Key Takeaways

- Vulcan Materials may face revenue growth challenges due to weak private construction demand and potential cost overruns impacting profitability.

- Recent acquisitions could pressure earnings due to pricing impacts and uncertain synergies, challenging expected earnings growth.

- Strategic acquisitions and improved margins are driving future growth, enhancing profitability and earnings potential for Vulcan Materials.

Catalysts

About Vulcan Materials- Produces and supplies construction aggregates in the United States.

- Vulcan Materials may face challenges in its revenue growth due to a potential decline in private construction activity, as indicated by ongoing weakness in private non-residential demand. This could result in slower than expected aggregate shipments and revenue growth.

- The company is projecting low to mid-single-digit increases in freight-adjusted aggregates unit cash costs in 2025, driven by moderating inflation and improved efficiencies. However, any significant cost overruns could compress net margins, adversely affecting profitability.

- The impact of recent acquisitions has caused a negative mix impact on pricing, with a more than 100 basis point drag expected. These acquisitions could put pressure on overall earnings if Vulcan Materials cannot promptly align these acquired businesses with its pricing and operational standards.

- Elevated interest rates and affordability issues remain significant headwinds for residential construction. A slower than anticipated rebound in residential construction could lead to disappointing revenue growth and tighter margins if recovery lags behind expectations.

- Despite plans for strategic M&A, there is uncertainty regarding the realization of anticipated synergies and contribution to adjusted EBITDA. If these acquisitions fail to deliver the expected $150 million in adjusted EBITDA, this could result in lower overall earnings growth than consensus projections.

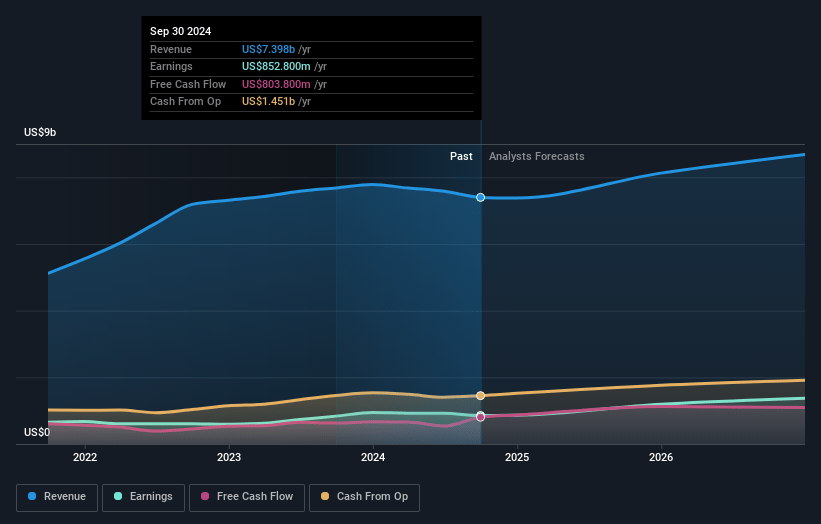

Vulcan Materials Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Vulcan Materials compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Vulcan Materials's revenue will grow by 4.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 12.4% today to 16.1% in 3 years time.

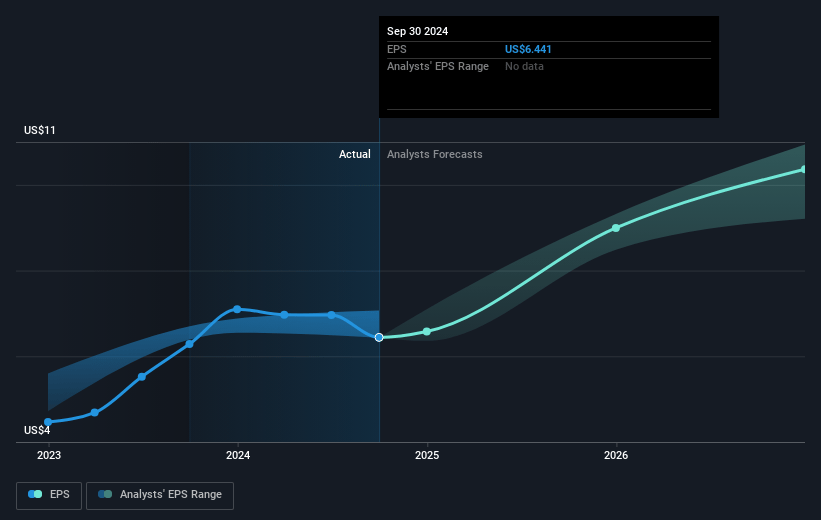

- The bearish analysts expect earnings to reach $1.4 billion (and earnings per share of $10.5) by about April 2028, up from $919.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 29.7x on those 2028 earnings, down from 35.1x today. This future PE is greater than the current PE for the US Basic Materials industry at 16.4x.

- Analysts expect the number of shares outstanding to decline by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.12%, as per the Simply Wall St company report.

Vulcan Materials Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Vulcan Materials has successfully enhanced its core business and expanded its reach by improving industry-leading aggregates cash gross profit per ton by 12 percent and investing over 2 billion dollars in value-creating acquisitions, indicating potential growth in earnings.

- The company reported a 16 percent improvement in adjusted EBITDA to 550 million dollars in Q4 2024, with an eighth consecutive quarter of year-over-year margin improvement, suggesting strong execution and positive future earnings prospects.

- Vulcan anticipates 2025 aggregate shipments to increase between 3 and 5 percent, driven by acquisitions and stable demand from its legacy business. This growth expectation could result in improved revenue.

- Improved pricing and moderating inflationary cost pressures are expected to result in double-digit year-over-year expansion in aggregate unit profitability, positively impacting net margins and earnings.

- Recent acquisitions are projected to contribute approximately 150 million dollars of adjusted EBITDA in 2025, supporting strong cash generation and potentially enhancing both revenue and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Vulcan Materials is $253.87, which represents one standard deviation below the consensus price target of $291.21. This valuation is based on what can be assumed as the expectations of Vulcan Materials's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $335.0, and the most bearish reporting a price target of just $184.78.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $8.5 billion, earnings will come to $1.4 billion, and it would be trading on a PE ratio of 29.7x, assuming you use a discount rate of 7.1%.

- Given the current share price of $244.53, the bearish analyst price target of $253.87 is 3.7% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystLowTarget holds no position in NYSE:VMC. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.