Key Takeaways

- Higher operating and interest expenses, coupled with a softer demand outlook, will pressure Sherwin-Williams' margins and revenue growth.

- Rising raw material costs and diminished acquisition synergies threaten further compressing gross and net margins.

- Strategic investments and pricing adjustments position Sherwin-Williams for enhanced revenue growth and margin expansion despite a challenging demand environment.

Catalysts

About Sherwin-Williams- Engages in the development, manufacture, distribution, and sale of paint, coatings, and related products to professional, industrial, commercial and retail customers.

- The company has indicated expectations for a softer for longer demand environment in 2025, with several end markets not projected to improve until 2026. This could limit revenue growth and affect their ability to meet previous sales projections.

- The new headquarters and R&D center, with an associated $80 million of additional operating costs, will put pressure on net margins. This increase in SG&A could have a dampening effect on earnings growth if revenue does not sufficiently offset these costs.

- Sherwin-Williams faces potential increased interest expenses due to refinancing $850 million in 2024 at higher rates, with an additional planned refinancing of approximately $1 billion in 2025. This will also include $20 million related to financing activities of the new building, impacting net income.

- The company has identified that raw material costs, driven by factors such as tariffs on Asian imports of epoxy, industrial resin, solvent, and TiO2 price increases, are expected to rise by low single digits, which could compress gross margins if not fully offset by corresponding price increases.

- Given that some significant acquisition synergies have already been realized, further expansion may not provide the same level of margin uplift, diminishing the effect of future M&A on earnings improvement amidst a competitive market.

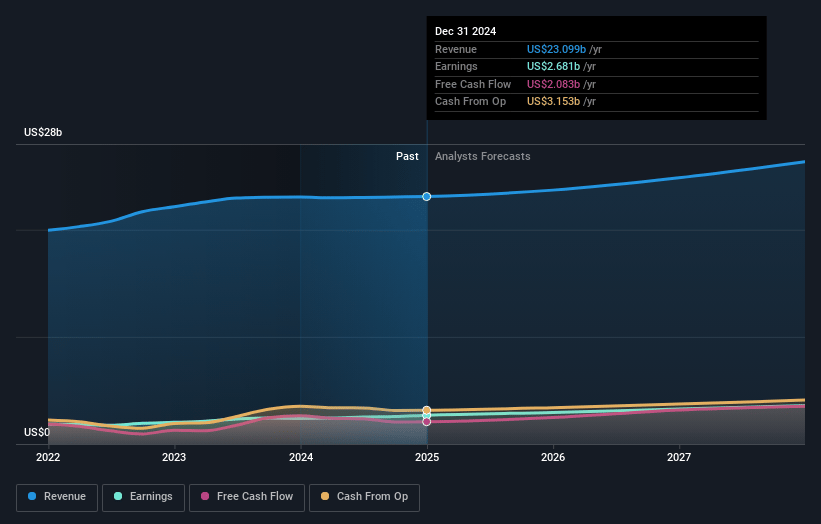

Sherwin-Williams Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Sherwin-Williams compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Sherwin-Williams's revenue will grow by 2.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 11.6% today to 13.0% in 3 years time.

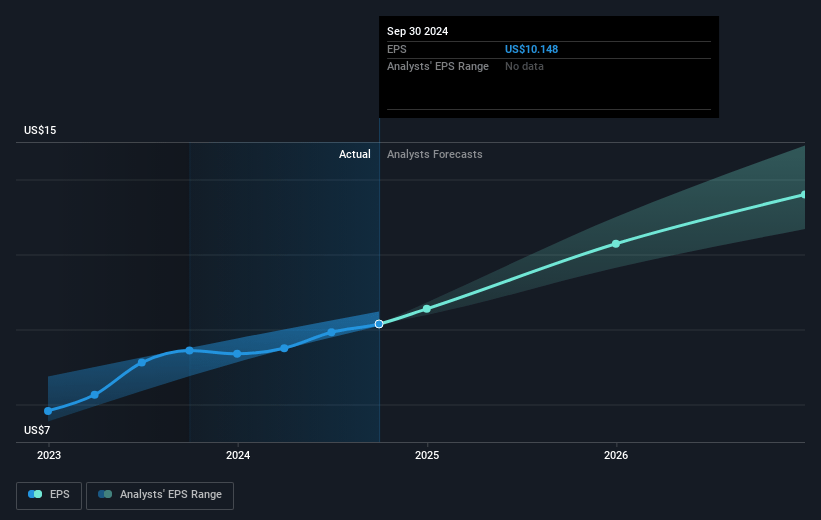

- The bearish analysts expect earnings to reach $3.2 billion (and earnings per share of $12.9) by about April 2028, up from $2.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 29.8x on those 2028 earnings, down from 30.9x today. This future PE is greater than the current PE for the US Chemicals industry at 17.7x.

- Analysts expect the number of shares outstanding to decline by 1.01% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.99%, as per the Simply Wall St company report.

Sherwin-Williams Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sherwin-Williams has implemented a robust strategy focused on gaining market share and delivering innovative solutions, which could enhance its competitive position, potentially boosting revenue and profitability over time.

- Despite a challenging demand environment, Sherwin-Williams managed to achieve record sales and profit growth in 2024, coupled with strong cash generation. This robust financial performance could contribute to sustained earnings.

- The company is proactively investing in key growth areas and executing a disciplined capital allocation strategy, including ongoing shareholder returns and infrastructure improvements, which could stabilize or enhance net margins.

- Sherwin-Williams expects to outpace the market in several categories, such as residential repainting and coil sales, supported by strategic investments and new account wins, which could lead to higher-than-anticipated revenue growth.

- With adjustments in pricing strategies, along with targeted price increases to offset raw material cost pressures, Sherwin-Williams aims to protect or expand its gross margins, potentially leading to better earnings results.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Sherwin-Williams is $321.82, which represents one standard deviation below the consensus price target of $372.37. This valuation is based on what can be assumed as the expectations of Sherwin-Williams's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $420.0, and the most bearish reporting a price target of just $247.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $24.5 billion, earnings will come to $3.2 billion, and it would be trading on a PE ratio of 29.8x, assuming you use a discount rate of 7.0%.

- Given the current share price of $331.28, the bearish analyst price target of $321.82 is 2.9% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystLowTarget holds no position in NYSE:SHW. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives