Narratives are currently in beta

Key Takeaways

- Maintenance of facilities and expected cost reductions enhance reliability, reduce expenses, and may boost margins and profitability.

- Anticipated interest rates and strategic acquisitions may stimulate demand and support long-term growth and shareholder value.

- Operational disruptions, competition, and economic slowdown may pressure margins and limit revenue growth, impacting Westlake's financial performance and future earnings.

Catalysts

About Westlake- Engages in the manufacture and marketing of performance and essential materials, and housing and infrastructure products in the United States, Canada, Germany, China, Mexico, Brazil, France, Italy, Taiwan, and internationally.

- Westlake has completed necessary repairs and maintenance on two key facilities, which should improve reliability and reduce operating costs going forward, positively impacting future earnings.

- The anticipated reduction in future interest rates in 2025 is expected to stimulate pent-up demand in the North American housing market, potentially boosting Westlake's sales and revenue in their Housing and Infrastructure Products segment.

- Expected cost savings from the company's mothballing of European epoxy units and continued reductions in fixed costs may enhance margins in the Performance and Essential Materials segment.

- The introduction of antidumping duties by the U.S. Department of Commerce on epoxy imports could lead to higher domestic prices, improving Westlake's profitability in this area.

- Westlake's significant cash reserves and intention to pursue strategic acquisitions may foster long-term growth and potentially increase shareholder value, underpinning earnings potential.

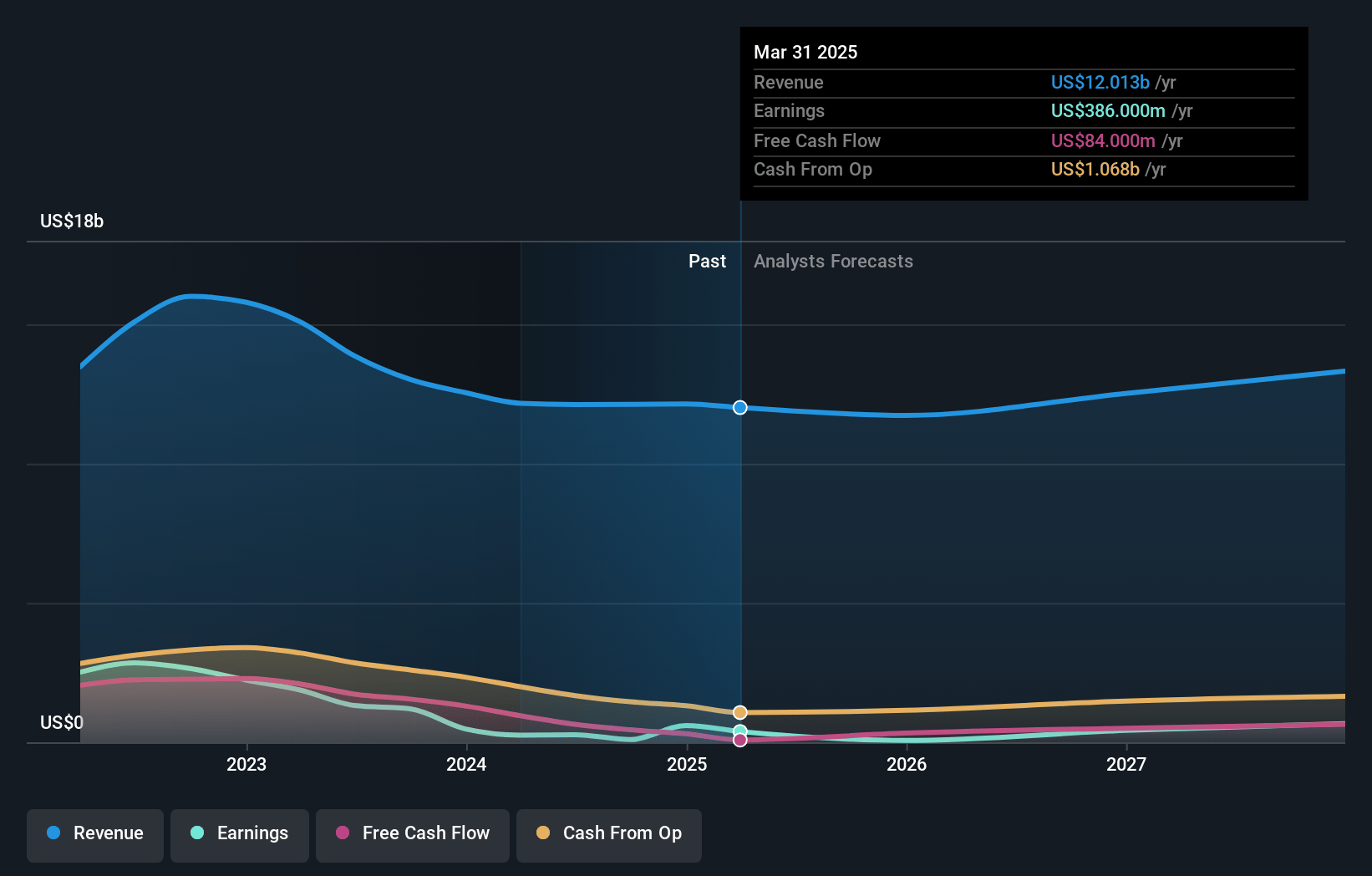

Westlake Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Westlake's revenue will grow by 6.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.8% today to 12.5% in 3 years time.

