Last Update07 May 25Fair value Increased 0.0025%

Key Takeaways

- Strong broadband leadership, advanced business services, and bundled offerings drive resilient, recurring revenue and boost customer loyalty and lifetime value.

- Investments in content, streaming, and global theme parks diversify growth opportunities, supporting margin expansion and offsetting challenges from legacy media segments.

- Intensifying competition, cord-cutting, and costly network and streaming investments are constraining Comcast's revenue growth, profit margins, and long-term earnings potential.

Catalysts

About Comcast- Operates as a media and technology company worldwide.

- Comcast’s leadership in high-speed broadband, network upgrades, and multi-gigabit capabilities directly positions the company to benefit from rising data consumption driven by trends like cloud adoption, remote work, smart homes, and the proliferation of connected devices, which will underpin resilient and growing broadband revenues and higher ARPU in the years ahead.

- The company’s expanding business services division is capitalizing on digital transformation across small, medium, and enterprise customers by offering advanced networking, cybersecurity, and managed services, supporting a long runway for higher-margin, recurring revenue growth and robust contribution to consolidated EBITDA.

- Comcast’s aggressive bundling of broadband and wireless, enabled by its superior WiFi footprint and mobile network partnerships, gives it uniquely high customer stickiness and cross-selling opportunities, providing a catalyst for ongoing ARPU growth, reduced churn, and growing customer lifetime value, with the company only beginning to penetrate its base with bundled wireless offerings.

- Substantial investments into original content, marquee sports rights such as the NBA, and the direct-to-consumer Peacock streaming service position Comcast to gain significant share from the secular migration from linear TV to streaming, enabling improved monetization of its vast content library and a path to future margin expansion as Peacock scales toward profitability.

- Global scaling of its Theme Parks and Sky businesses, including new landmark openings in Orlando, Europe, and Las Vegas, expand Comcast’s access to diverse, high-growth international markets and non-cyclical revenue streams, driving consolidated earnings growth and offsetting legacy business headwinds.

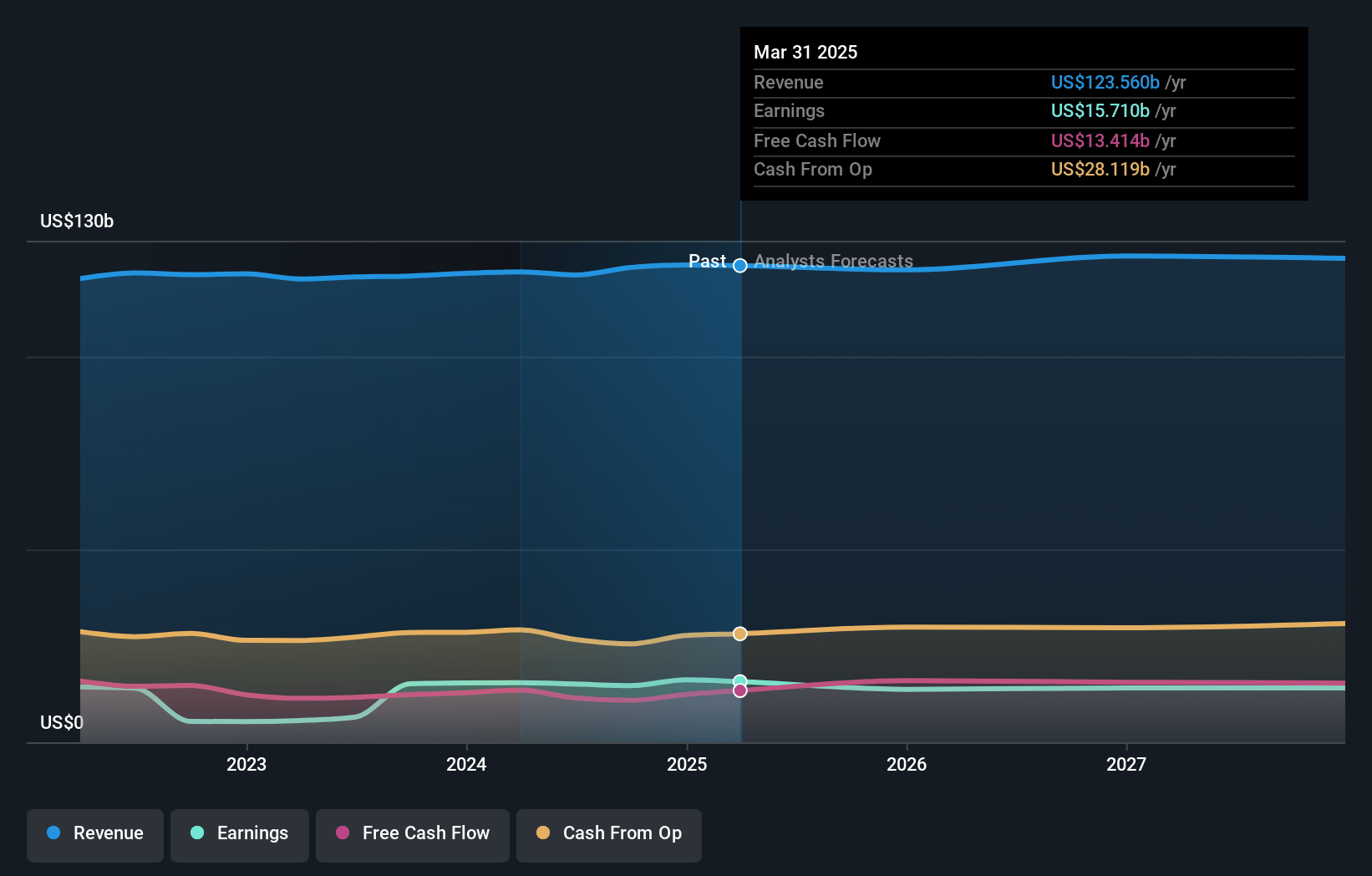

Comcast Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Comcast compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Comcast's revenue will grow by 1.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 12.7% today to 12.0% in 3 years time.

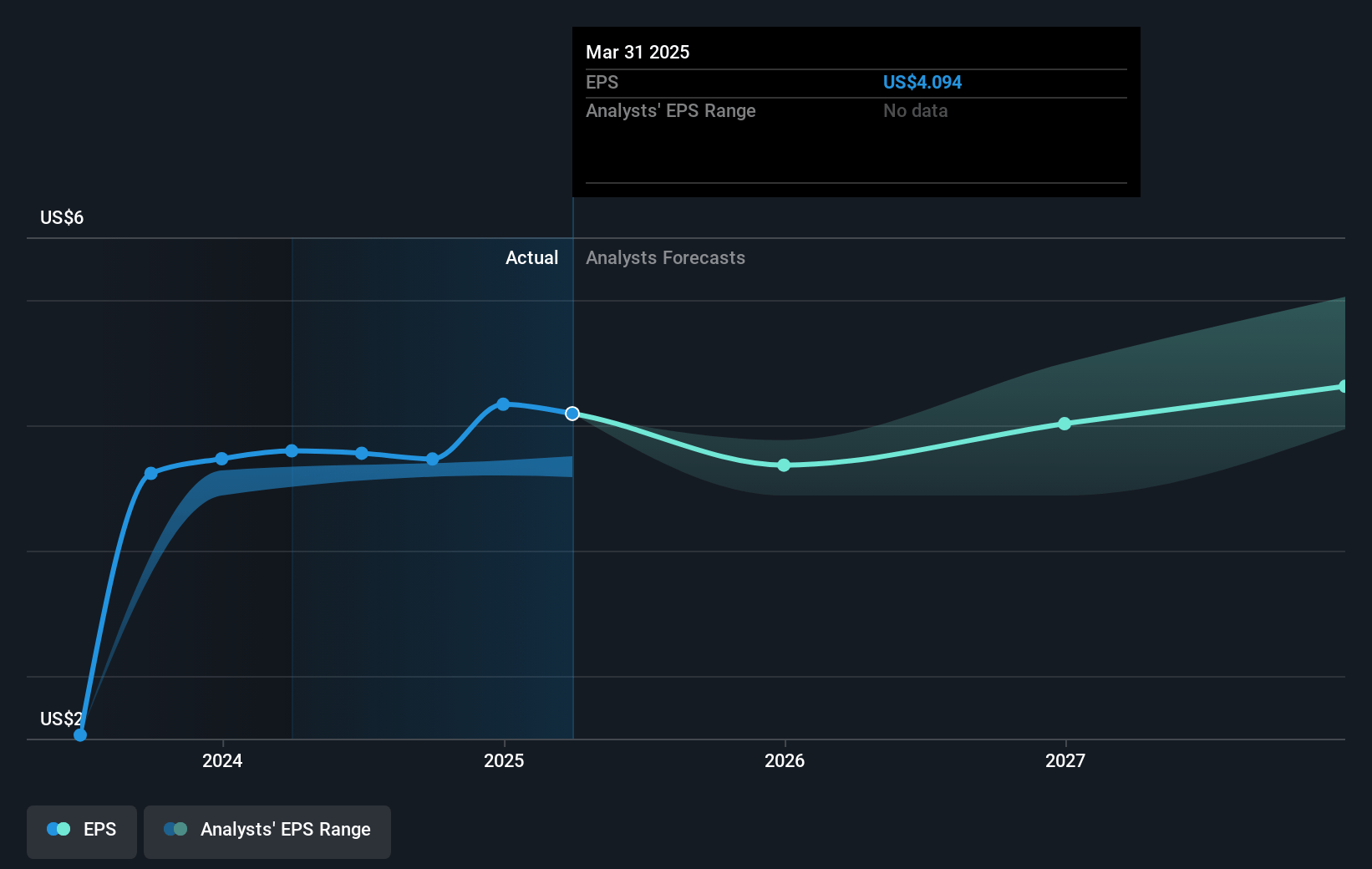

- The bullish analysts expect earnings to reach $15.4 billion (and earnings per share of $5.01) by about May 2028, down from $15.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.3x on those 2028 earnings, up from 8.2x today. This future PE is lower than the current PE for the US Media industry at 15.4x.

- Analysts expect the number of shares outstanding to decline by 4.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.43%, as per the Simply Wall St company report.

Comcast Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained competitive pressure from fiber overbuilds and aggressive fixed wireless offerings continues across Comcast’s footprint, leading to increased broadband subscriber losses and elevated churn, which may result in stagnant or declining top-line revenue growth and put long-term pressure on broadband margins.

- Ongoing secular decline in legacy video subscribers due to cord-cutting, as highlighted by revenue declines in video and advertising, indicates that Comcast’s traditional video segment will continue to shrink faster than streaming can make up for, undermining overall company revenues and segment profitability.

- Expansion into streaming with Peacock requires significant ongoing investment and content spend, and despite recent improvements in monetization, rising sports rights and production costs (such as the NBA deal) risk further EBITDA losses or margin compression if revenue growth in streaming does not keep pace with escalating expenses.

- High capital expenditure needs to upgrade networks (including DOCSIS 4.0, fiber deployments, and new product rollouts such as the XB10 gateway) consume significant free cash flow, reducing the company’s ability to generate earnings and potentially compressing profit margins over time as competition for network superiority intensifies.

- The maturity of core U.S. markets, combined with only modest broadband ARPU growth and few signs of industry-wide subscriber expansion, means that Comcast’s organic growth opportunities remain limited; this structural headwind is likely to constrain both revenue growth and future earnings, particularly as population trends plateau in key geographies.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Comcast is $51.37, which represents two standard deviations above the consensus price target of $40.5. This valuation is based on what can be assumed as the expectations of Comcast's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $52.67, and the most bearish reporting a price target of just $30.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $128.9 billion, earnings will come to $15.4 billion, and it would be trading on a PE ratio of 13.3x, assuming you use a discount rate of 7.4%.

- Given the current share price of $34.49, the bullish analyst price target of $51.37 is 32.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.