Key Takeaways

- Restructuring and workforce reduction aim to improve profitability while enhancing monetization channels to boost revenue.

- Deployment of AI capabilities and subscription growth suggest potential for sustained revenue growth and user engagement.

- Heavy reliance on new products like AI features must succeed to offset declining legacy segments, amid regulatory risks and restructuring-related operational disruptions.

Catalysts

About Zedge- Zedge, Inc. builds digital marketplaces and competitive games around content that people use to express themselves.

- The return of TikTok to the app stores is expected to boost advertising demand and increase CPMs, positively impacting Zedge's advertising revenue in the coming quarters.

- The company's restructuring plan, which includes a substantial reduction in workforce and closure of the Norway office, aims to save approximately $4 million annually, thus improving net margins and profitability.

- The growing subscription revenue, which increased by 13% year-over-year, and the expansion of new and higher-value subscription offerings indicate sustained revenue growth and enhanced earnings potential.

- The development and deployment of Gen AI capabilities, such as image-to-image editing and AI audio creation tools, are expected to drive user engagement and open new monetization opportunities, potentially increasing revenue.

- Zedge's focus on optimizing and expanding monetization channels, including Zedge Premium and rewarded video usage, is likely to boost gross transaction volume (GTV) and improve overall earnings.

Zedge Future Earnings and Revenue Growth

Assumptions

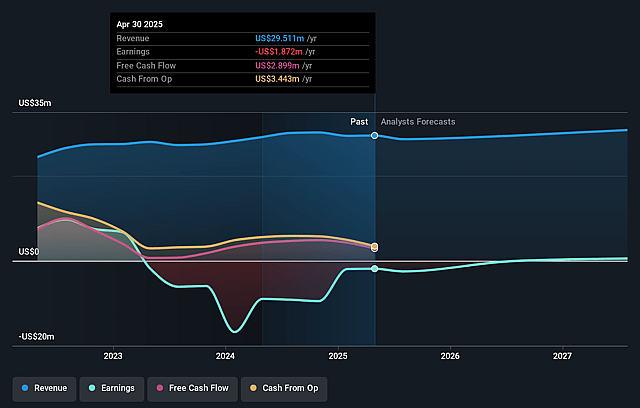

How have these above catalysts been quantified?- Analysts are assuming Zedge's revenue will grow by 1.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from -6.3% today to 2.6% in 3 years time.

- Analysts expect earnings to reach $798.2 thousand (and earnings per share of $0.06) by about August 2028, up from $-1.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 94.7x on those 2028 earnings, up from -22.0x today. This future PE is greater than the current PE for the US Interactive Media and Services industry at 13.5x.

- Analysts expect the number of shares outstanding to decline by 3.62% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.01%, as per the Simply Wall St company report.

Zedge Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The unclear regulatory status and temporary ban of TikTok caused a significant decline in ad revenue, which remains a risk if future restrictions or issues arise, potentially recurring impacts on Zedge's revenue.

- The company experienced a 10% year-over-year decline in total revenue primarily due to industry-wide advertising headwinds, impacting overall financial performance.

- Continued challenges with GuruShots, with a 33% year-over-year revenue decline, highlight potential weaknesses in sustaining or growing user engagement, impacting revenue generation.

- Restructuring efforts, while aimed at improving profitability, include significant workforce reductions, which may lead to short-term operational disruptions and affect long-term growth prospects, impacting net margins and earnings.

- Heavy reliance on new or emerging products such as AI features and other innovations must be successfully executed to compensate for declining legacy segments, posing execution and market acceptance risks that could affect future revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.0 for Zedge based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $31.2 million, earnings will come to $798.2 thousand, and it would be trading on a PE ratio of 94.7x, assuming you use a discount rate of 8.0%.

- Given the current share price of $3.02, the analyst price target of $5.0 is 39.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.