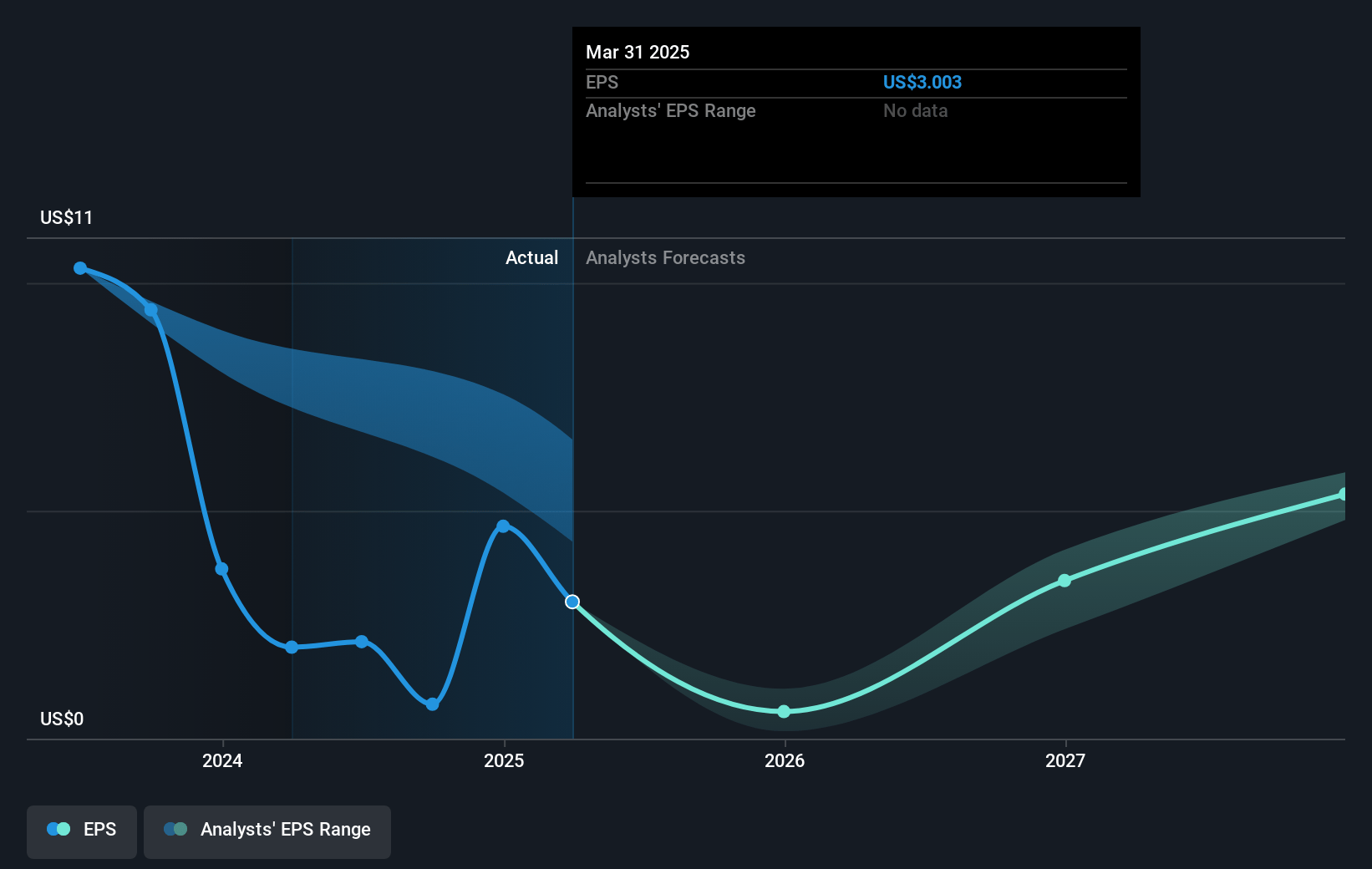

- Analysts expect earnings to reach $1.8 billion (and earnings per share of $14.17) by about November 2027, up from $97.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.7x on those 2027 earnings, down from 168.4x today. This future PE is lower than the current PE for the US Chemicals industry at 22.6x.

- Analysts expect the number of shares outstanding to decline by 0.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.15%, as per the Simply Wall St company report.

Westlake Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The mothballing of two units within the European Epoxy business is expected to lead to extended costs spread over several years, potentially impacting future expenses and net margins.

- Extended maintenance outages at two facilities caused a significant financial impact, reducing EBITDA by $120 million in the third quarter, which could signal operational disruptions impacting future earnings.

- Weather disruptions, such as hurricanes impacting the southeastern U.S., have negatively affected sales volumes in the HIP segment, potentially decreasing revenue if adverse weather conditions continue.

- The slow economic recovery in Europe and Asia, combined with muted activity levels, may continue to suppress demand and limit revenue growth in international markets.

- Competition from low-priced epoxy imports from Asia impacting profitability in both Europe and North America could continue to pressure margins until potential duties provide relief.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $157.94 for Westlake based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $185.0, and the most bearish reporting a price target of just $135.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $14.5 billion, earnings will come to $1.8 billion, and it would be trading on a PE ratio of 13.7x, assuming you use a discount rate of 7.1%.

- Given the current share price of $126.95, the analyst's price target of $157.94 is 19.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives