Key Takeaways

- Growth in diverse user segments and AI tools enhances revenue potential and operational efficiency, improving net margins and competitiveness.

- Decreased share-based compensation and focus on small enterprise revenue diversification boosts profitability and supports stable earnings growth.

- Macro uncertainties, AI-generated resume challenges, and careful ARPPU strategies strain revenue growth, while high R&D expenses and share repurchases pressure profit margins and cash reserves.

Catalysts

About Kanzhun- Provides online recruitment services in the People’s Republic of China.

- The company's continued growth in monthly active users (MAU) and user base indicates strong potential for future revenue increases, particularly with the expansion into blue-collar segments and non-Tier 1 cities. This will likely impact revenue as these market segments continue to grow.

- The implementation of AI technologies, such as AI-powered job matching and interaction tools, is expected to enhance user experience and operational efficiency. This could lead to improved net margins by reducing costs and scaling operations without proportional increases in staffing.

- The focus on increasing revenue contributions from micro and small enterprises presents an opportunity to diversify and stabilize revenue streams, potentially supporting steady earnings growth as these businesses contribute a larger portion of total revenue.

- The decrease in share-based compensation expenses and improved customer acquisition efficiencies suggest an increased profitability outlook, which could positively impact earnings and net margins as these costs decline as a percentage of revenue.

- Active investments and developments in AI and technology, such as AI interview coaching and enhanced recruiter tools, could provide competitive advantages in the tech-driven recruitment industry, supporting future earnings growth through innovative service offerings.

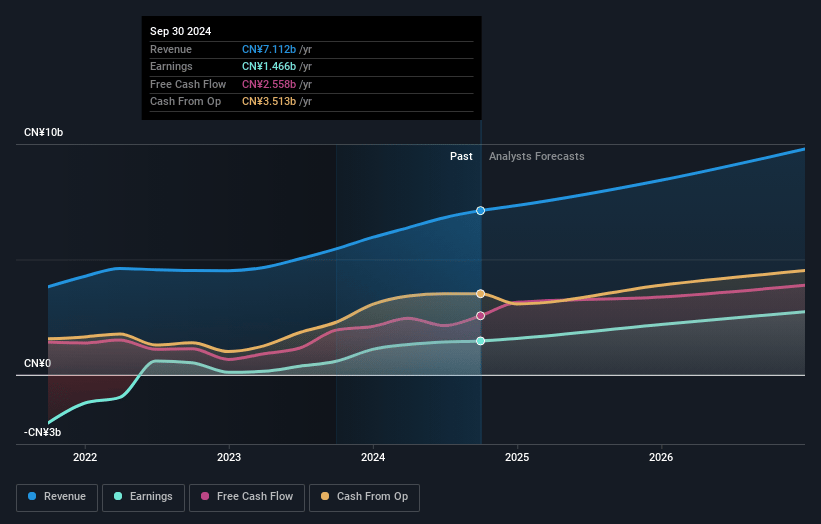

Kanzhun Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kanzhun's revenue will grow by 13.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 21.5% today to 30.9% in 3 years time.

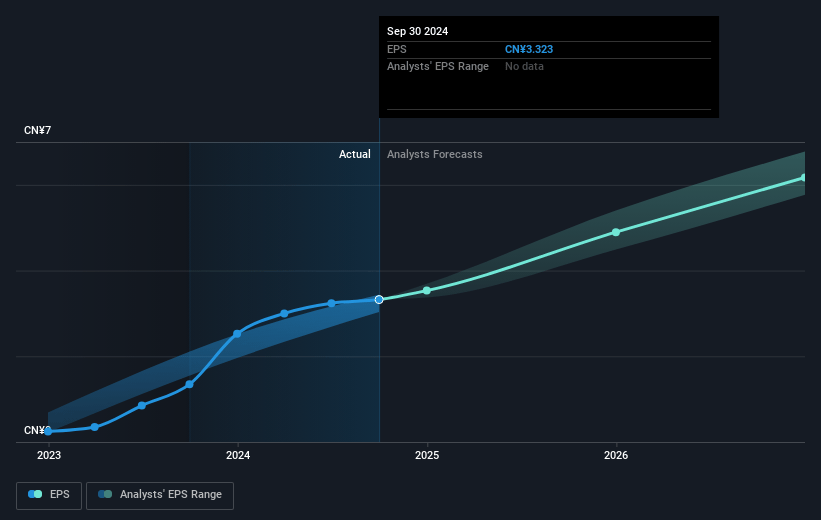

- Analysts expect earnings to reach CN¥3.3 billion (and earnings per share of CN¥7.62) by about April 2028, up from CN¥1.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting CN¥3.8 billion in earnings, and the most bearish expecting CN¥2.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.4x on those 2028 earnings, down from 28.8x today. This future PE is greater than the current PE for the US Interactive Media and Services industry at 15.4x.

- Analysts expect the number of shares outstanding to decline by 0.75% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.4%, as per the Simply Wall St company report.

Kanzhun Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The online recruitment industry is facing challenges due to the potential mass pollution of AI-generated resumes and job descriptions, which could complicate the effectiveness of job candidate matching and recruitment processes, impacting user trust and eventually leading to a slowdown in user growth and service adoption, affecting revenue.

- Despite being in a fast user growth stage with reduced marketing costs, the company cautiously avoids aggressive ARPPU increases, indicating potential constraints in rapidly monetizing its user base, which could limit revenue scalability.

- Significant investments in AI infrastructure have increased R&D expenses, which, while aimed at enhancing offerings, might weigh on profit margins if these efforts do not translate into sufficient new revenue streams quickly.

- The business faces macroeconomic uncertainties in the recruitment market, which could hinder its growth trajectory, impacting revenue and profitability, especially if the demand forecast and economic recovery do not proceed as anticipated.

- The company's current capital reserves and strong operating cash flow are under pressure to sustain shareholder returns and future growth initiatives, evidenced by substantial share repurchases; any potential misallocation or external fiscal policy changes could strain these resources, affecting net margins and cash positions.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $20.854 for Kanzhun based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $27.97, and the most bearish reporting a price target of just $13.98.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥10.6 billion, earnings will come to CN¥3.3 billion, and it would be trading on a PE ratio of 25.4x, assuming you use a discount rate of 8.4%.

- Given the current share price of $14.15, the analyst price target of $20.85 is 32.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.