Key Takeaways

- Strategic player acquisitions and upcoming events like the All-Star game could boost game attendance, merchandise sales, and overall revenue.

- Expanded broadcasting deals and development in The Battery Atlanta with new tenants could increase revenue through higher viewership and rental income.

- Revenue volatility arises from seasonal business nature, coupled with potential margin pressures from increased player expenses and fluctuating media deal effectiveness.

Catalysts

About Atlanta Braves Holdings- Through its subsidiary, Braves Holdings, LLC, owns and operates the Atlanta Braves Major League Baseball Club in the United States.

- The addition of All-Star Outfielder Jurickson Profar and returning players, alongside expected competition for the World Series, could enhance team performance, potentially leading to higher game attendance and increased baseball event revenue.

- Hosting the Major League Baseball All-Star game in July 2025 will showcase Atlanta and Truist Park, increasing brand visibility and potentially driving revenue from merchandise, sponsorships, and ticket sales.

- New broadcasting partnerships with FanDuel Sports Network and Gray Media expand accessibility and streaming options, which could increase viewership and broadcasting revenue.

- Continued development of The Battery Atlanta, including new tenant announcements like Shake Shack and Walk-ons Sports Bistro, and upcoming completion of the Truist Securities headquarters could boost mixed-use development revenue from rental income and visitor spending.

- Enhanced fan experience initiatives, such as the new Children's Healthcare of Atlanta Park and the Outfield Market food hall at Truist Park, aim to increase visitor engagement and spending, potentially improving net margins through higher revenue per attendee.

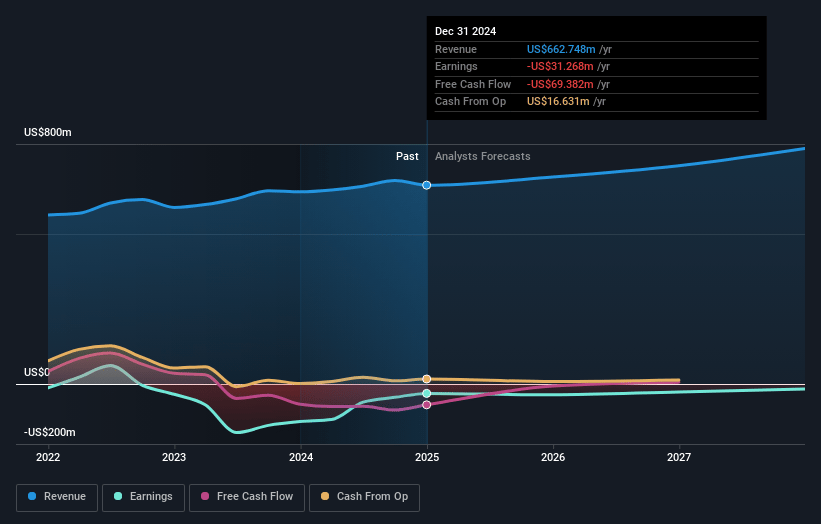

Atlanta Braves Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Atlanta Braves Holdings's revenue will grow by 5.8% annually over the next 3 years.

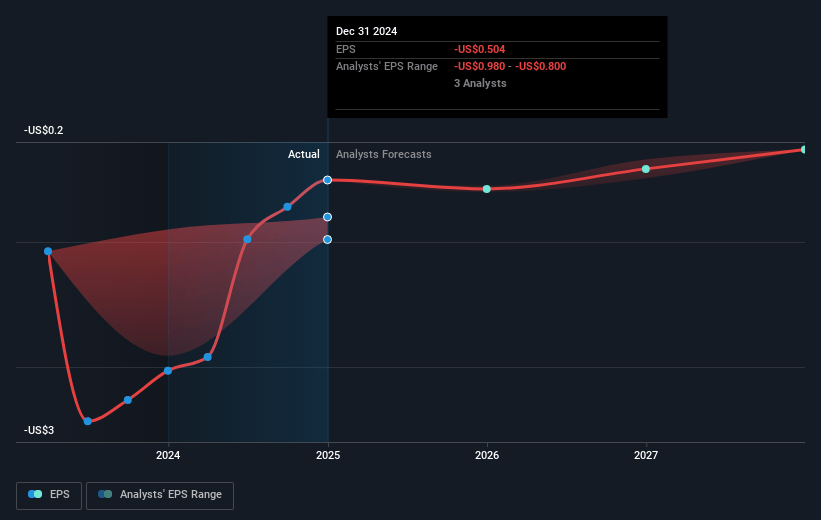

- Analysts are not forecasting that Atlanta Braves Holdings will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Atlanta Braves Holdings's profit margin will increase from -4.7% to the average US Entertainment industry of 9.1% in 3 years.

- If Atlanta Braves Holdings's profit margin were to converge on the industry average, you could expect earnings to reach $71.2 million (and earnings per share of $1.11) by about May 2028, up from $-31.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 62.7x on those 2028 earnings, up from -80.0x today. This future PE is greater than the current PE for the US Entertainment industry at 23.5x.

- Analysts expect the number of shares outstanding to grow by 1.01% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.05%, as per the Simply Wall St company report.

Atlanta Braves Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The absence of home games or concerts in the fourth quarter of 2024 resulted in a decline in revenue compared to the previous year, indicating potential revenue volatility due to the seasonal nature of the business.

- The company's increase in player salaries and revenue share expenses, along with the possibility of crossing the competitive balance tax, could pressure operating expenses and net margins.

- Reduced attendance at regular season home games, despite new sponsorship agreements and contractual rate increases, poses a risk to overall event revenue growth.

- The reengineering of the local media deal for more accessibility may not necessarily lead to increased broadcast revenue growth, especially given the current uncertainties in national broadcast agreements.

- The sports media landscape's increasing focus on short-form content and digital platforms, which might not be immediately monetized, could impact traditional linear broadcasting revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $53.75 for Atlanta Braves Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $60.0, and the most bearish reporting a price target of just $45.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $785.0 million, earnings will come to $71.2 million, and it would be trading on a PE ratio of 62.7x, assuming you use a discount rate of 9.0%.

- Given the current share price of $39.96, the analyst price target of $53.75 is 25.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.