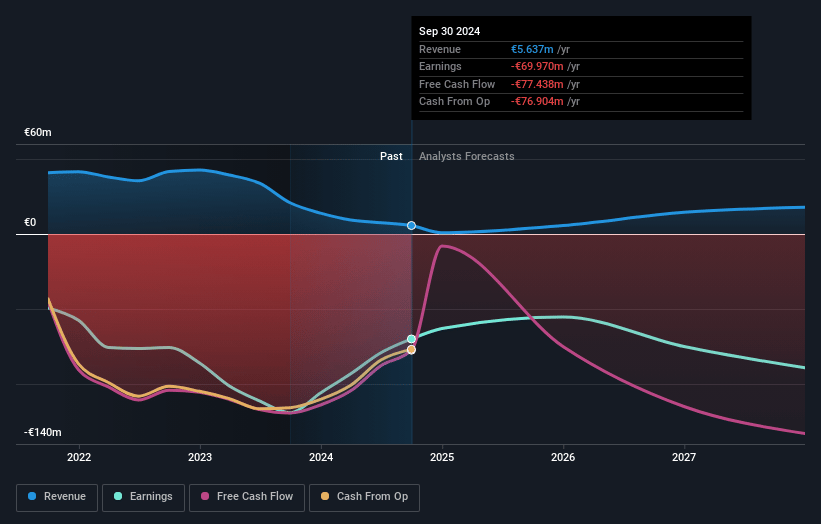

Affimed Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Affimed's revenue will grow by 44.4% annually over the next 3 years.

- Analysts are not forecasting that Affimed will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Affimed's profit margin will increase from -1241.3% to the average US Biotechs industry of 15.9% in 3 years.

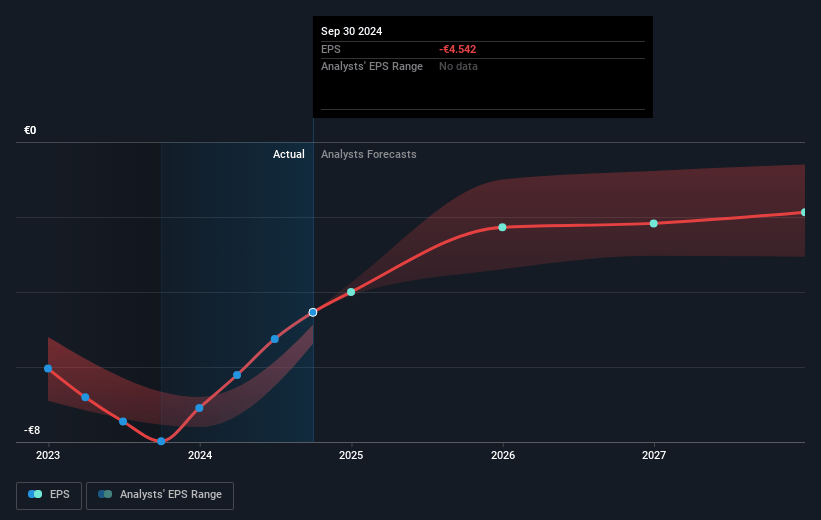

- If Affimed's profit margin were to converge on the industry average, you could expect earnings to reach €2.7 million (and earnings per share of €0.13) by about May 2028, up from €-70.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 105.8x on those 2028 earnings, up from -0.2x today. This future PE is greater than the current PE for the US Biotechs industry at 20.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.83%, as per the Simply Wall St company report.

Affimed Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's cash reserves have decreased significantly from €72 million at the end of 2023 to €24.1 million in the third quarter of 2024, indicating potential short-term financial instability, which could affect operations and future revenue generation.

- Affimed's minimal current revenue (€0.2 million for the third quarter of 2024) highlights the challenge of generating substantial income from its product pipeline in the near term, potentially impacting earnings.

- The company is relying on strategic partnerships and potential collaborations to improve its financial position, which introduces uncertainty regarding revenue sources and could affect net margins if these do not materialize or meet expectations.

- Major reliance on clinical trials and the uncertainty associated with obtaining regulatory approvals pose risks to future revenue and profitability, given that positive outcomes are not guaranteed.

- Economic performance is heavily tied to external factors such as competitive pressures, regulatory changes, and market dynamics within the biotechnology industry, which could adversely impact Affimed's net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $12.912 for Affimed based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $26.92, and the most bearish reporting a price target of just $5.38.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €17.0 million, earnings will come to €2.7 million, and it would be trading on a PE ratio of 105.8x, assuming you use a discount rate of 7.8%.

- Given the current share price of $0.99, the analyst price target of $12.91 is 92.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.