Key Takeaways

- The release of new ARK franchise titles is expected to drive revenue growth through expanded content and increased player engagement.

- Investments in AI technologies are anticipated to enhance productivity and operational efficiencies, improving net margins over time.

- Declining sales and revenue dependence on key franchises highlight the urgent need for diversification and successful market expansion to ensure future growth.

Catalysts

About Snail- Researches, develops, markets, publishes, and distributes interactive digital entertainment for consumers worldwide.

- The release of new ARK franchise titles, including highly anticipated additions such as the Astraeos Map and Aquatica DLC, is expected to drive revenue growth by expanding the game's content and player engagement.

- The planned launch of the Bellwright game on Xbox in Q4 2025 has the potential to expand the user base and increase sales, potentially impacting net revenue positively.

- The development of new games like Honeycomb and Echoes of Elysium, scheduled for release in 2025, could diversify revenue streams and contribute to long-term growth, enhancing overall earnings.

- The company's strategy to increase its licensing pipeline by signing publishing deals with third-party developers is expected to provide revenue diversification and potentially improve net margins by leveraging external resources.

- Snail's investment in advanced AI technologies for enhancing creativity and productivity is anticipated to increase operational efficiencies, likely leading to improved net margins over time.

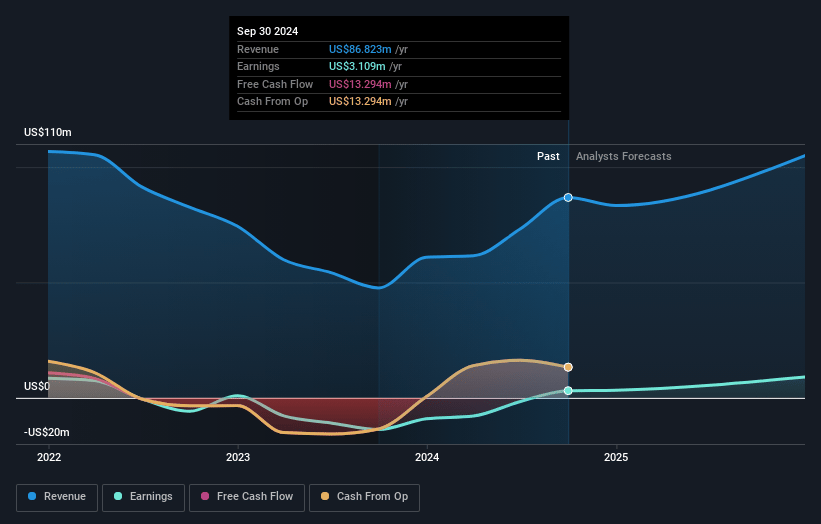

Snail Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Snail's revenue will grow by 18.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.8% today to 7.3% in 3 years time.

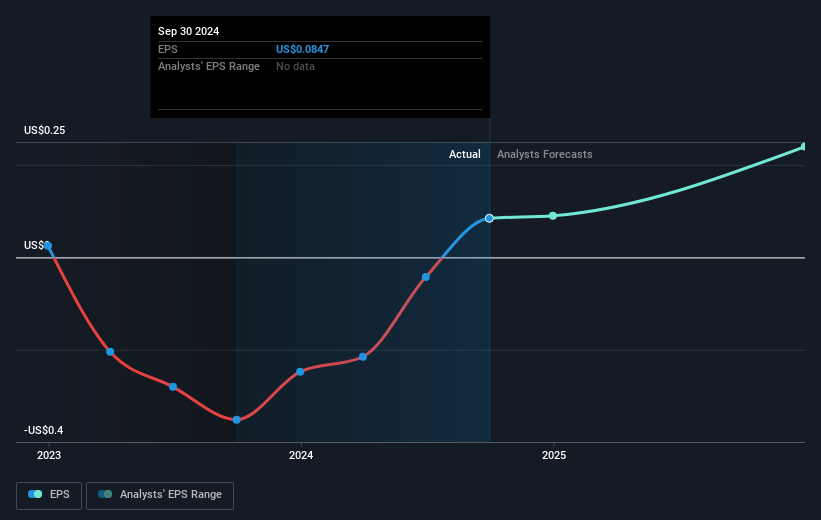

- Analysts expect earnings to reach $11.0 million (and earnings per share of $0.3) by about July 2028, up from $1.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.9x on those 2028 earnings, down from 32.0x today. This future PE is lower than the current PE for the US Entertainment industry at 26.9x.

- Analysts expect the number of shares outstanding to grow by 1.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.06%, as per the Simply Wall St company report.

Snail Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Decrease in net revenue for the fourth quarter of 2024 suggests a declining trend in sales that could affect future revenue generation.

- Drop in bookings for the three months ended December 31, 2024, indicates potential challenges in maintaining user engagement and demand, which could impact future earnings.

- Increased research and development costs without a proportional increase in revenue or profits could put pressure on net margins if new projects do not perform well.

- Revenue dependence on a few key franchises such as ARK could pose a risk if these franchises become less popular, impacting overall company revenue.

- Ongoing need to diversify product offerings and achieve successful market expansion; failure to do so may hinder revenue growth and affect long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $4.0 for Snail based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $151.2 million, earnings will come to $11.0 million, and it would be trading on a PE ratio of 17.9x, assuming you use a discount rate of 9.1%.

- Given the current share price of $1.43, the analyst price target of $4.0 is 64.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.