Narratives are currently in beta

Key Takeaways

- TEGNA's AI and automation focus is set to boost efficiency, enhancing operating margins and profitability.

- Expanding digital channels and securing local sports rights aim to grow revenue and audience engagement.

- Declining traditional TV viewership and advertising, coupled with decreasing subscription revenue and cyclical political advertising, threaten TEGNA's revenue stability and margins.

Catalysts

About TEGNA- Operates as a media company in the United States.

- TEGNA's focus on leveraging AI and automation to improve product offerings and drive efficiency is expected to enhance operating margins and profitability over time.

- The company's strategy to deepen user engagement through digital channels could potentially increase revenue by expanding its online audience and reach.

- TEGNA’s opportunity to secure local sports rights could enhance advertising revenue and audience engagement, contributing positively to both top-line growth and brand strength.

- A strong emphasis on cost reduction and management, with expected annualized savings of $90 million to $100 million by 2025, is likely to improve net margins and free cash flow.

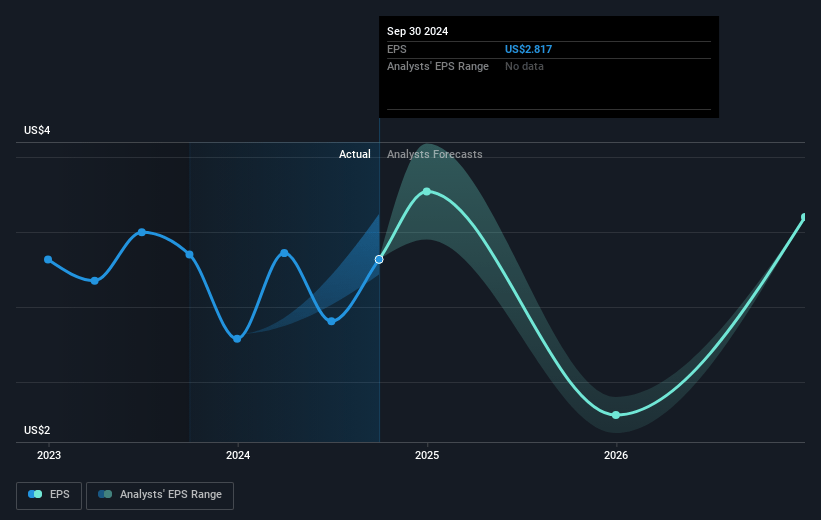

- Share repurchase activities and capital allocation policy, including returning 40%-60% of adjusted free cash flow to shareholders, are expected to support earnings per share (EPS) growth.

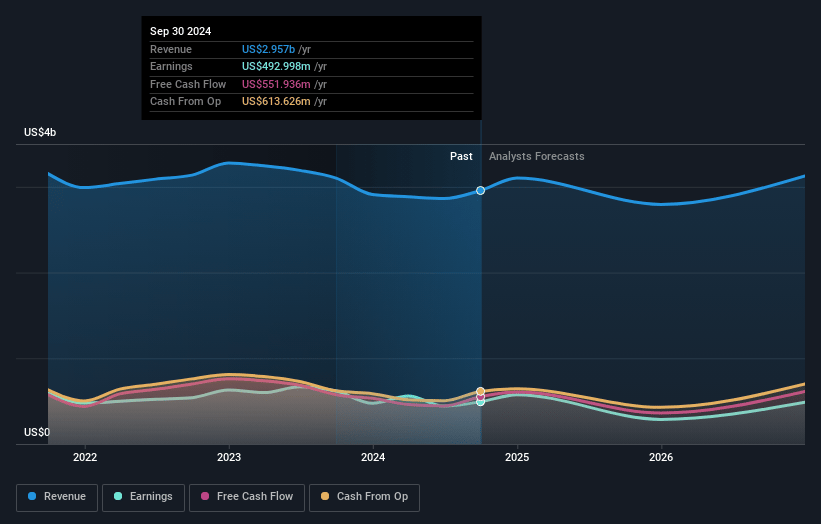

TEGNA Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming TEGNA's revenue will decrease by 0.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 16.7% today to 11.7% in 3 years time.

- Analysts expect earnings to reach $351.5 million (and earnings per share of $2.52) by about November 2027, down from $493.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.3x on those 2027 earnings, up from 6.0x today. This future PE is lower than the current PE for the US Media industry at 14.6x.

- Analysts expect the number of shares outstanding to decline by 4.71% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.07%, as per the Simply Wall St company report.

TEGNA Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The digital transformation has led to a decline in traditional TV viewership, with pay TV homes decreasing by 5% to 7% per year and TV advertising declining by 3% to 5% per year, which could negatively impact TEGNA's future revenues and net margins.

- There is a risk of underutilizing automation and AI within TEGNA's processes, which could lead to inefficiencies and higher operational costs, impacting earnings.

- Subscription revenue decreased by 6% year-over-year, highlighting a potential vulnerability in TEGNA's revenue streams if this trend continues.

- The continued softness in national customer advertising and core categories like automotive, retail, and home improvement could affect advertising and marketing services revenues.

- Political advertising, which currently drives revenue growth, is cyclical and may not match current levels in future, potentially affecting revenue stability in non-election years.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $20.7 for TEGNA based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $23.0, and the most bearish reporting a price target of just $18.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $3.0 billion, earnings will come to $351.5 million, and it would be trading on a PE ratio of 10.3x, assuming you use a discount rate of 8.1%.

- Given the current share price of $18.47, the analyst's price target of $20.7 is 10.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives