Narratives are currently in beta

Key Takeaways

- New facility in Texas and strategic positioning in high-demand markets enhance product offerings and drive revenue growth with sustainable materials.

- Strong cash flow, disciplined capital allocation, and market expansion efforts support earnings growth and increased pricing power.

- Disruptions, market challenges, and input costs might pressure revenues and margins if weather, demand, and infrastructure funding issues persist.

Catalysts

About Eagle Materials- Through its subsidiaries, manufactures and sells heavy construction materials and light building materials in the United States.

- Commissioning of the Texas Lehigh slag grinding facility in Houston is expected to enhance Eagle Materials' product offering with over 500,000 tons of low-carbon intensity slag, potentially increasing future revenue by expanding the product line in a market with growing demand for sustainable building materials.

- Upcoming infrastructure projects funded by the $1 trillion Federal infrastructure bill (IIJA) and anticipated rebound in non-residential and residential construction are expected to drive demand, which could increase revenue and support higher pricing power in cement and aggregates markets.

- The modernization and expansion project at the Mountain Cement plant, alongside the clinker cooler replacement at Texas Lehigh, aim to improve operational reliability and efficiency, which could enhance net margins through reduced maintenance costs and heightened production capabilities.

- Strategic positioning in the U.S. Heartland market, where demand exceeds the national average due to less import competition, allows Eagle Materials to capitalize on localized demand, sustain revenues, and support announced price increases slated for early January 2025.

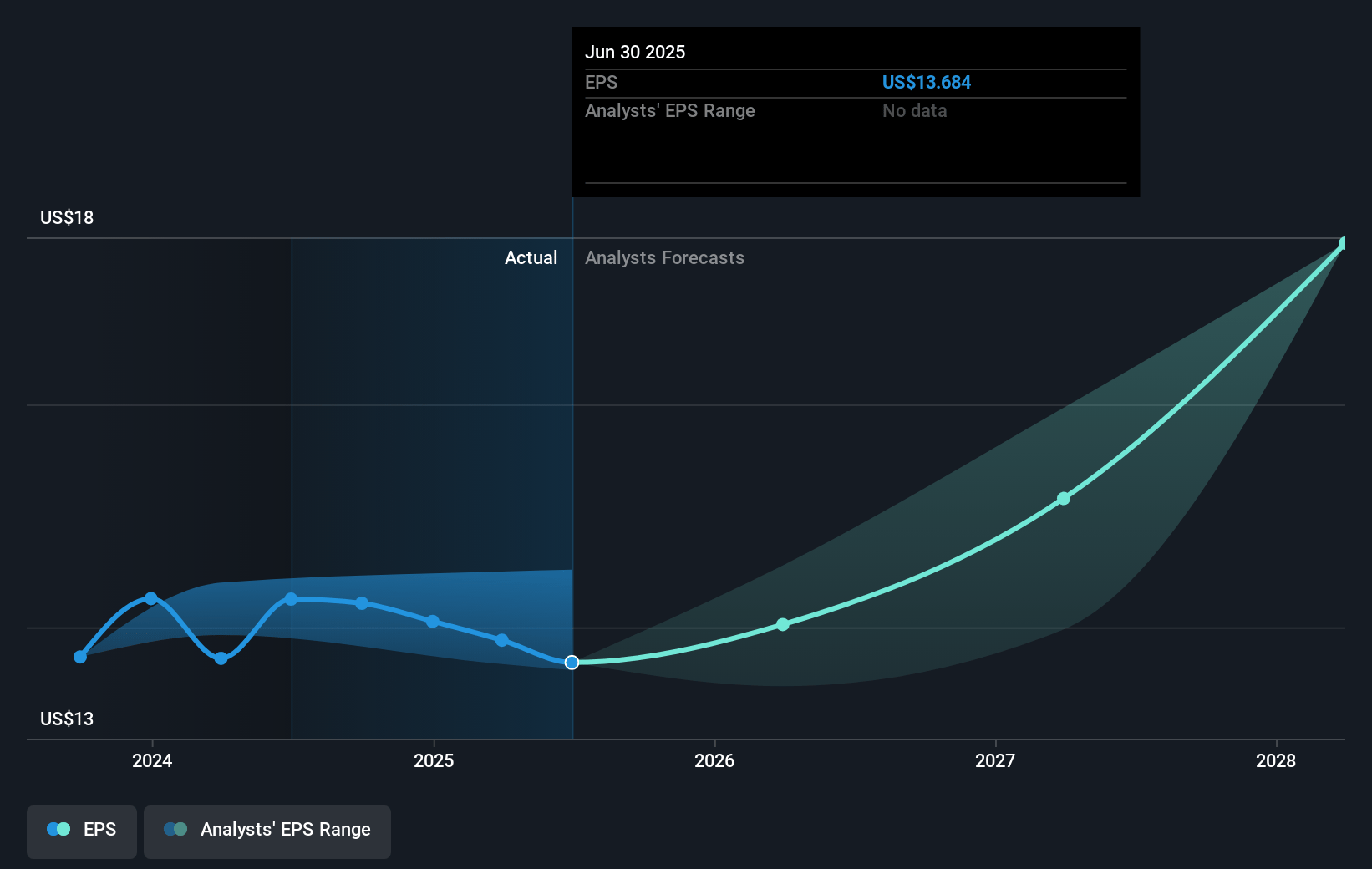

- The strong cash flow generation and disciplined capital allocation, including share buybacks and strategic bolt-on acquisitions like the aggregates business in Kentucky, are expected to drive continued earnings growth and increased EPS as operational efficiencies and market reach improve.

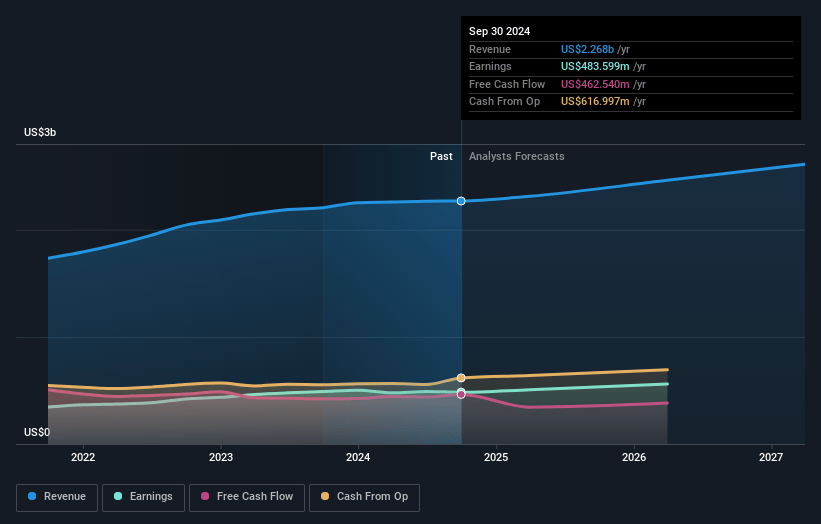

Eagle Materials Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Eagle Materials's revenue will grow by 5.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 21.3% today to 24.0% in 3 years time.

- Analysts expect earnings to reach $642.9 million (and earnings per share of $20.13) by about November 2027, up from $483.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.2x on those 2027 earnings, down from 21.4x today. This future PE is lower than the current PE for the US Basic Materials industry at 24.3x.

- Analysts expect the number of shares outstanding to decline by 1.63% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.87%, as per the Simply Wall St company report.

Eagle Materials Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Weather disruptions and project delays significantly impacted cement and concrete volumes, which could continue to pressure revenues in the near term if similar conditions persist.

- Challenges in specific markets, such as Denver and Kansas City, have affected aggregate and concrete volumes, which could impact revenue if the demand recovery is slower than anticipated.

- The slow rollout of the Federal infrastructure bill (IIJA) funding has resulted in a delay in expected construction demand. If this persists, it could affect the projected revenue increase from infrastructure projects.

- Planned outages for maintenance at key facilities, like Texas Lehigh and Tulsa, are adding to maintenance costs, potentially lowering net margins in the upcoming quarters.

- Fluctuations in input costs, such as natural gas and OCC (Old Corrugated Containers) for paperboard, along with reliance on commodity market pricing, could affect earnings if these costs rise unexpectedly.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $309.78 for Eagle Materials based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $334.0, and the most bearish reporting a price target of just $265.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $2.7 billion, earnings will come to $642.9 million, and it would be trading on a PE ratio of 18.2x, assuming you use a discount rate of 6.9%.

- Given the current share price of $308.25, the analyst's price target of $309.78 is 0.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives