Key Takeaways

- Strategic divestitures and cost reduction actions are set to improve net margins and support sustainable organic growth for PPG Industries.

- Demand in Aerospace Coatings and share gains in multiple segments are poised to drive revenue and organic sales growth.

- Weak market conditions in Europe, currency translation issues, and soft global demand risk impacting PPG Industries' revenue growth and profit margins.

Catalysts

About PPG Industries- Manufactures and distributes paints, coatings, and specialty materials in the United States, Canada, the Asia Pacific, Latin America, Europe, the Middle East, and Africa.

- PPG Industries' strategic divestitures, such as the Architectural Coatings U.S. and Canada businesses, are expected to improve operating margins and position the company for sustainable organic growth. This is likely to positively impact net margins and earnings.

- The robust demand and backlog in Aerospace Coatings, along with continued share gains in the Auto Refinish and Protective & Marine Coatings segments, are expected to drive organic sales growth and revenue.

- PPG plans to capitalize on industrial production stabilization and share gains in Industrial Coatings in Latin America and China, supporting future revenue growth and expanded margins.

- PPG's cost reduction actions, including global structural costs and European manufacturing consolidations, aim to deliver $175 million in savings, enhancing net margins and overall financial performance.

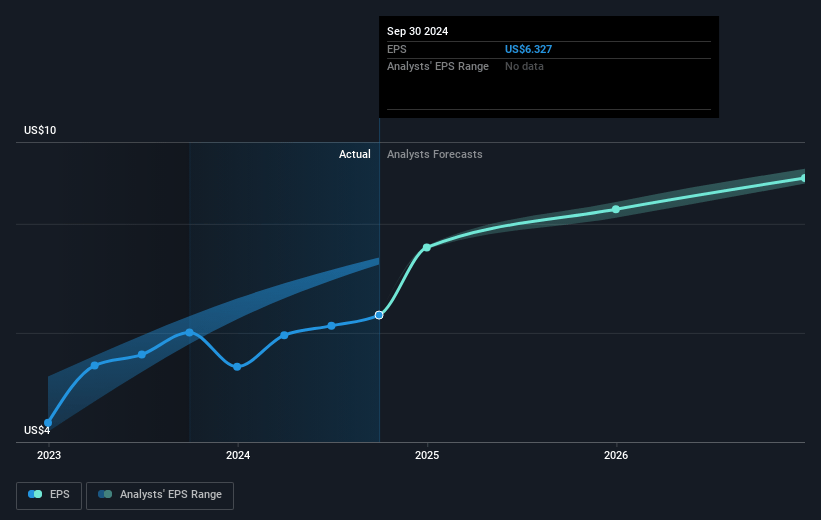

- With cash deployment strategies focused on share repurchases and potential M&A, along with a strong balance sheet, PPG is positioned to enhance earnings per share (EPS) by leveraging financial flexibility.

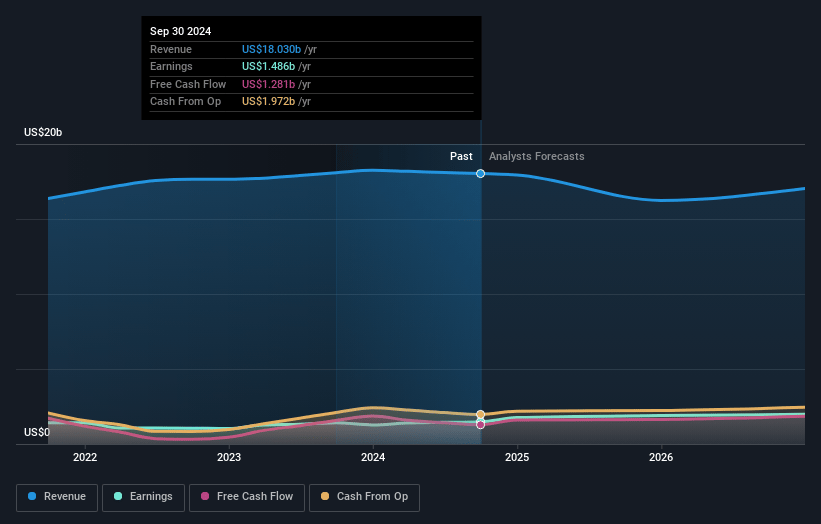

PPG Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming PPG Industries's revenue will grow by 2.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.5% today to 11.2% in 3 years time.

- Analysts expect earnings to reach $1.9 billion (and earnings per share of $8.66) by about March 2028, up from $1.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.7x on those 2028 earnings, down from 19.5x today. This future PE is lower than the current PE for the US Chemicals industry at 22.1x.

- Analysts expect the number of shares outstanding to decline by 3.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.31%, as per the Simply Wall St company report.

PPG Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Weak consumer confidence and lower sales volumes in the European architectural coatings market could affect revenue and net margins.

- Unfavorable foreign currency translations, especially from the Mexican peso, impacted net sales, affecting earnings and profit margins.

- The Industrial Coatings segment faced reduced demand due to soft global industrial production and weak automotive OEM industry production, which could impact revenue and overall earnings.

- Delays in order fulfillment, as indicated by increased order backlog in Aerospace Coatings despite improved production capacity, might affect short-term revenue recognition and cash flow.

- With anticipated slow demand in Europe and global industrial end-use markets, there is a risk to revenue growth expectations and margin stability if the economy does not improve as projected in 2025.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $131.778 for PPG Industries based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $166.0, and the most bearish reporting a price target of just $115.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $16.8 billion, earnings will come to $1.9 billion, and it would be trading on a PE ratio of 17.7x, assuming you use a discount rate of 7.3%.

- Given the current share price of $115.48, the analyst price target of $131.78 is 12.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

DM

Dman

Community Contributor

PPG Industries set to soar with 9% revenue growth in the next 3 years

Industries Investment Analysis: Navigating Challenges and Opportunities in 2025 PPG Industries, Inc. (NYSE: PPG), a global leader in paints, coatings, and specialty materials, presents a complex investment profile as of February 2025.

View narrativeUS$152.76

FV

24.9% undervalued intrinsic discount16.00%

Revenue growth p.a.

6users have liked this narrative

0users have commented on this narrative

39users have followed this narrative

7 days ago author updated this narrative