Narratives are currently in beta

Key Takeaways

- Anticipated recovery in the tire market and improved specialty segment to drive volume and revenue growth, aided by the new Huaibei plant.

- Tight supply-demand in the carbon black industry and trade policy changes to support pricing and domestic sales, enhancing margins and earnings.

- Weak demand, elevated imports, and potential policy impacts could pressure Orion’s revenues, with cost inflation also threatening margins in their Specialty segment.

Catalysts

About Orion- Engages in the manufacture and sale of carbon black products.

- Orion expects a recovery in the tire market, particularly in the Americas and EMEA regions, due to an anticipated normalization of tire imports and a revival in manufacturing, leading to potential volume growth in their Rubber segment. This could positively impact revenue in 2025.

- The company has a positive outlook on its Specialty segment, anticipating volume improvement due to completed debottlenecking efforts and significant contributions from the new Huaibei plant, which should bolster segment earnings and overall revenue growth in 2025.

- Orion foresees a tight supply-demand balance in the North American carbon black industry due to reduced effective capacity from stricter emission controls and plant closures. This tightness could support stable to higher pricing, potentially enhancing net margins.

- Trade policy changes, such as potential antidumping duties on imported truck tires from countries like Thailand, are expected to benefit Orion by reducing competitive pressure from imports, thereby supporting domestic production. This could indirectly improve earnings through higher domestic sales volumes.

- Orion plans reduced capital expenditure in 2025 and 2026, focusing on maintenance projects and small growth initiatives. This reduction, alongside higher expected EBITDA, is set to significantly boost free cash flow, improving the company’s financial flexibility and earnings.

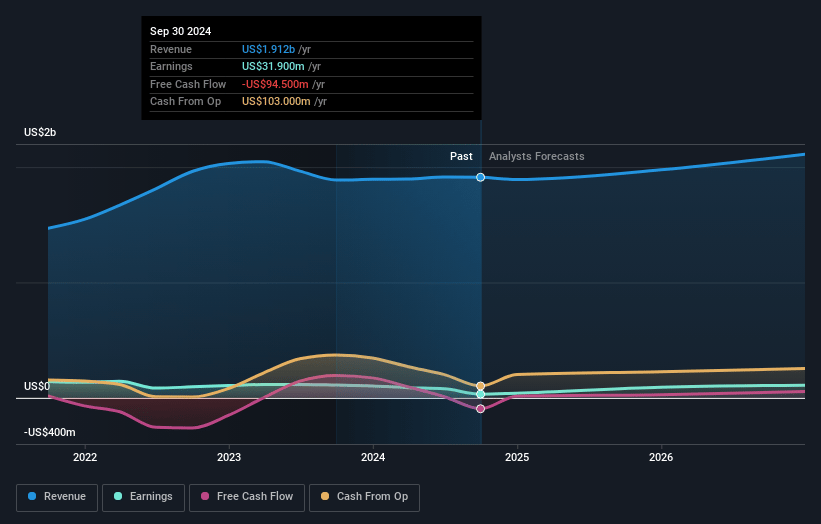

Orion Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Orion's revenue will grow by 4.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.7% today to 7.4% in 3 years time.

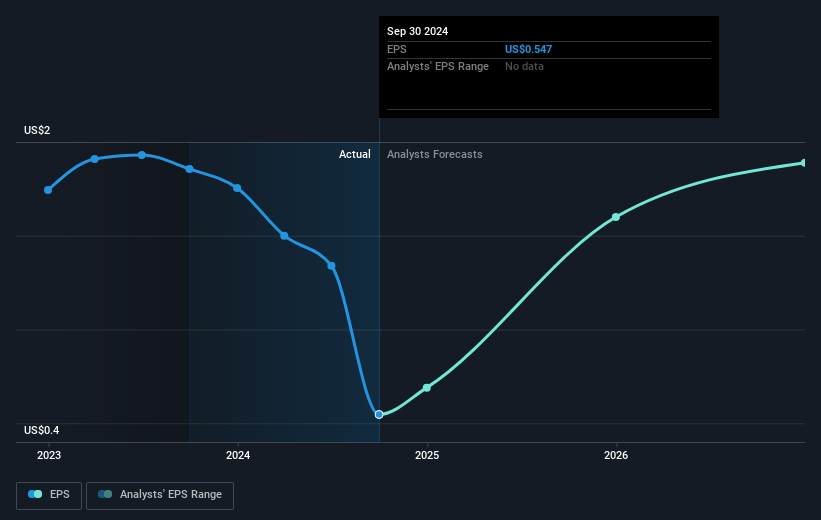

- Analysts expect earnings to reach $161.2 million (and earnings per share of $2.78) by about November 2027, up from $31.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.4x on those 2027 earnings, down from 31.8x today. This future PE is lower than the current PE for the US Chemicals industry at 25.4x.

- Analysts expect the number of shares outstanding to grow by 0.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.51%, as per the Simply Wall St company report.

Orion Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rubber segment demand in the Americas and EMEA is currently weak, with U.S. tire production significantly below mid-cycle conditions, which could negatively impact future revenues if demand does not recover.

- Elevated tire imports, which are closer to or above 60%, are affecting Orion’s business due to carbon black supply chain regional dependencies. This could continue to pressure revenues if not rectified.

- The industrial economy has softened, and customers have signaled a weaker month of December, which could dampen revenue expectations and impact Orion's earnings if the trend persists.

- Government policy, such as the antidumping duties on tires, might alter trade flows unpredictably. If not favorable, this could further impact Orion’s Rubber segment and corresponding revenues.

- Orion’s Specialty segment is subject to cost inflation and strategic staffing needs, which may impact net margins if these costs cannot be offset by volume improvements and favorable pricing.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $23.0 for Orion based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $26.0, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $2.2 billion, earnings will come to $161.2 million, and it would be trading on a PE ratio of 10.4x, assuming you use a discount rate of 8.5%.

- Given the current share price of $17.55, the analyst's price target of $23.0 is 23.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives