Narratives are currently in beta

Key Takeaways

- FMC's focus on new fungicide and herbicide products is expected to drive significant sales growth and revenue expansion.

- Restructuring efforts and strategic divestitures aim to enhance financial stability, improving net margins and reducing debt burdens.

- Challenges in Latin America, Asia, and EMEA, including market instability, pricing pressures, and regulatory impacts, threaten FMC's revenue growth and margin stability.

Catalysts

About FMC- An agricultural sciences company, provides crop protection, plant health, and professional pest and turf management products.

- FMC is prioritizing the commercialization of new products like Fluindapyr-based fungicide and Isoflex-containing herbicide, which are anticipated to generate significant sales in upcoming quarters. This is expected to drive revenue growth.

- The company is executing a restructuring plan that targets $125 million to $150 million in savings for 2024 and over $225 million in run-rate savings in 2025, which should improve net margins and overall earnings.

- FMC is launching new fungicides, an area where it has historically underperformed, leading to potential expansion into new markets and additional revenue streams.

- With expected inventory normalization in Latin America and other regions, FMC anticipates improved market conditions by the second half of 2025, which could boost revenue and help stabilize pricing.

- The planned sale of the Global Specialty Solutions business will reduce debt and interest expenses, allowing for increased free cash flows and potentially improving net earnings through reduced financial costs.

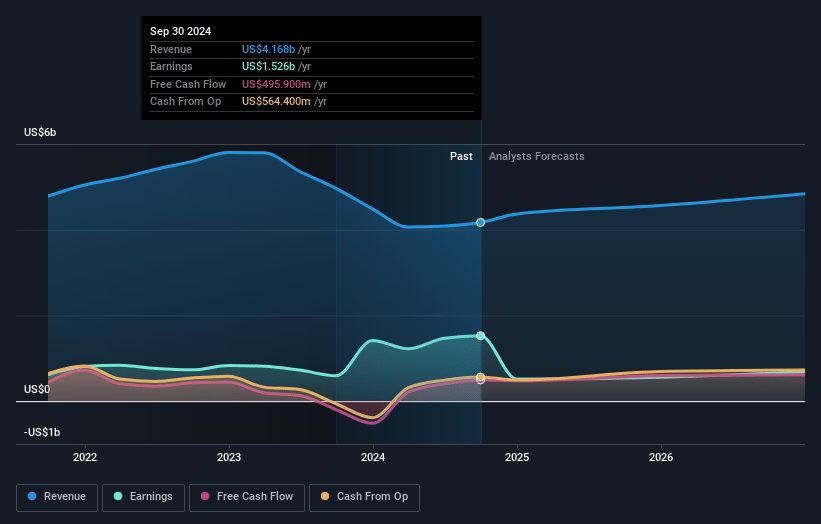

FMC Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming FMC's revenue will grow by 7.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 35.9% today to 13.9% in 3 years time.

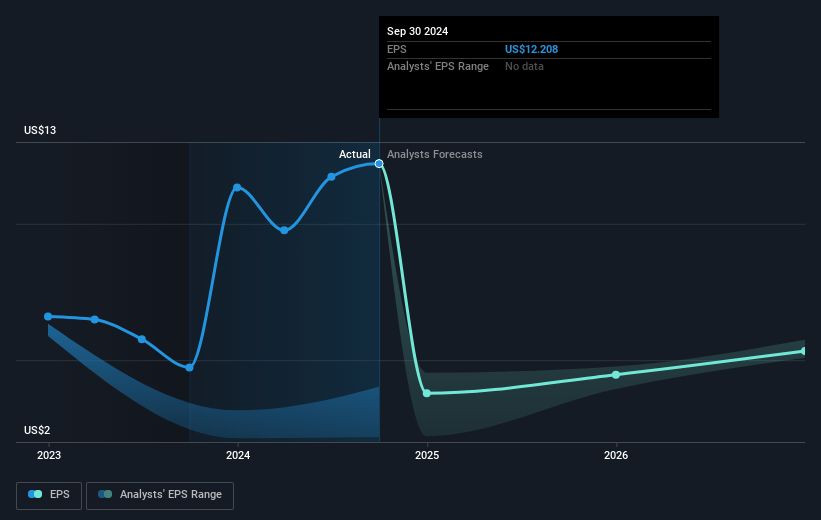

- Analysts expect earnings to reach $707.5 million (and earnings per share of $5.59) by about October 2027, down from $1.5 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $634 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.3x on those 2027 earnings, up from 5.1x today. This future PE is lower than the current PE for the US Chemicals industry at 25.5x.

- Analysts expect the number of shares outstanding to grow by 0.47% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 7.48%, as per the Simply Wall St company report.

FMC Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Latin America's weak market and FMC's challenges due to delayed rains and increased borrowing rates could continue to impact revenue and margins, particularly if these market conditions persist or worsen.

- The bankruptcy of a large customer in Brazil, which has led to specific challenges for FMC, may affect revenue stability and market share if similar events occur in the future.

- Continued price pressure in Brazil and Argentina, where FMC has chosen to protect its market position, impacts overall company pricing strategy and could negatively affect net margins if aggressive pricing continues.

- The uncertain recovery timeline in Asia, particularly in India, where no channel inventory recovery is expected until 2026, creates a revenue risk by potentially delaying growth in a significant market.

- Expected registration losses in EMEA due to regulatory pressures could impact FMC's revenue and reduce sales, especially if not compensated by the introduction of new products.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $73.56 for FMC based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $110.0, and the most bearish reporting a price target of just $59.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $5.1 billion, earnings will come to $707.5 million, and it would be trading on a PE ratio of 16.3x, assuming you use a discount rate of 7.5%.

- Given the current share price of $60.18, the analyst's price target of $73.56 is 18.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives