Last Update07 May 25Fair value Increased 1.48%

Key Takeaways

- Anticipated game releases and strategic marketing are expected to drive significant growth in net bookings and cash flows over the next few fiscal years.

- Strong engagement in titles like NBA 2K and expansion of Zynga's mobile games signal robust potential for revenue growth and improved operating margins.

- Take-Two's mobile sector faces growth challenges and increasing future expenses, potentially impacting revenue and net margins due to underperforming legacy titles and heightened competition.

Catalysts

About Take-Two Interactive Software- Develops, publishes, and markets interactive entertainment solutions for consumers worldwide.

- The planned release of multiple highly anticipated titles, including Grand Theft Auto VI, Borderlands 4, and Mafia: The Old Country, is expected to significantly drive net bookings growth, contributing to a positive revenue outlook for fiscal 2026 and 2027.

- The strong performance and engagement of NBA 2K, including its mobile and online versions, with substantial growth in recurrent consumer spending and active users, suggests an ongoing capability to enhance net margins through both innovation and community-driven content.

- The launch of Sid Meier's Civilization VII, with record preorders and positive media reception, is likely to boost revenue and net bookings, capitalizing on the game's strong franchise following and player engagement.

- The continued success and expansion of Zynga's mobile titles, such as Match Factory!, and new initiatives in mobile games, highlight potential revenue and earnings growth from increased consumer spending in digital and mobile sectors.

- Upcoming fiscal years are forecast to be financially significant, driven by new game releases and strategic marketing efforts, potentially leading to enhanced cash flows, operating margins, and overall company profitability.

Take-Two Interactive Software Future Earnings and Revenue Growth

Assumptions

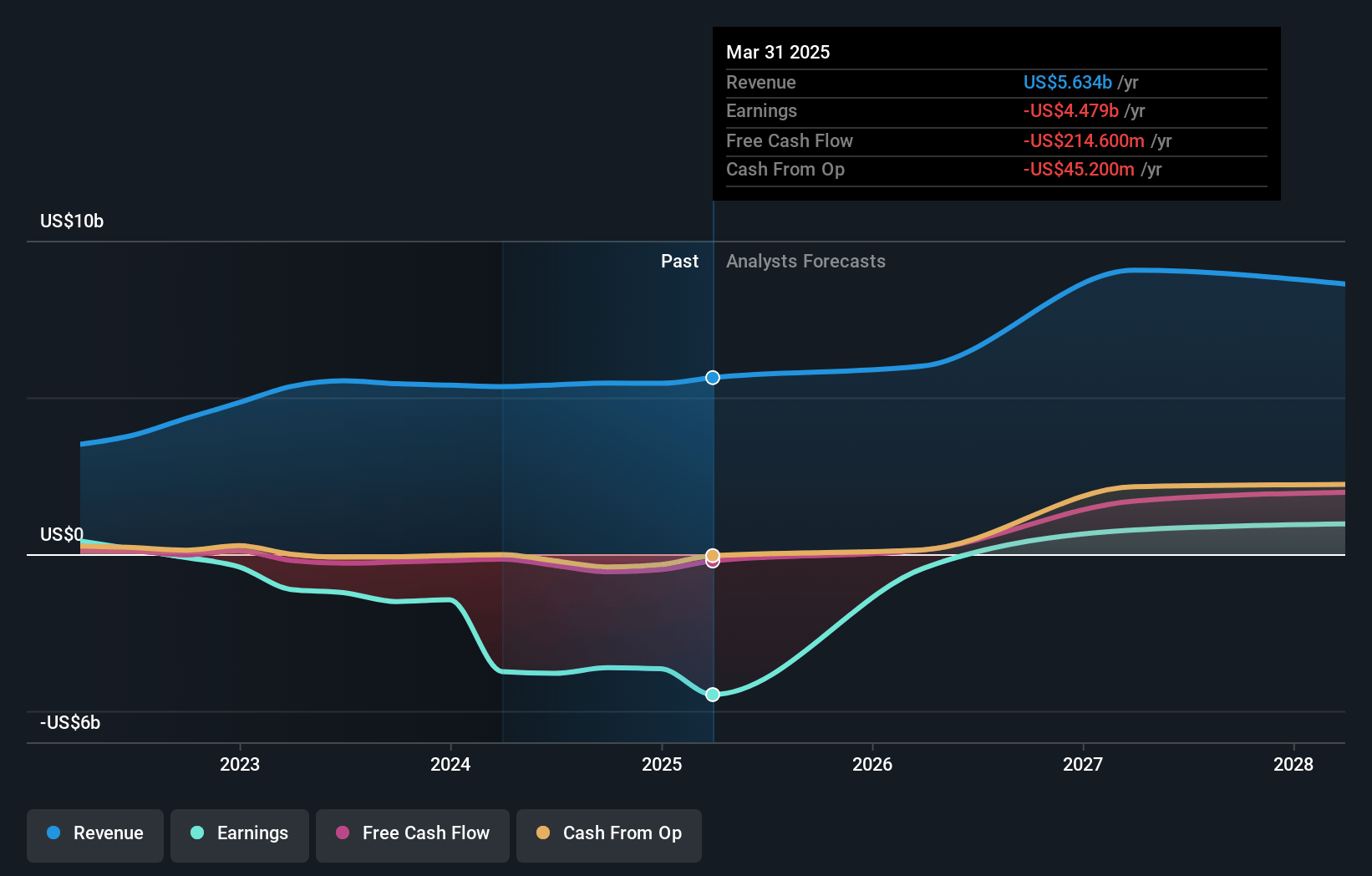

How have these above catalysts been quantified?- Analysts are assuming Take-Two Interactive Software's revenue will grow by 16.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from -67.1% today to 8.6% in 3 years time.

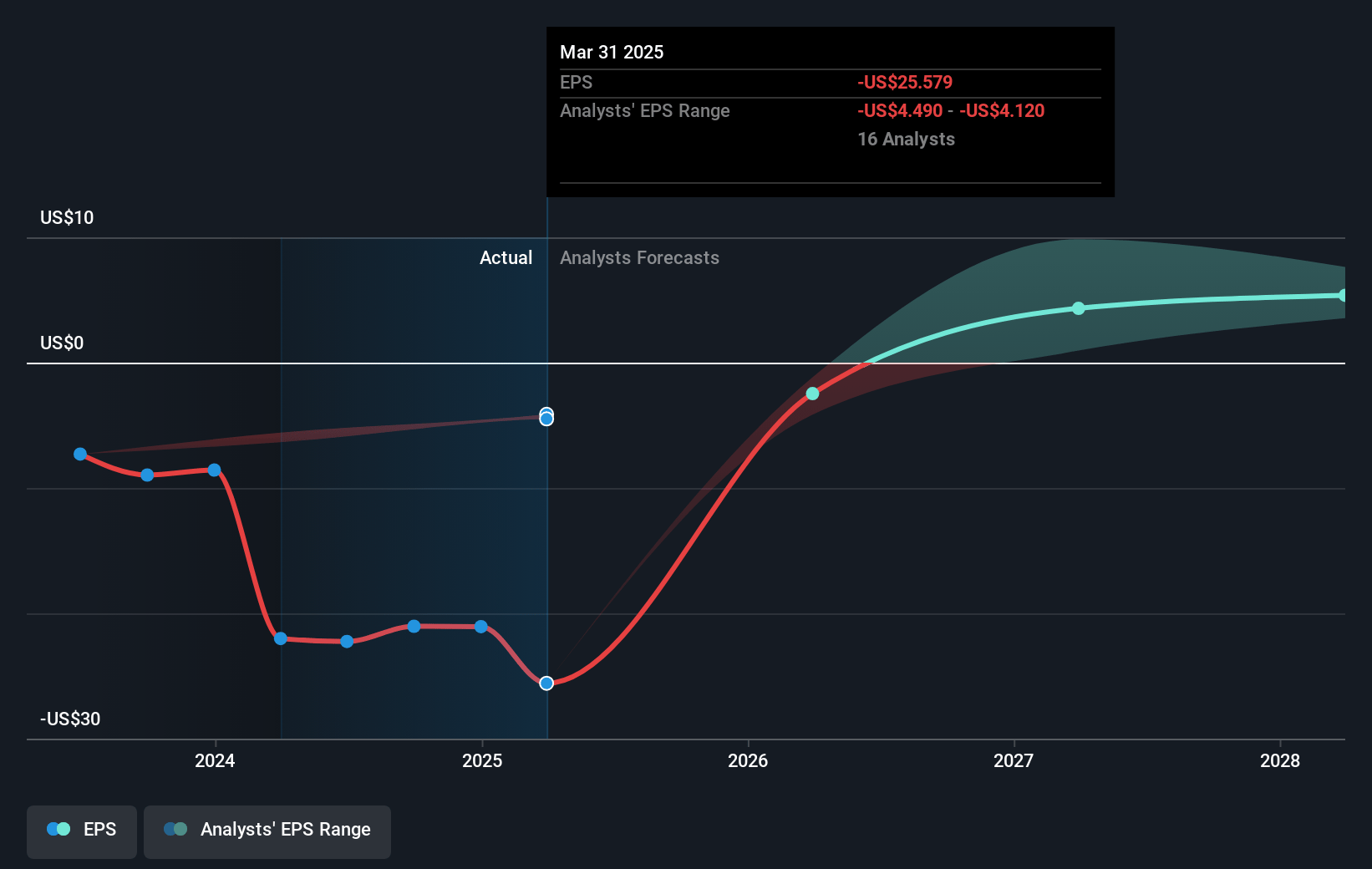

- Analysts expect earnings to reach $732.7 million (and earnings per share of $3.89) by about May 2028, up from $-3.7 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $992.6 million in earnings, and the most bearish expecting $420.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 75.0x on those 2028 earnings, up from -11.2x today. This future PE is greater than the current PE for the US Entertainment industry at 22.4x.

- Analysts expect the number of shares outstanding to grow by 2.98% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.54%, as per the Simply Wall St company report.

Take-Two Interactive Software Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- There is ongoing moderation in some of Take-Two's mobile franchises, leading to lower than expected growth in recurrent consumer spending for mobile, which could impact revenue growth.

- The shift in timing of operating expenses into future periods, including the fourth quarter, while beneficial for the current quarter, could lead to increased expenses that might compress net margins when these costs are realized.

- Competition in the mobile gaming sector remains a potential risk, as specifically mentioned for Empires & Puzzles, which underperformed expectations, indicating possible challenges to maintaining strong earnings from older titles.

- Challenges in certain legacy mobile titles like Empires & Puzzles reflect game-specific issues rather than industry-wide problems, suggesting potential hits to net margins and inconsistent revenue from mobile operations.

- The current mobile business growth rate is lower than expected, with fewer profitability tailwinds for the industry compared to mid-2022, potentially affecting overall earnings and financial projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $223.964 for Take-Two Interactive Software based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $270.0, and the most bearish reporting a price target of just $135.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $8.6 billion, earnings will come to $732.7 million, and it would be trading on a PE ratio of 75.0x, assuming you use a discount rate of 8.5%.

- Given the current share price of $231.84, the analyst price target of $223.96 is 3.5% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives