Narratives are currently in beta

Key Takeaways

- EA's focus on massive online communities and innovative IP is likely to boost long-term revenue through increased engagement and monetization.

- Expanding sports offerings and generative AI investments could enhance future revenue growth, leveraging fandom and new technology integration.

- Fierce competition and challenges in live services and innovation may impact EA's market share, revenue, and engagement across Apex Legends and American Football franchises.

Catalysts

About Electronic Arts- Develops, markets, publishes, and delivers games, content, and services for game consoles, PCs, mobile phones, and tablets worldwide.

- EA is leveraging its production strength and broad portfolio of IP to create and engage massive online communities, extending player interactions beyond traditional gameplay. This strategy is likely to drive significant long-term revenue growth through increased player engagement and monetization opportunities.

- The expansion of EA SPORTS American Football ecosystem, including successful launches like College Football 25 and the MVP Bundle in Madden, highlights EA's ability to harness fandom and innovate with new offerings, potentially boosting net bookings and live services revenue.

- EA SPORTS FC is achieving global expansion with more than 130% player reach increase, which should continue to drive live services net bookings growth through deeper social play and monetization improvements.

- The planned launch of a feature-rich EA SPORTS app integrating real-world and virtual sports content aims to deepen fan engagement and attract new sports fans, potentially impacting long-term recurring revenue streams and overall earnings through enhanced monetization avenues.

- EA is investing in innovative technologies such as generative AI to expand and transform entertainment experiences, potentially creating new business opportunities that could drive future revenue and margin expansion as these technologies become integrated into EA's offerings.

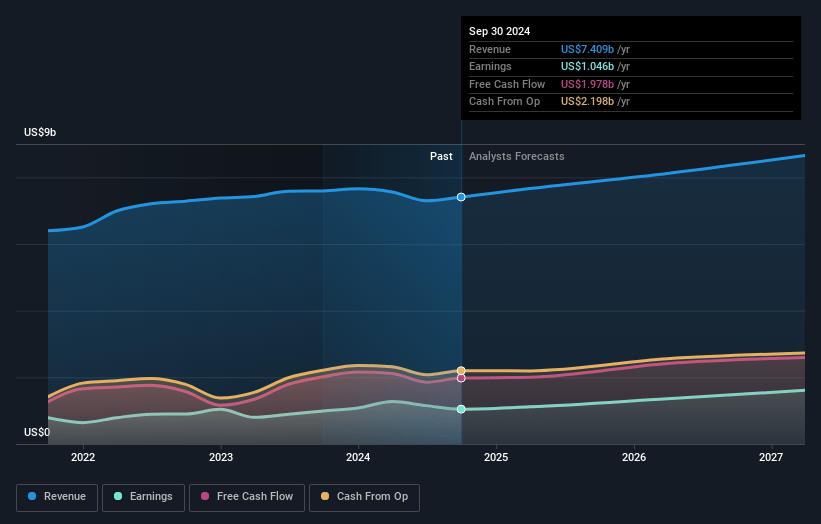

Electronic Arts Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Electronic Arts's revenue will grow by 5.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.1% today to 18.6% in 3 years time.

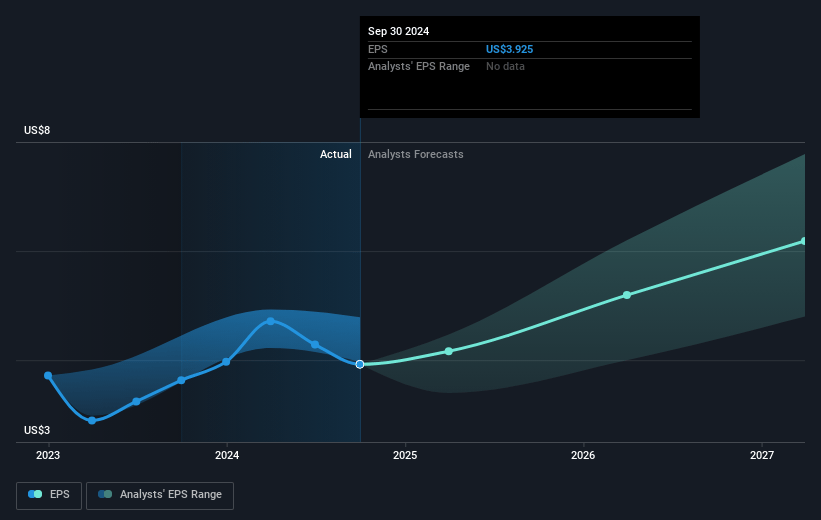

- Analysts expect earnings to reach $1.6 billion (and earnings per share of $6.36) by about November 2027, up from $1.0 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $2.0 billion in earnings, and the most bearish expecting $1.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 31.4x on those 2027 earnings, down from 40.8x today. This future PE is greater than the current PE for the US Entertainment industry at 21.5x.

- Analysts expect the number of shares outstanding to decline by 0.74% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.36%, as per the Simply Wall St company report.

Electronic Arts Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The lower-than-expected engagement levels and monetization in Apex Legends highlight risks in maintaining consumer interest in live services, which can adversely affect revenue and engagement compared to projections.

- Despite EA's strong portfolio, competition in the free-to-play FPS space is fierce, as indicated by the drop in engagement in Apex Legends, potentially threatening market share and future revenue growth.

- EA’s strategy to expand its American Football franchise into a holistic fan platform demands significant investment and innovation; failure to maintain engagement or innovate sufficiently could impact long-term revenue growth.

- The introduction of new systematic changes in Apex Legends to drive growth presents operational risks; delays or missteps could affect user retention and revenue projections.

- EA's reliance on generative AI and new App rollouts as growth pillars may not yield the expected results promptly, posing risks to their projected revenue stream and compelling financial returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $161.38 for Electronic Arts based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $183.0, and the most bearish reporting a price target of just $143.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $8.8 billion, earnings will come to $1.6 billion, and it would be trading on a PE ratio of 31.4x, assuming you use a discount rate of 7.4%.

- Given the current share price of $162.72, the analyst's price target of $161.38 is 0.8% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives