Key Takeaways

- Strategic focus on transitioning customers to natural colors is expected to drive significant revenue growth while maintaining stable profit margins.

- Portfolio optimization and strategic acquisitions are anticipated to enhance product offerings, reduce costs, and boost future revenue through natural ingredients demand.

- Sensient Technologies faces challenges such as reliance on non-GAAP measures, shifting market dynamics, geopolitical risks, and strategic financial resource allocation impacting margins and revenue stability.

Catalysts

About Sensient Technologies- Manufactures and markets colors, flavors, and other specialty ingredients worldwide.

- Sensient's focus on transitioning customers from synthetic to natural colors is seen as a significant revenue growth catalyst. Natural colors can result in up to 10x sales volume compared to synthetic colors, which is expected to raise overall revenue while maintaining stable profit margins due to the technical expertise and innovative product solutions offered by Sensient.

- The company's ongoing portfolio optimization plan aims to achieve annual savings of $8 million to $10 million by the end of 2025. This focus on cost optimization is expected to improve net margins as Sensient manages fixed costs and reduces inventory levels.

- Sensient's strategic acquisitions, such as the innovative French startup for natural color extraction, are designed to enhance its product offerings and supply chain capabilities, potentially boosting future revenue by catering to the emerging demand for natural ingredients in personal care and food products.

- Sensient's increased capital expenditures planned for 2025, totaling between $70 million to $80 million, highlight their commitment to internal investments that are anticipated to drive future growth, particularly through ROI projects in the Flavors Group, impacting revenue and earnings growth positively.

- The ongoing shift in consumer preference and regulatory landscape favoring natural colors, especially in the U.S., presents a substantial opportunity for Sensient as natural color conversions continue to accelerate. This transition is expected to impact revenue significantly due to higher sales volumes and a broader customer base adopting natural color solutions.

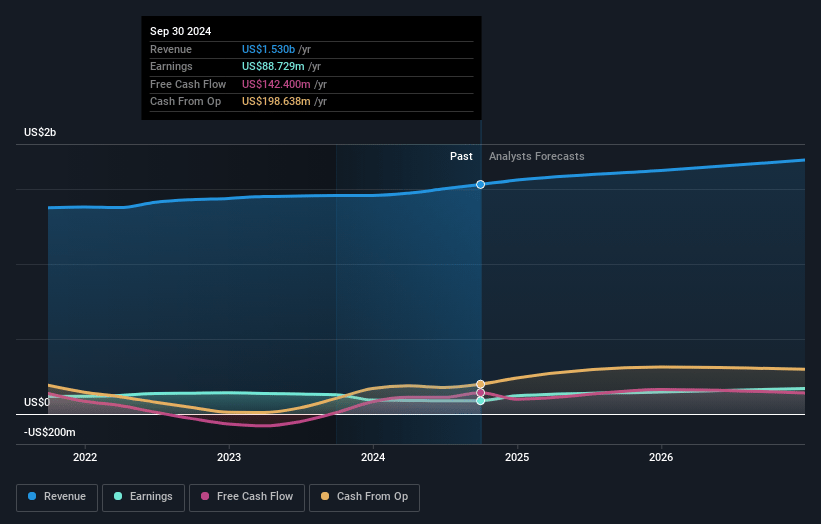

Sensient Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sensient Technologies's revenue will grow by 4.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.0% today to 10.2% in 3 years time.

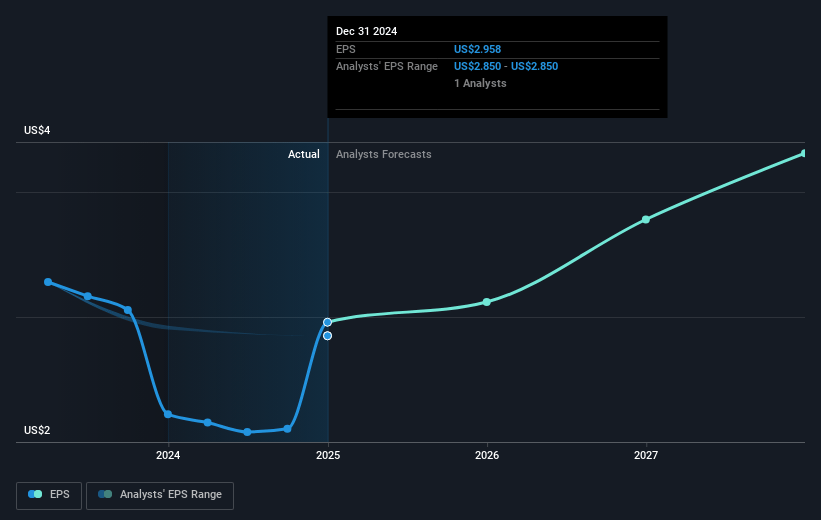

- Analysts expect earnings to reach $182.7 million (and earnings per share of $4.31) by about April 2028, up from $124.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.2x on those 2028 earnings, down from 26.7x today. This future PE is greater than the current PE for the US Chemicals industry at 17.6x.

- Analysts expect the number of shares outstanding to grow by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.11%, as per the Simply Wall St company report.

Sensient Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's reliance on non-GAAP financial measures and the fact that actual results may differ materially from projections due to a wide range of factors present uncertainty, which could impact earnings consistency and investor trust.

- The anticipated U.S. shift from synthetic to natural colors presents an opportunity but also involves supply chain challenges, regulatory hurdles, and could lead to increased costs, impacting net margins if not efficiently managed.

- The reliance on the Asia Pacific region for high revenue growth might expose the company to geopolitical risks and market-specific volatility, potentially affecting overall revenue stability.

- Tariff discussions are dynamic, with potential unknowns for how upcoming tariffs will affect the company; although price increases may offset costs, demand could be impacted, affecting revenue.

- Despite efforts to pay down debt, the company's plan to allocate capital towards both acquisitions and stock buybacks could stretch financial resources, potentially impacting net margins if acquisitions do not yield expected returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $85.5 for Sensient Technologies based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.8 billion, earnings will come to $182.7 million, and it would be trading on a PE ratio of 24.2x, assuming you use a discount rate of 7.1%.

- Given the current share price of $78.4, the analyst price target of $85.5 is 8.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.