Narratives are currently in beta

Key Takeaways

- Major affiliate agreements and innovative partnerships enhance value and drive revenue growth from bundled offerings and increased subscriptions.

- Expanding streaming services and strategic content licensing optimize monetization and audience reach, boosting revenue and profitability.

- Shifting consumer habits towards streaming and heavy reliance on platform partnerships pose risks, while traditional revenue declines pressure short-term earnings and growth investments.

Catalysts

About AMC Networks- An entertainment company, owns and operates a suite of video entertainment products that are delivered to audiences, a platform to distributors, and advertisers in the United States, Europe, and internationally.

- Renewal of major affiliate agreements, such as with Charter, is expected to enhance customer value by integrating linear networks and streaming services, potentially increasing future revenue from bundled offerings.

- Innovative partnerships, including licensing prior seasons of popular AMC series to Netflix, are boosting awareness and driving traffic back to AMC’s own platforms, likely contributing to revenue growth from increased subscriptions.

- Expanding ad-supported streaming services and FAST channels on multiple platforms are broadening AMC's audience reach, which could drive growth in both digital advertising revenue and subscriber numbers.

- Strategic content licensing and ownership, such as with the return of rights to The Walking Dead, provide opportunities to optimize monetization and increase future revenue by leveraging popular IP across various platforms and deals.

- Increased free cash flow generation targets, supported by operational improvements and strategic partnerships, are anticipated to strengthen the balance sheet and maintain profitability, impacting future earnings positively.

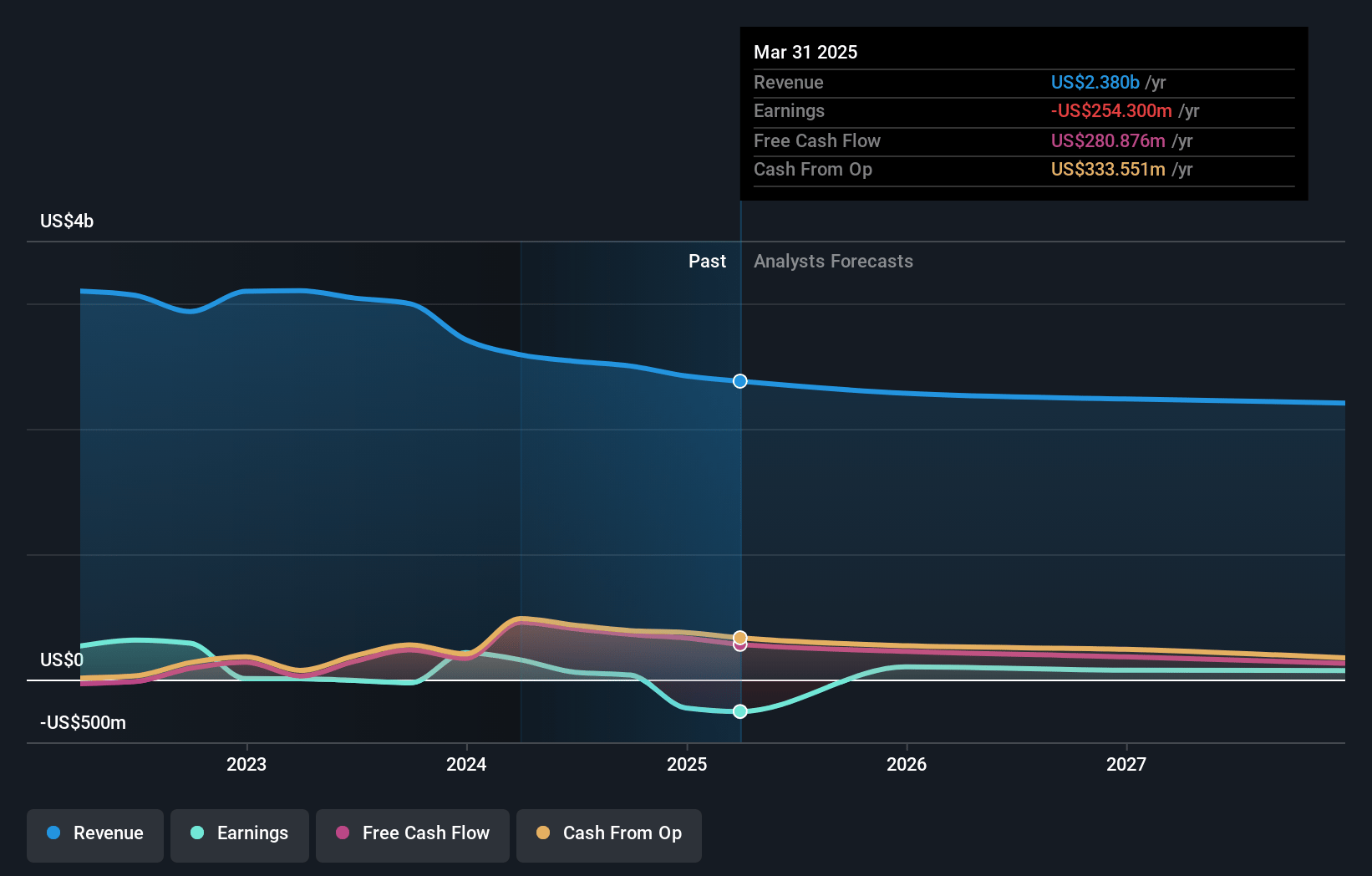

AMC Networks Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AMC Networks's revenue will decrease by -1.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.4% today to 6.5% in 3 years time.

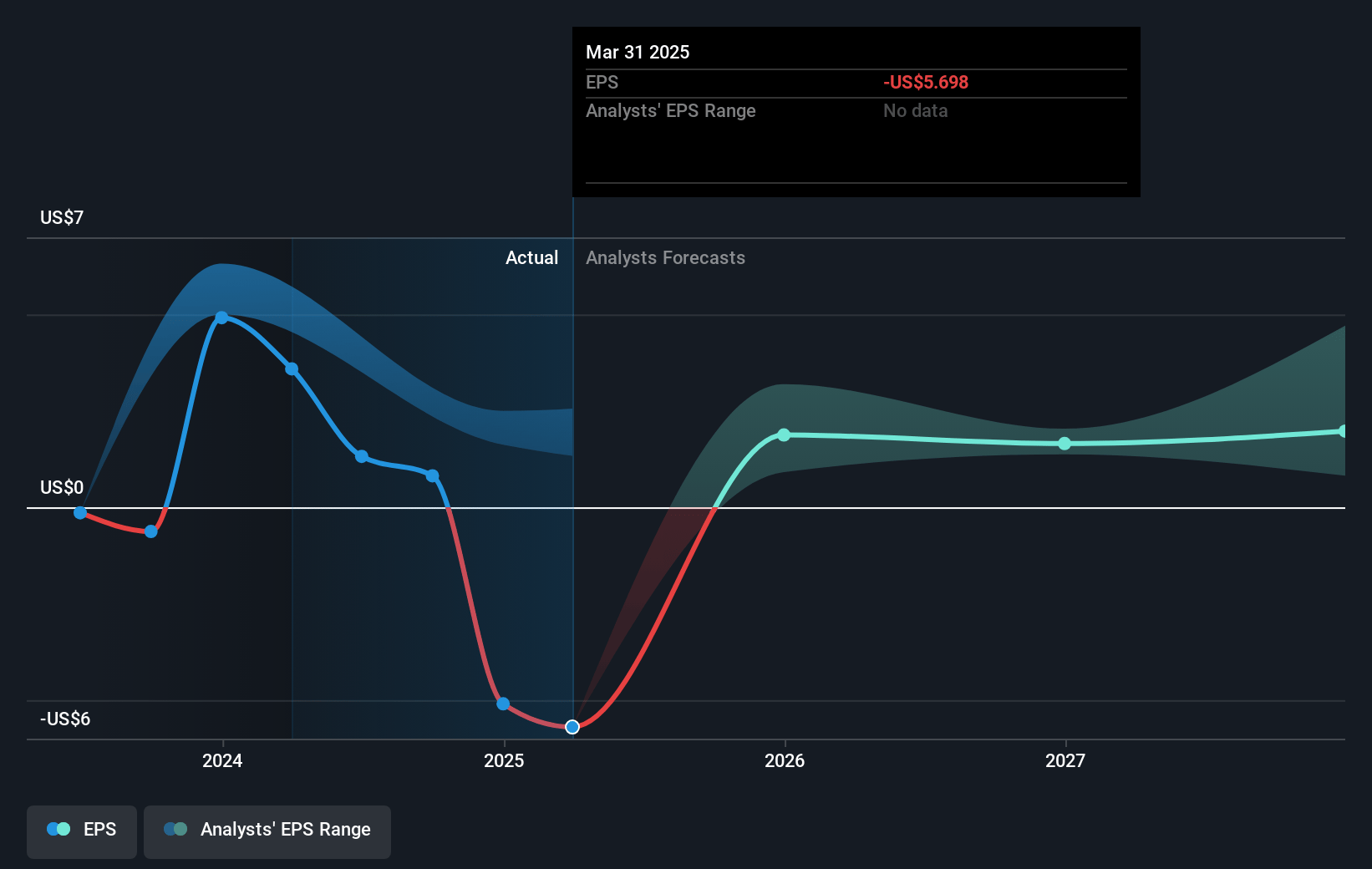

- Analysts expect earnings to reach $153.9 million (and earnings per share of $2.95) by about November 2027, up from $36.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $198 million in earnings, and the most bearish expecting $82.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 4.7x on those 2027 earnings, down from 11.7x today. This future PE is lower than the current PE for the US Media industry at 14.4x.

- Analysts expect the number of shares outstanding to grow by 5.75% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.86%, as per the Simply Wall St company report.

AMC Networks Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A decline in linear subscriber numbers, resulting in a 5% decrease in subscription revenue, highlights the challenge of shrinking traditional TV revenues. This trend, if it continues, could impact overall revenue growth.

- The decrease in advertising revenue by 10% due to lower linear ratings might indicate difficulty in attracting ad dollars, which could contribute to decreasing net margins.

- The exposure to linear content declines and shifting consumer behaviors towards streaming services requires heavy investment in streaming and digital offerings, potentially pressuring short-term earnings.

- The significant reliance on partnerships with platforms like Netflix and Amazon for content distribution creates dependency risks, which could affect AMC Networks' ability to capture revenue if partnership terms are unfavorable.

- The heavy financial strategy focusing on generating free cash flow and maintaining a strong balance sheet might limit flexibility for aggressive growth investments, potentially impacting future earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $10.29 for AMC Networks based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $8.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $2.4 billion, earnings will come to $153.9 million, and it would be trading on a PE ratio of 4.7x, assuming you use a discount rate of 10.9%.

- Given the current share price of $9.57, the analyst's price target of $10.29 is 7.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives