Narratives are currently in beta

Key Takeaways

- Expansion in prebid social optimization and new customer acquisition positions IAS for significant revenue growth through improved advertiser ROI and broadened client base.

- Strategic investments in CTV, leadership, and innovative products aim to capture growing market share and enhance operational efficiency, boosting revenue and margins.

- Economic and competitive pressures could lead to constrained revenue growth and profitability, necessitating IAS to focus on proving value and maintaining effective pricing strategies.

Catalysts

About Integral Ad Science Holding- Operates as a digital advertising verification company in the United States, the United Kingdom, France, Ireland, Germany, Italy, Singapore, Australia, Japan, India, and the Nordics.

- The company is focusing on expanding its prebid social optimization products, especially with Meta, which can drive substantial revenue growth in 2025 due to its ability to improve efficiency and ROI for advertisers. This is expected to influence revenue positively.

- IAS has won over 75 new customers from Oracle following the latter's exit from the advertising business. These new clients, including brands like Heineken and Emirates, are anticipated to increase revenue stream in the coming years.

- The addition of experienced leadership, such as Mark Grabowski from Oracle and Srishti Gupta, could enhance IAS's product offerings and customer relations, potentially improving operational efficiency and net margins.

- IAS aims to capture a share of the $40 billion CTV ad spend market projected by 2027 by investing in CTV products and partnerships, which is expected to significantly boost revenue.

- The continued rollout and adoption of new products, such as Total Media Quality (TMQ) and misinformation detection, are designed to enhance advertiser spend efficiency. This should contribute to higher revenue and potentially improved margins as these products scale.

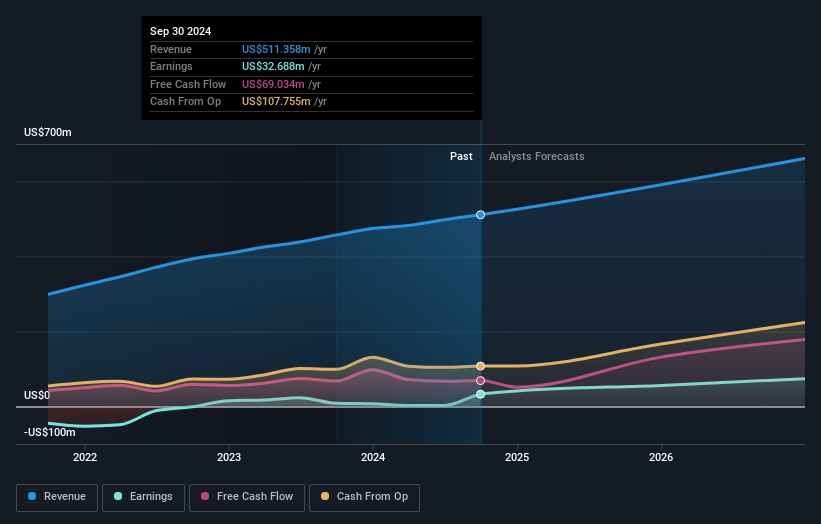

Integral Ad Science Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Integral Ad Science Holding's revenue will grow by 14.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.6% today to 10.4% in 3 years time.

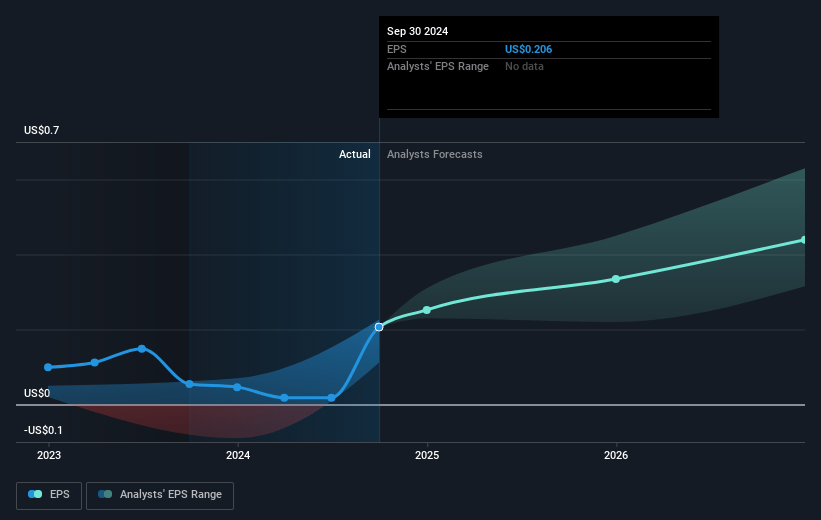

- Analysts expect earnings to reach $77.5 million (and earnings per share of $0.45) by about November 2027, up from $2.8 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $110 million in earnings, and the most bearish expecting $45.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 41.9x on those 2027 earnings, down from 714.5x today. This future PE is greater than the current PE for the US Media industry at 14.6x.

- Analysts expect the number of shares outstanding to grow by 2.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.33%, as per the Simply Wall St company report.

Integral Ad Science Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The slowdown in volume growth, particularly in the CPG and retail verticals due to budget cuts and delays in digital media spending, may constrain IAS's future revenue growth from these segments.

- Lower-than-anticipated monetization of new products, despite healthy adoption rates, could impact both IAS's revenue and earnings projections.

- The competitive environment and the need to offer competitive rates during the Oracle customer transition may put pressure on IAS's pricing strategy and affect its net margins.

- Economic factors such as softness in brand spending leading up to the U.S. elections and slower overall volume growth could result in variability in revenue streams and profits.

- The increasing focus on demonstrating value and transparency to distinguish from competitors suggests that IAS’s pricing and revenue strategy heavily depends on continually proving ROI and may face challenges if effectiveness is not perceived as sufficient by clients.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $15.79 for Integral Ad Science Holding based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $12.57.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $742.9 million, earnings will come to $77.5 million, and it would be trading on a PE ratio of 41.9x, assuming you use a discount rate of 6.3%.

- Given the current share price of $12.62, the analyst's price target of $15.79 is 20.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives