Key Takeaways

- The Perion One strategy focuses on unifying technologies and adopting AI solutions to enhance efficiency, optimize costs, and improve profit margins.

- Strategic focus on high-growth areas like connected TV and leveraging industry leadership are expected to boost market reach and revenue growth.

- Declining search and ad revenues, non-renewed contracts, and inadequate growth pose risks to Perion Network's earnings, revenue stability, and profitability.

Catalysts

About Perion Network- Provides digital advertising solutions to brands, agencies, and publishers in North America, Europe, and internationally.

- The launch of the Perion One strategy, which aims to unify all technologies and business units under one platform, is expected to attract more customers, enhance operational efficiency, and optimize advertising campaigns. This could impact revenue growth and profit margins positively.

- The focus on AI-driven solutions within the Perion One strategy is expected to automate and improve efficiency in operations and campaign execution. This could lead to higher net margins and improved earnings through cost reductions and streamlined processes.

- The shift towards high-growth and high-value areas such as CTV (connected TV), digital out-of-home, and retail media, which have outpaced market growth, is expected to drive future revenue. This strategic focus positions Perion to capitalize on these growing markets, impacting both revenue and margins positively.

- Leadership appointments from industry veterans such as Google and Criteo are expected to expand market reach, deepen customer relationships, and unlock new growth opportunities. This could enhance sales efficiency, impacting revenue growth and potentially improving net margins through increased scale.

- Planned headcount reductions and operational streamlining as part of the Perion One strategy are expected to optimize costs and drive higher profit margins in 2025 and beyond. This cost optimization effort aims to improve net earnings by achieving higher operational efficiency.

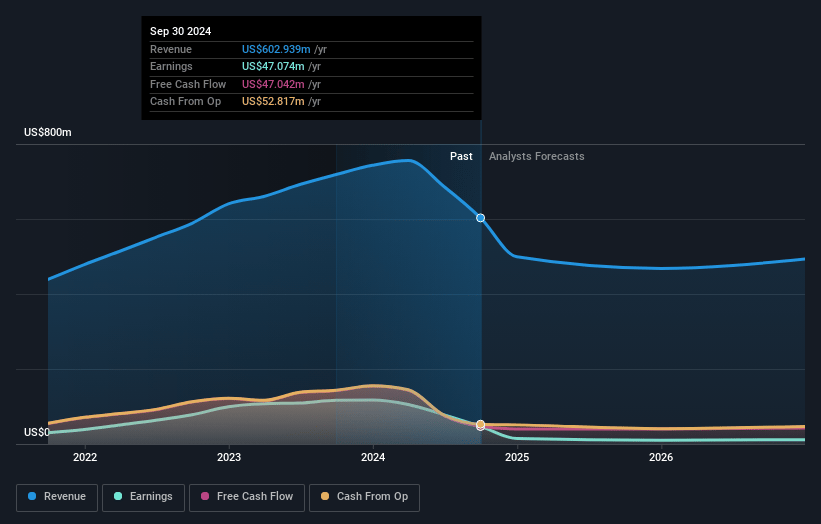

Perion Network Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Perion Network's revenue will decrease by 6.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 2.5% today to 1.9% in 3 years time.

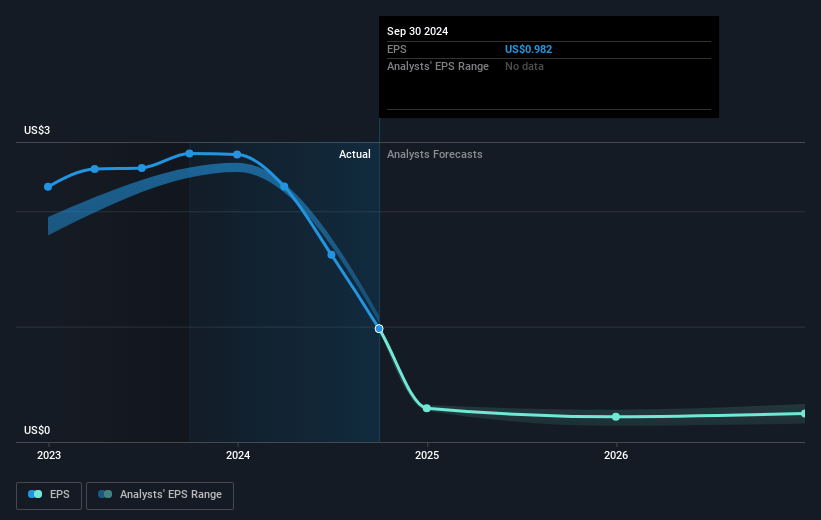

- Analysts expect earnings to reach $7.7 million (and earnings per share of $0.15) by about April 2028, down from $12.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 57.3x on those 2028 earnings, up from 31.2x today. This future PE is greater than the current PE for the US Media industry at 13.6x.

- Analysts expect the number of shares outstanding to decline by 6.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.95%, as per the Simply Wall St company report.

Perion Network Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company experienced a 33% decrease in overall revenue year-over-year, primarily due to declines in search revenue and weaknesses in open web video and standard ad formats, potentially impacting future earnings growth.

- The non-renewal of the Microsoft Bing contract could lead to a stabilization rather than growth in search revenue, which constitutes about 20% of the total revenue, potentially affecting future revenue streams.

- The slow growth of 10% in CTV revenue in Q4 compared to the annual growth of 30% suggests a deceleration that might not keep up with market expectations, posing a risk to revenue projections.

- The overall reliance on new strategy implementation, including headcount reductions and reorganization, poses risks of potential disruption, which could impact execution and thus the revenue and net margins.

- The company's substantial gap in non-GAAP net income from 2023 to 2024, coupled with decreased adjusted EBITDA margins, points to potential risks in maintaining profitability, impacting future earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $9.75 for Perion Network based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $411.5 million, earnings will come to $7.7 million, and it would be trading on a PE ratio of 57.3x, assuming you use a discount rate of 8.0%.

- Given the current share price of $8.74, the analyst price target of $9.75 is 10.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.