Key Takeaways

- Strengthened partnerships and a diverse film slate, including local language and event cinema, expand global reach and bolster revenue and market share.

- Global network expansion and advancements in technology improve installations' appeal, driving revenue growth and enhancing margins through operational leverage.

- Overreliance on China and joint ventures, combined with market saturation and streaming service challenges, could threaten IMAX's financial stability and earnings.

Catalysts

About IMAX- Operates as a technology platform for entertainment and events in the United States, Greater China, rest of Asia, Western Europe, Canada, Latin America, and internationally.

- IMAX's strengthened partnerships with filmmakers and studios, including the biggest IMAX film slate ever and high-profile collaborations like a landmark deal with Netflix, bolster revenue projections by expanding content offerings and increasing global market share.

- The dramatic turnaround and record-breaking performance in the Chinese New Year box office demonstrate a recovery in a key market, positively impacting revenue and net margins as local language films tap into higher box office shares and joint venture systems generate substantial income.

- The global expansion of the IMAX network, with significant system signings and installations, particularly in high revenue-generating markets like Japan and Western Europe, is expected to drive revenue growth and improve EBITDA margins through operational leverage.

- IMAX's diversification into local language films and expansion into event cinema programming, such as exclusive releases for major events and concerts, enhance overall audience reach and incremental revenue, supporting sustained revenue growth and operational efficiency.

- Advancements in IMAX's proprietary technology and collaborative partnerships with major studios and tech companies for exclusive releases (e.g., F1 with Apple) enhance the appeal of IMAX installations and attract premium pricing, likely improving both revenue and net margins.

IMAX Future Earnings and Revenue Growth

Assumptions

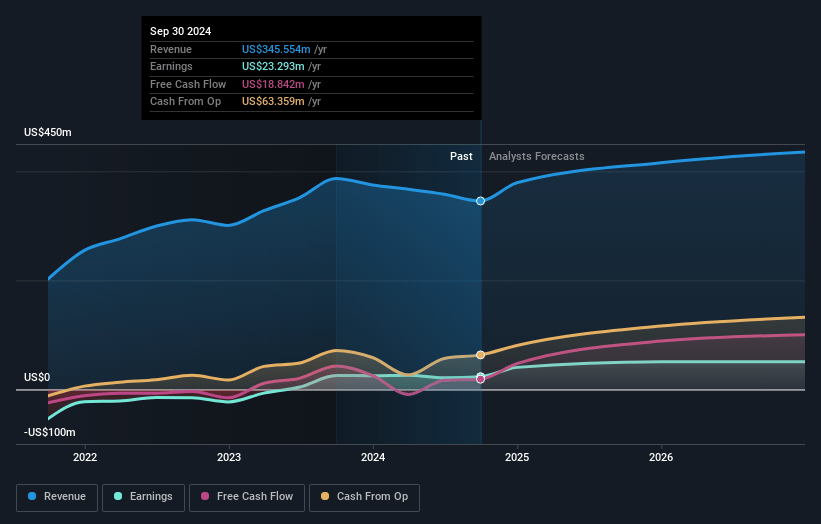

How have these above catalysts been quantified?- Analysts are assuming IMAX's revenue will grow by 7.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.4% today to 12.0% in 3 years time.

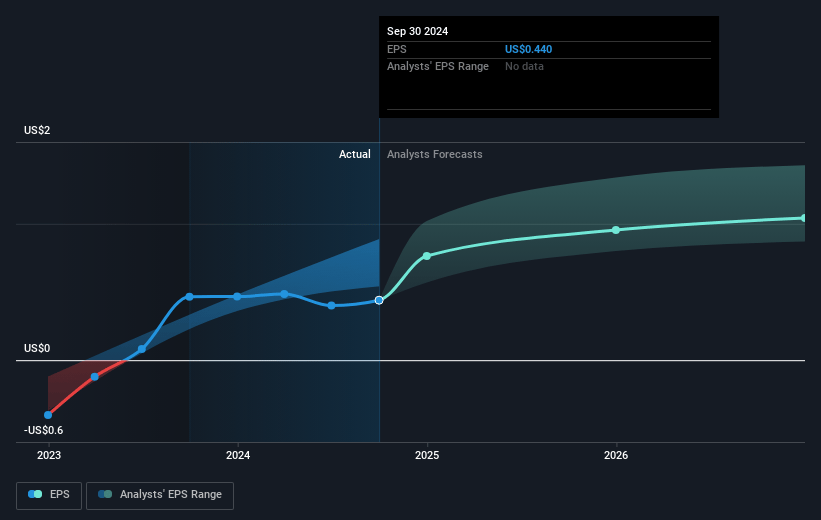

- Analysts expect earnings to reach $52.9 million (and earnings per share of $1.02) by about April 2028, up from $26.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $60.8 million in earnings, and the most bearish expecting $46 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 38.6x on those 2028 earnings, down from 47.8x today. This future PE is greater than the current PE for the US Entertainment industry at 21.8x.

- Analysts expect the number of shares outstanding to grow by 0.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.79%, as per the Simply Wall St company report.

IMAX Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The overreliance on the Chinese market poses a risk, as IMAX's growth heavily depends on the performance in China. Any geopolitical tensions or regulatory changes could negatively affect future revenue and earnings.

- While the company sees strong growth in system installations, the market saturation in top-performing regions like North America might limit longer-term revenue growth potential.

- The continued use and investment in joint venture arrangements mean that IMAX bears more financial risk, which could impact net margins if box office results do not meet expectations.

- IMAX's strategy includes unique partnerships with streaming services, but it may face challenges from the broader industry trend of films going directly to streaming, which could impact theater attendance and revenue.

- The focus on big-budget films, which are subject to market variations and audience reception, could result in financial volatility impacting earnings if there are any significant underperformances.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $29.4 for IMAX based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $35.0, and the most bearish reporting a price target of just $16.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $442.8 million, earnings will come to $52.9 million, and it would be trading on a PE ratio of 38.6x, assuming you use a discount rate of 8.8%.

- Given the current share price of $23.5, the analyst price target of $29.4 is 20.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.