Last Update07 May 25Fair value Increased 0.14%

Key Takeaways

- Expansion in owned stores and strategic acquisitions aim to boost growth, capture demand in key markets, and strengthen recurring, resilient revenue streams.

- Focus on digitization, operational efficiencies, and sustainable products supports higher margins, premium pricing opportunities, and competitive positioning in shifting regulatory landscapes.

- Sluggish core markets, regulatory pressures, rising input costs, and heightened competition threaten Sherwin-Williams’ revenue growth, margins, and earnings stability.

Catalysts

About Sherwin-Williams- Engages in the development, manufacture, distribution, and sale of paint, coatings, and related products to professional, industrial, commercial and retail customers.

- Sherwin-Williams is expanding its company-owned store network in North America, targeting 80 to 100 openings this year, strategically positioning itself to capture incremental demand as urbanization rises and more households form. This will boost direct-to-contractor sales, drive higher revenue growth, and support margin expansion as store density increases and pricing power improves.

- The acquisition of Suvinil, a leading player in Brazil, sets the stage for significant growth in emerging markets, where ongoing urbanization and increasing homeownership are driving demand for both new build and renovation projects. This transaction will accelerate Sherwin-Williams’ access to faster-growing, premium markets and should support above-market revenue and earnings growth over the next several years.

- Sherwin-Williams is poised to benefit from long-term increasing maintenance and renovation needs tied to aging housing stock and infrastructure in North America and Europe. With a strong focus on the residential repaint segment—gaining market share even in flat or contracting markets—the company is positioned for highly recurring, resilient revenue streams as cyclical demand recovers.

- Strategic investments in digitization, plant upgrades, and supply chain simplification are already translating into lower SG&A costs and supply chain efficiencies, which are expected to drive durable margin expansion and higher net income as volumes recover and more business shifts to higher-margin segments.

- Ongoing development and commercialization of sustainable and low-VOC products positions Sherwin-Williams at the forefront of tightening environmental regulations and shifting consumer preferences, giving the company a structural opportunity to capture premium pricing and additional market share while improving gross margin mix.

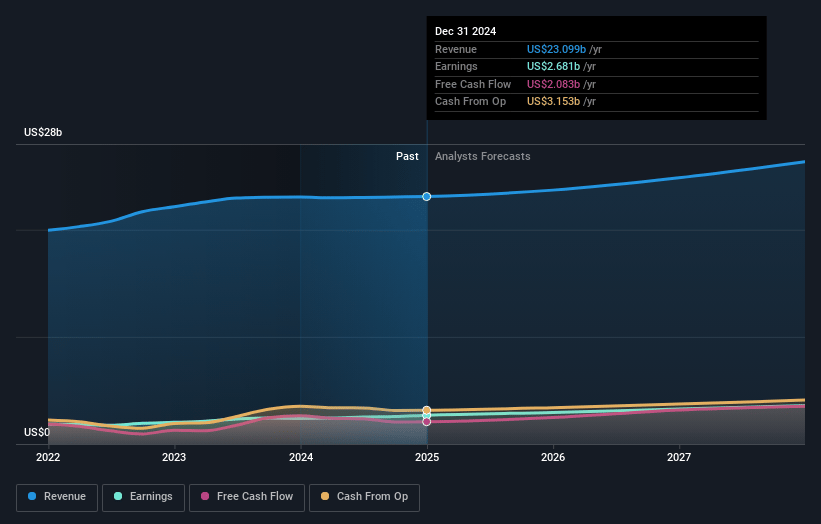

Sherwin-Williams Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Sherwin-Williams compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Sherwin-Williams's revenue will grow by 5.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 11.6% today to 14.3% in 3 years time.

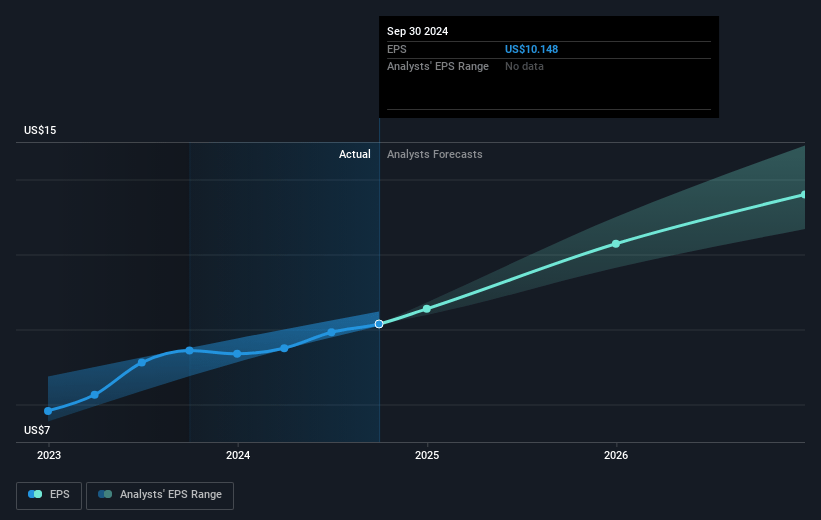

- The bullish analysts expect earnings to reach $3.8 billion (and earnings per share of $15.0) by about May 2028, up from $2.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 32.3x on those 2028 earnings, down from 32.9x today. This future PE is greater than the current PE for the US Chemicals industry at 20.2x.

- Analysts expect the number of shares outstanding to decline by 1.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.02%, as per the Simply Wall St company report.

Sherwin-Williams Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent softness and choppiness in core North American and European markets, driven by slowing homeownership and flat existing home sales, signal a structural ceiling on aggregate demand for Sherwin-Williams, which could hinder long-term revenue growth.

- Accelerating climate change regulation and consumer demand for sustainable, low-VOC products may require costly adaptations of legacy coatings portfolios, potentially leading to margin compression and higher compliance costs over time, negatively affecting net margins.

- Intensifying competition—including from regional and direct-to-consumer entrants leveraging advances in e-commerce—risks eroding Sherwin-Williams’ pricing power and undermining the value of its extensive retail footprint, which could pressure revenues and compress gross margins.

- Heavy reliance on the cyclical U.S. residential market leaves Sherwin-Williams exposed to downturns driven by high mortgage rates, weak commercial construction, and the uncertain DIY segment, resulting in increased earnings volatility and unpredictable cash flows.

- Rising raw material and input costs, specifically for petrochemical and specialty chemicals, combined with inflation and tariff-related headwinds, could outpace the company’s ability to raise prices, putting structural pressure on net margins if cost inflation persists.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Sherwin-Williams is $420.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Sherwin-Williams's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $420.0, and the most bearish reporting a price target of just $248.43.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $26.7 billion, earnings will come to $3.8 billion, and it would be trading on a PE ratio of 32.3x, assuming you use a discount rate of 7.0%.

- Given the current share price of $352.52, the bullish analyst price target of $420.0 is 16.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives