Key Takeaways

- Challenges in maintaining broadband growth amid intense competition could pressure revenue expectations and impact margins as Comcast integrates wireless offerings.

- Strategic shifts, including Project Genesis and media repositioning, risk short-term earnings strain due to high capital needs and execution risks.

- Comcast's diversified growth in sectors like broadband, wireless, streaming, and theme parks underscores strong financial health and potential for sustained profit increases.

Catalysts

About Comcast- Operates as a media and technology company worldwide.

- The negative addition of 139,000 net broadband subscribers in the fourth quarter signals ongoing challenges in maintaining growth amid intense competition, which could pressure future revenue expectations.

- With the strategic shift to deeply integrate and grow wireless within the broadband offerings, there may be an impact on margin expansion, as initial investments and competitive pricing potentially suppress short to medium-term earnings.

- The transformation strategy involving SpinCo and the focus on core NBC assets could lead to temporary operational discontinuities, impacting immediate margins and signaling higher execution risk, which may not yield the anticipated synergies quickly.

- The rapid pace of executing Project Genesis with its emphasis on upgrading to a multi-gigabit symmetrical network requires substantial capital and potential integration challenges, which could strain free cash flow and pressure EPS growth.

- Expected costs associated with strategic shifts like the introduction of the NBA to Peacock, along with its ad sales strategy and content repositioning, suggest short-term headwinds on streaming service profitability, potentially impacting consolidated EBITDA.

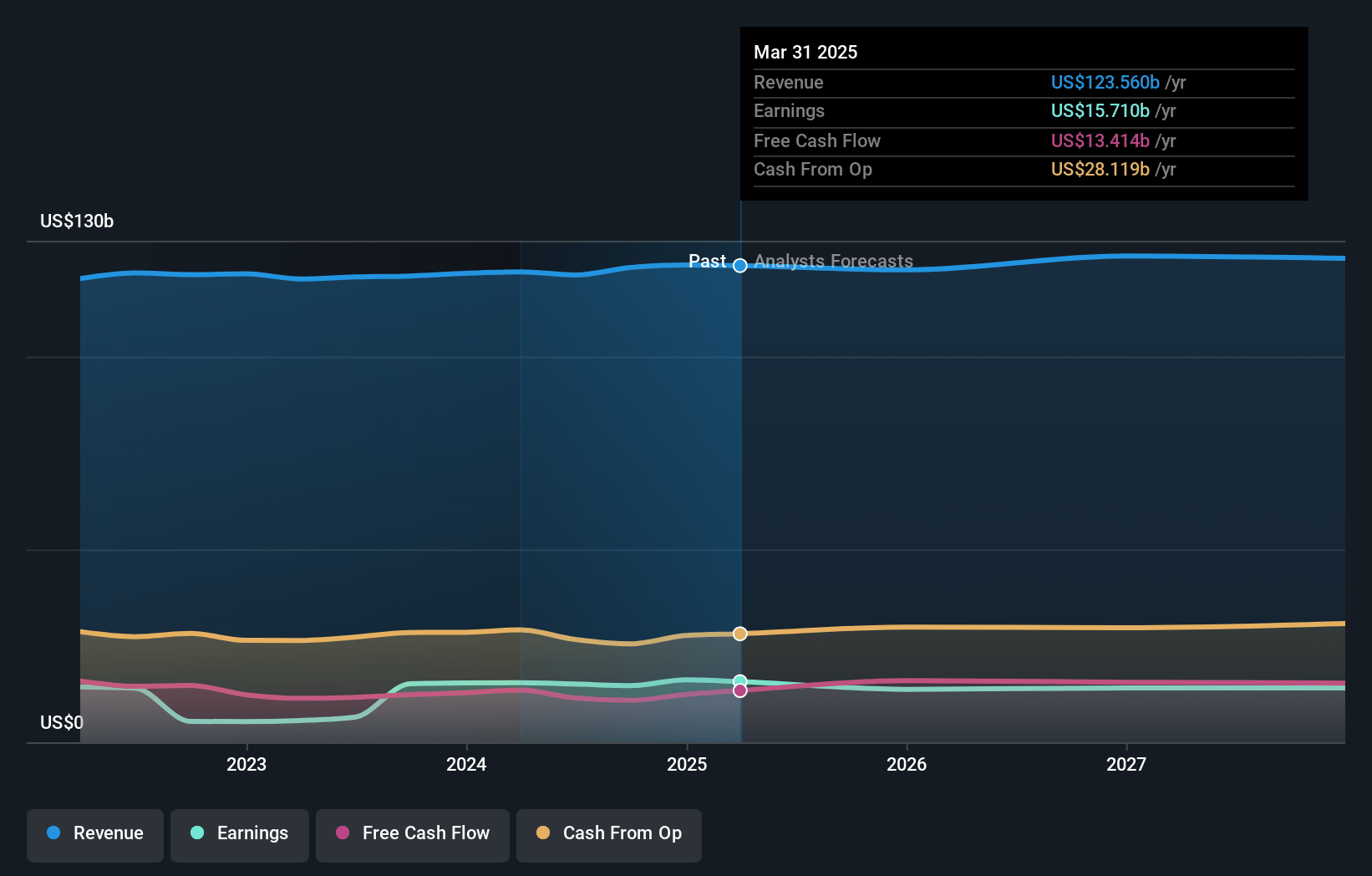

Comcast Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Comcast compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Comcast's revenue will decrease by 0.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 13.1% today to 11.1% in 3 years time.

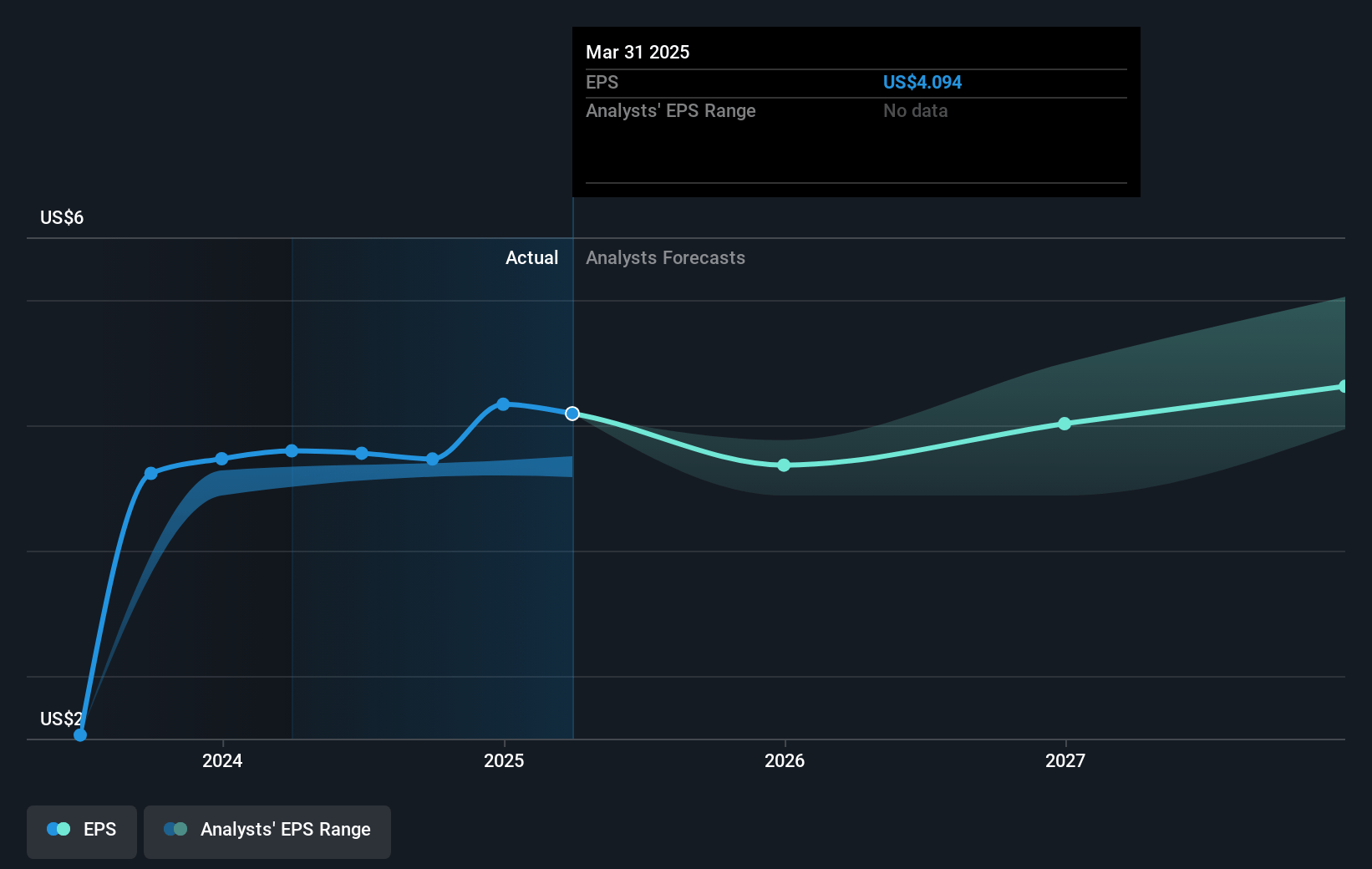

- The bearish analysts expect earnings to reach $13.5 billion (and earnings per share of $4.06) by about April 2028, down from $16.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.3x on those 2028 earnings, up from 8.0x today. This future PE is lower than the current PE for the US Media industry at 13.6x.

- Analysts expect the number of shares outstanding to decline by 3.63% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.44%, as per the Simply Wall St company report.

Comcast Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Comcast reported record revenue of $124 billion and record adjusted EBITDA of $38 billion in 2024, alongside a 9% growth in adjusted EPS and substantial free cash flow generation of $12.5 billion, indicating robust financial health and resilience even in a competitive environment. This positive financial performance could sustain or increase its earnings in future years.

- The company experienced revenue growth in several sectors such as broadband, wireless, and business services, with revenues and EBITDA in these areas growing at mid-single to mid-teens rates. These expanding revenue streams could positively impact Comcast's overall revenue trajectory.

- Comcast's wireless revenue grew at a mid-teens rate, and the company added 1.2 million new lines, highlighting strong growth potential in wireless which is a significant and expanding market. This success in wireless could enhance Comcast's net margins and overall revenue growth.

- Peacock, Comcast's streaming service, showed a $1 billion improvement in EBITDA losses and demonstrated strong revenue growth, indicating progress in reducing losses and adding value. This turnaround in streaming could lead to better profit margins and earnings in the future.

- Comcast's Theme Parks experienced attendance growth and are expected to be boosted further by the opening of the technologically advanced Epic Universe, potentially driving higher revenues and improving the company’s revenue and earnings in a growing sector.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Comcast is $36.45, which represents one standard deviation below the consensus price target of $42.62. This valuation is based on what can be assumed as the expectations of Comcast's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $55.0, and the most bearish reporting a price target of just $31.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $122.1 billion, earnings will come to $13.5 billion, and it would be trading on a PE ratio of 11.3x, assuming you use a discount rate of 7.4%.

- Given the current share price of $34.4, the bearish analyst price target of $36.45 is 5.6% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that the bearish analysts believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystLowTarget holds no position in NasdaqGS:CMCSA. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.