Narratives are currently in beta

Key Takeaways

- Aggressive transformation to reduce complexity and costs aims to enhance net margins, while focusing on strategic customers and markets drives earnings.

- Exploration of strategic options, including selling the GCF business and acquiring DS Smith, aims to reduce volatility and boost market position and revenue growth.

- Reliability issues and plant closures may affect future earnings and revenue stability, while uncertain productivity gains and demand softening pose additional risks.

Catalysts

About International Paper- Produces and sells renewable fiber-based packaging and pulp products in North America, Latin America, Europe, and North Africa.

- International Paper is aggressively engaging in a transformation that includes reducing complexity, lowering costs, and focusing on strategic customers and markets, which is expected to enhance net margins and drive earning improvements.

- The implementation of the 80/20 strategy across the company, aimed at operational optimization and resource allocation, is projected to significantly boost productivity and reduce costs, positively impacting net margins and potentially boosting earnings.

- The closure of five plants, accompanied by investment in remaining facilities, is targeted at optimizing the company's footprint, which should reduce structural costs and improve profitability, thus enhancing net margins.

- Potential strategic options for the Global Cellulose Fibers (GCF) business, including a possible sale, are being explored to better position the company long-term, with an expectation to reduce volatility and improve net margins.

- International Paper's imminent acquisition of DS Smith is expected to create synergies and enhance market positions in North America and Europe, which should contribute to revenue growth and operational efficiencies, thus enhancing earnings.

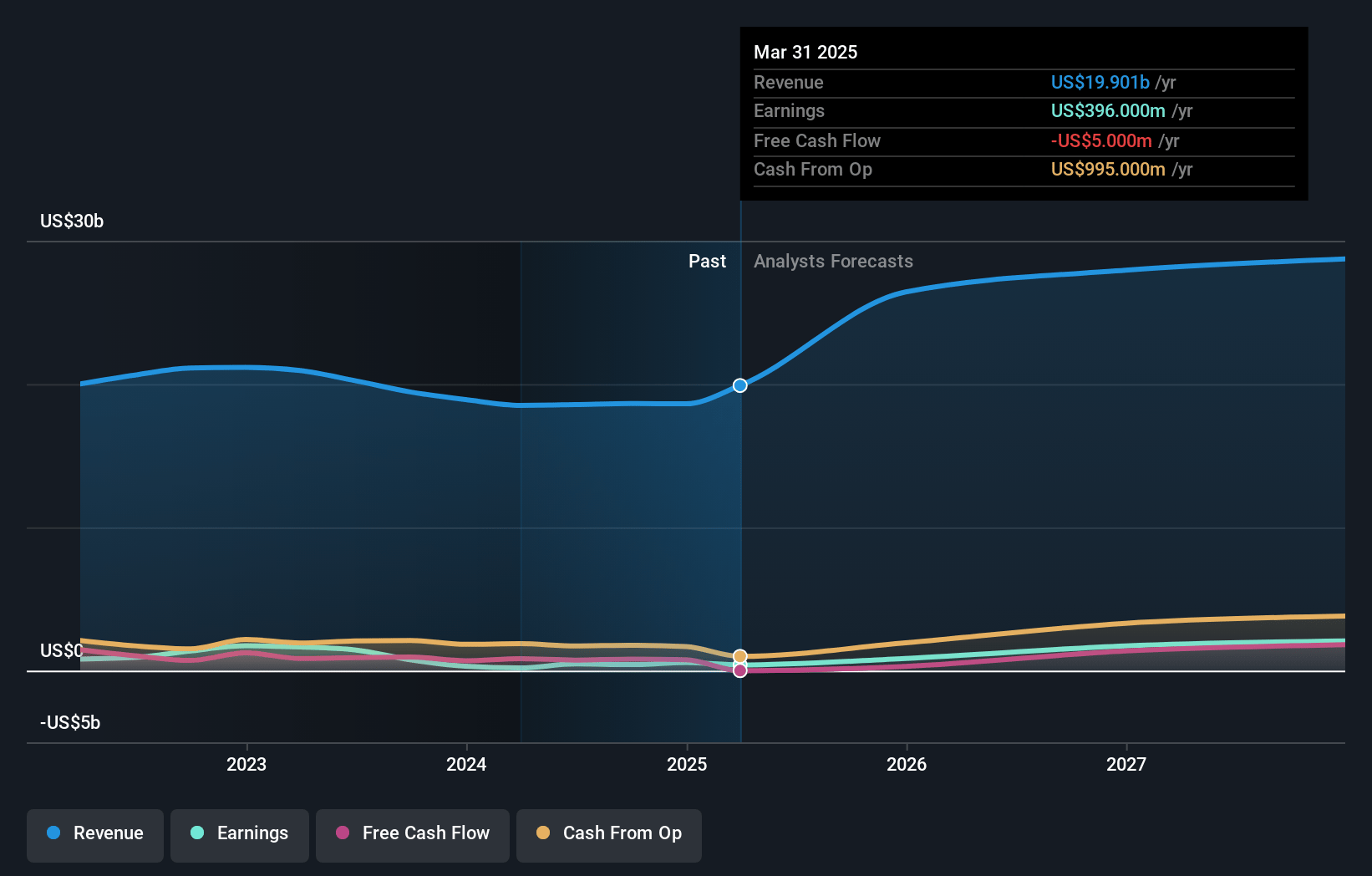

International Paper Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming International Paper's revenue will grow by 10.7% annually over the next 3 years.

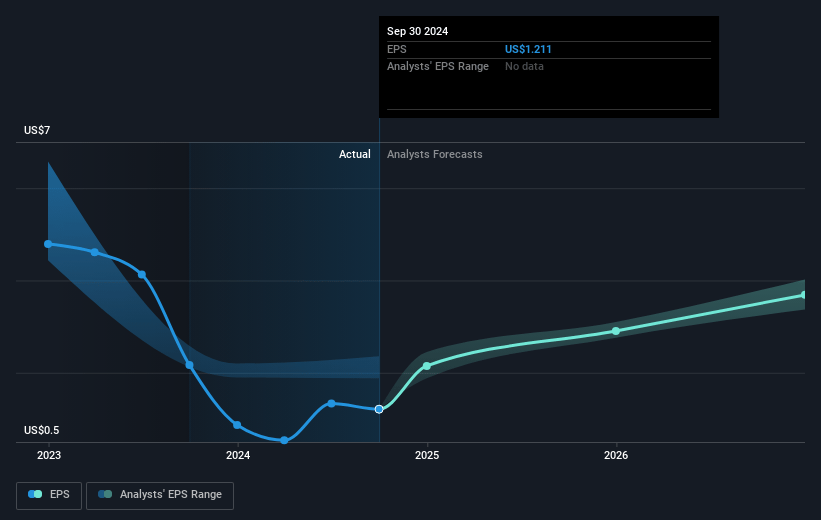

- Analysts assume that profit margins will increase from 2.3% today to 5.3% in 3 years time.

- Analysts expect earnings to reach $1.3 billion (and earnings per share of $3.8) by about November 2027, up from $420.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.5 billion in earnings, and the most bearish expecting $1.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.1x on those 2027 earnings, down from 47.6x today. This future PE is lower than the current PE for the US Packaging industry at 24.6x.

- Analysts expect the number of shares outstanding to grow by 0.55% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 6.07%, as per the Simply Wall St company report.

International Paper Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is facing reliability issues in its mill system and higher operational costs which could impact future earnings due to increased spending in these areas.

- With the announced plant closures, there is a risk of potential loss of revenues if 100% of strategic customers are not retained, impacting future revenue stability.

- The expected lower earnings in the Global Cellulose Fibers segment due to prior price index declines and higher maintenance outages could reduce overall company earnings.

- Europe is experiencing some softening in demand, which may negatively affect revenues from the EMEA region if this trend continues or worsens.

- The company is still in the early stages of the 80/20 implementation, and there is uncertainty on whether the expected productivity improvements will be fully realized, possibly affecting net margins and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $54.6 for International Paper based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $66.0, and the most bearish reporting a price target of just $45.1.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $25.3 billion, earnings will come to $1.3 billion, and it would be trading on a PE ratio of 17.1x, assuming you use a discount rate of 6.1%.

- Given the current share price of $57.56, the analyst's price target of $54.6 is 5.4% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives