Key Takeaways

- Expanding the game portfolio through acquisitions and new launches is expected to drive revenue growth and strengthen market presence.

- Shifting to direct-to-consumer platforms and focusing on new studios aims to improve margins and stabilize long-term earnings.

- Revenue growth and profitability are under pressure due to income declines, cost increases, and underperformance of key games, raising concerns for future earnings.

Catalysts

About Playtika Holding- Develops mobile games in the United States, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

- The acquisition of SuperPlay and the addition of two strong game franchises are expected to expand Playtika's portfolio and drive future revenue growth.

- The launch of three new games, including Disney Solitaire, is anticipated to help generate consistent top-line revenue growth and reestablish Playtika's market presence.

- Investments in existing games with strong leadership positions aim to maximize returns and defend market share, likely improving revenue and net margins.

- Transitioning some games to direct-to-consumer platforms is predicted to elevate EBITDA margins by leveraging higher-margin channels.

- A strategic shift away from declining legacy titles toward new studio acquisitions is projected to stabilize and potentially increase revenue and earnings in 2026 and beyond.

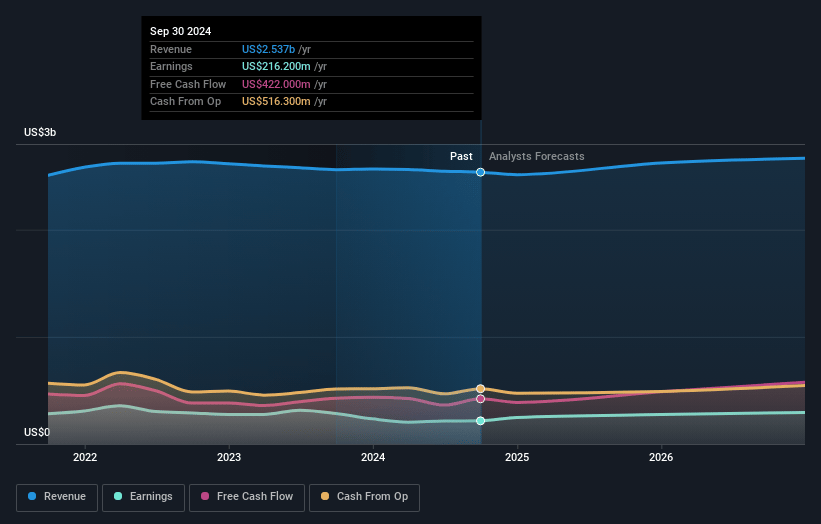

Playtika Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Playtika Holding's revenue will grow by 5.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.4% today to 8.8% in 3 years time.

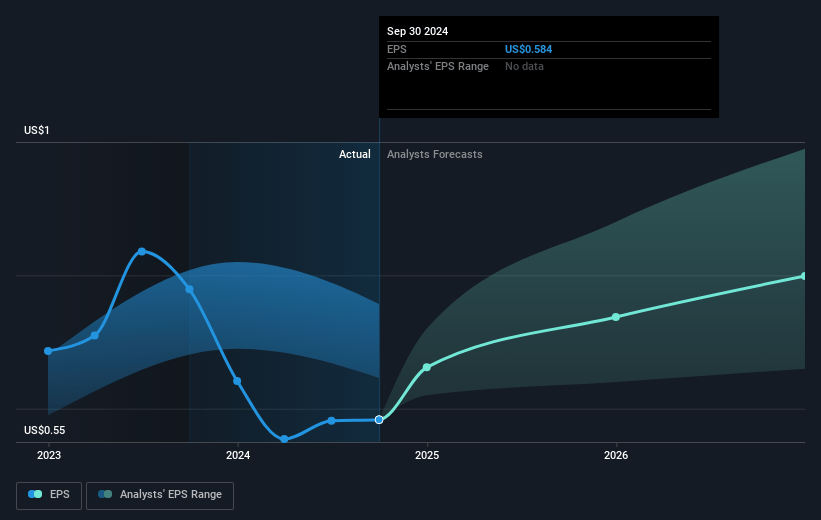

- Analysts expect earnings to reach $265.3 million (and earnings per share of $0.69) by about March 2028, up from $162.2 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $215.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.6x on those 2028 earnings, up from 11.6x today. This future PE is lower than the current PE for the US Entertainment industry at 23.4x.

- Analysts expect the number of shares outstanding to grow by 1.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.67%, as per the Simply Wall St company report.

Playtika Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The slight year-over-year revenue decline of 0.7% and the drop in GAAP net income from $235 million to $162.2 million suggest potential challenges in sustaining revenue growth and profitability.

- The decline in EBITDA margin from 32.4% in 2023 to 29.7% in 2024, alongside the expectation of EBITDA pressure in 2025, could negatively impact earnings and investor confidence.

- Slotomania's significant underperformance in Q4 due to game economy issues highlights risks in maintaining market share and could pressure future revenue streams in their slots category.

- With the new games contributing immaterially in 2025 and ongoing investments in growth titles causing near-term pressure, there is uncertainty around when these investments will become substantial revenue drivers.

- The increase in operating expenses by 13.7% year-over-year, driven by acquisitions and higher sales and marketing costs, presents a risk to net margins, especially if revenue growth does not offset these rising costs.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $8.205 for Playtika Holding based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $16.0, and the most bearish reporting a price target of just $5.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.0 billion, earnings will come to $265.3 million, and it would be trading on a PE ratio of 18.6x, assuming you use a discount rate of 15.7%.

- Given the current share price of $5.02, the analyst price target of $8.2 is 38.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives