Key Takeaways

- Investment in AI and new video formats is boosting enterprise engagement and revenue growth, with a focus on enhanced product differentiation.

- Strategic shifts and consolidation efforts in enterprise services are driving acceleration in revenue, subscriber growth, and high-value contracts.

- Vimeo's reliance on risky investments, AI innovation, and strategic shifts may disrupt revenue growth amid competitive challenges and changing subscriber dynamics.

Catalysts

About Vimeo- Provides video software solutions in the United States and internationally.

- Vimeo is investing up to $30 million this year, focusing on AI, video formats, security, and enterprise solutions, which is expected to drive future revenue growth and provide a return on investment through increased bookings and enterprise engagements.

- The expansion of AI capabilities, such as video translations and indexing, has already contributed to 40% of Q4 bookings, indicating a potential increase in revenue and enhanced product differentiation in future quarters as more enterprises adopt these innovative features.

- The company's focus on enterprise growth, with double-digit growth in both subscribers and ARPU, is likely to contribute significantly to revenue acceleration as they expand services across multiple departments and industries, including healthcare and telecommunications.

- Vimeo’s commitment to improving Self-Serve offerings by increasing prices and introducing AI features aims to stabilize and grow subscriber numbers, potentially reversing current subscriber pressures and leading to higher average revenue per user (ARPU) and revenue growth.

- The consolidation of the Enterprise and OTT teams to better address streaming demands indicates a strategic shift that is expected to increase revenue from higher-end products and larger accounts, including the uptrend seen in large customer growth with contracts over $100,000.

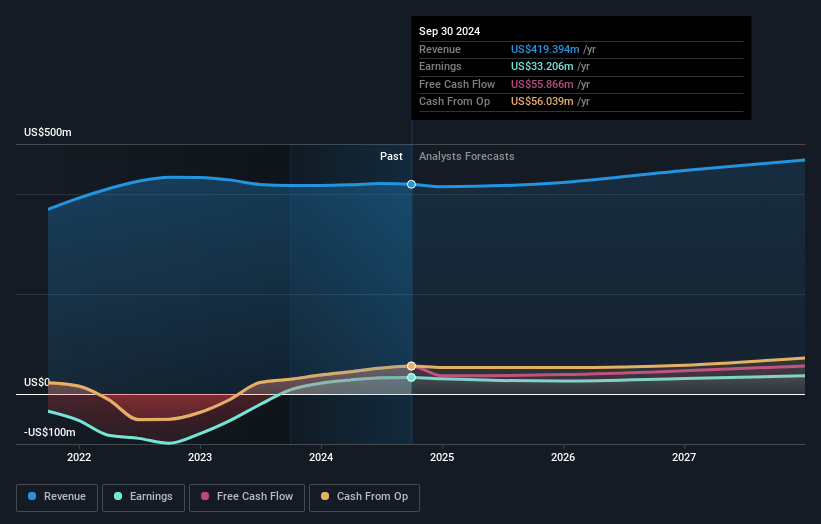

Vimeo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Vimeo's revenue will grow by 5.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 6.4% today to 4.4% in 3 years time.

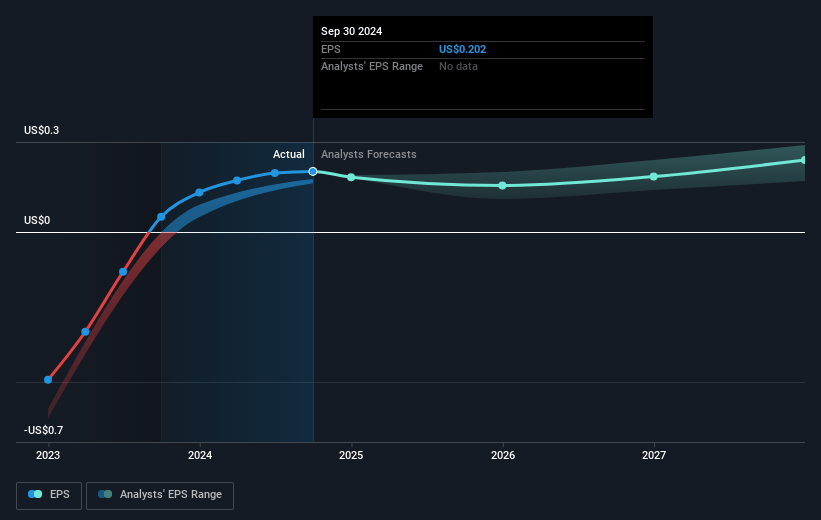

- Analysts expect earnings to reach $21.6 million (and earnings per share of $0.12) by about May 2028, down from $26.5 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $27.5 million in earnings, and the most bearish expecting $17.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 66.4x on those 2028 earnings, up from 32.4x today. This future PE is greater than the current PE for the US Interactive Media and Services industry at 16.9x.

- Analysts expect the number of shares outstanding to decline by 2.61% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.41%, as per the Simply Wall St company report.

Vimeo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Vimeo's focus on substantial long-term investments, such as the $30 million allocation for growth, introduces a risk of not achieving expected returns, which could negatively impact EBITDA and overall profitability.

- The increasingly competitive landscape for AI-driven video solutions presents a challenge, potentially affecting Vimeo's ability to capture and maintain market share, impacting revenue growth.

- Dependency on the success of new AI capabilities and features to drive customer adoption and retention could pose a risk if these innovations do not meet customer expectations, which might affect future bookings and revenue stability.

- Lower-than-anticipated growth in the Self-Serve segment, coupled with recent price increases, might deter new subscribers or lead to higher churn rates, which would impact subscriber numbers and associated revenues.

- The shift in organizational focus and sales strategy might not effectively address the nuances of both small and large customer needs, potentially leading to inefficiencies or lost opportunities, which could impact revenue growth projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $7.6 for Vimeo based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $5.4.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $490.4 million, earnings will come to $21.6 million, and it would be trading on a PE ratio of 66.4x, assuming you use a discount rate of 7.4%.

- Given the current share price of $5.2, the analyst price target of $7.6 is 31.6% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.