Key Takeaways

- Strengthened tariffs, reshoring trends, and industry consolidation position Cleveland-Cliffs for lasting pricing power, shipment growth, and margin expansion over competitors.

- Vertical integration and innovation in specialty steels enable substantial upside in cash generation, premium pricing, and hidden value realization through asset optimization and potential divestitures.

- Persistent reliance on traditional steelmaking, high debt, and reluctance to decarbonize expose Cleveland-Cliffs to market, regulatory, and competitive risks that threaten long-term profitability.

Catalysts

About Cleveland-Cliffs- Operates as a flat-rolled steel producer in the United States, Canada, and internationally.

- Analyst consensus sees the Section 232 tariffs as a revenue and margin support, but this likely understates their transformative impact: with enforcement solidifying, Cleveland-Cliffs could see an extended period of structurally higher domestic steel pricing, a step-change in market share, and greater long-term earnings leverage as competitors lose cost advantages and import levels remain pinned at multi-year lows.

- Analysts broadly expect $120 million in Stelco synergies and unspecified cost improvements, but the integration is already driving coke self-sufficiency and $100+ per ton internal benefit, suggesting that realized synergies and ongoing asset optimization could far surpass current expectations, delivering substantial upside to net margins and cash generation well beyond 2025.

- Cleveland-Cliffs is poised to benefit disproportionately from the accelerating reshoring of U.S. manufacturing and infrastructure renewal, with multi-year government investments and new trade rules set to create sustained, elevated demand across key value-added steel segments, supporting a rapid and durable increase in shipment volumes and higher contractual pricing.

- The company's unique vertical integration and early moves in value-added steels (electrical, automotive, and premium stainless), coupled with its independence from imported feedstocks, enables Cleveland-Cliffs to capitalize on surging adoption of electric vehicles, domestic appliance production, and clean energy infrastructure, driving a mix shift toward structurally higher average selling prices and persistent gross margin expansion.

- Active review and potential sale of noncore or idled assets, high inbound interest from foreign and strategic investors, and the likelihood of further North American industry consolidation create multiple near-term opportunities to unlock significant hidden value and accelerate debt reduction, resulting in a step-change in capital structure and a direct boost to earnings per share.

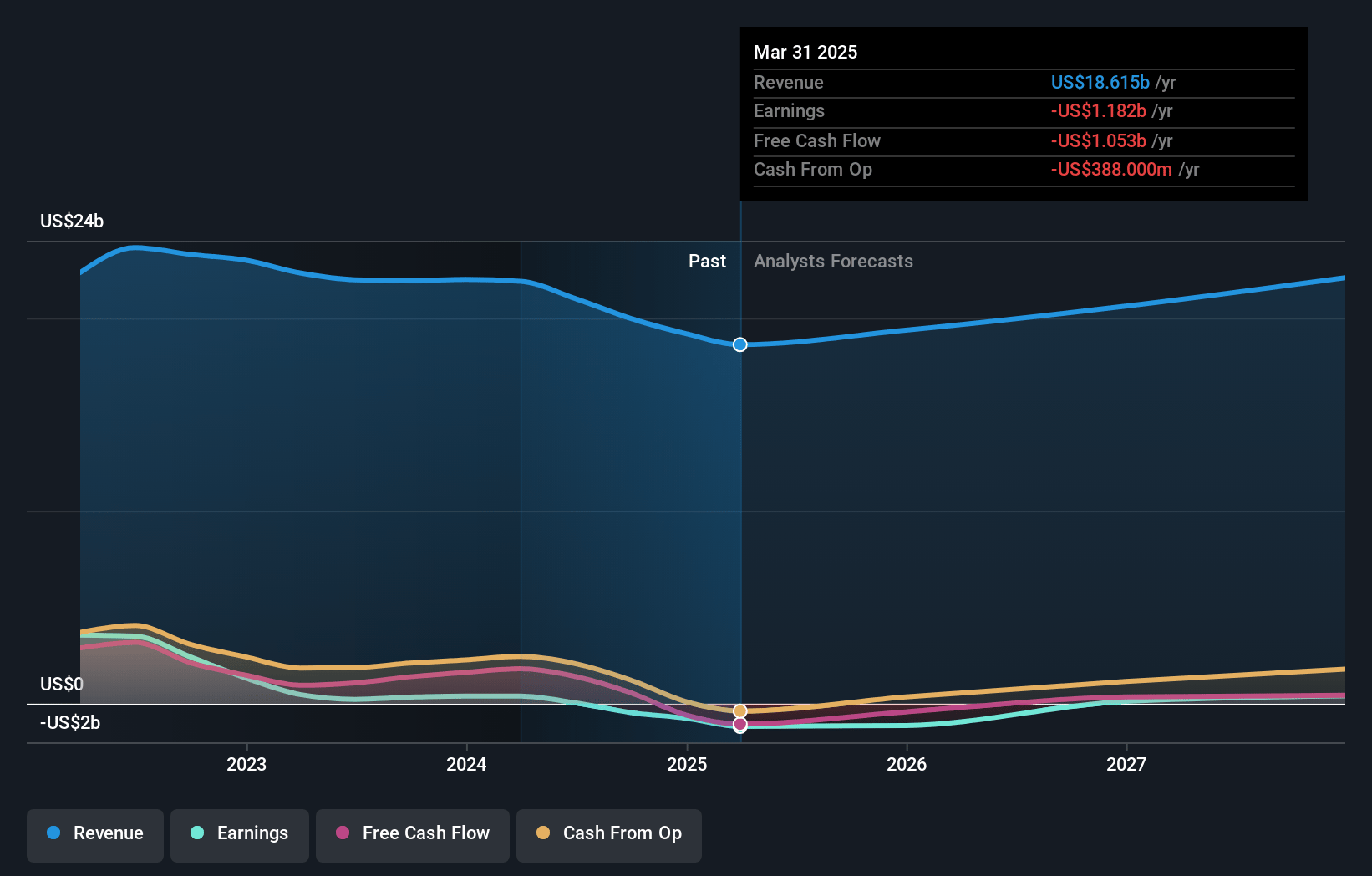

Cleveland-Cliffs Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Cleveland-Cliffs compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Cleveland-Cliffs's revenue will grow by 9.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -9.0% today to 2.9% in 3 years time.

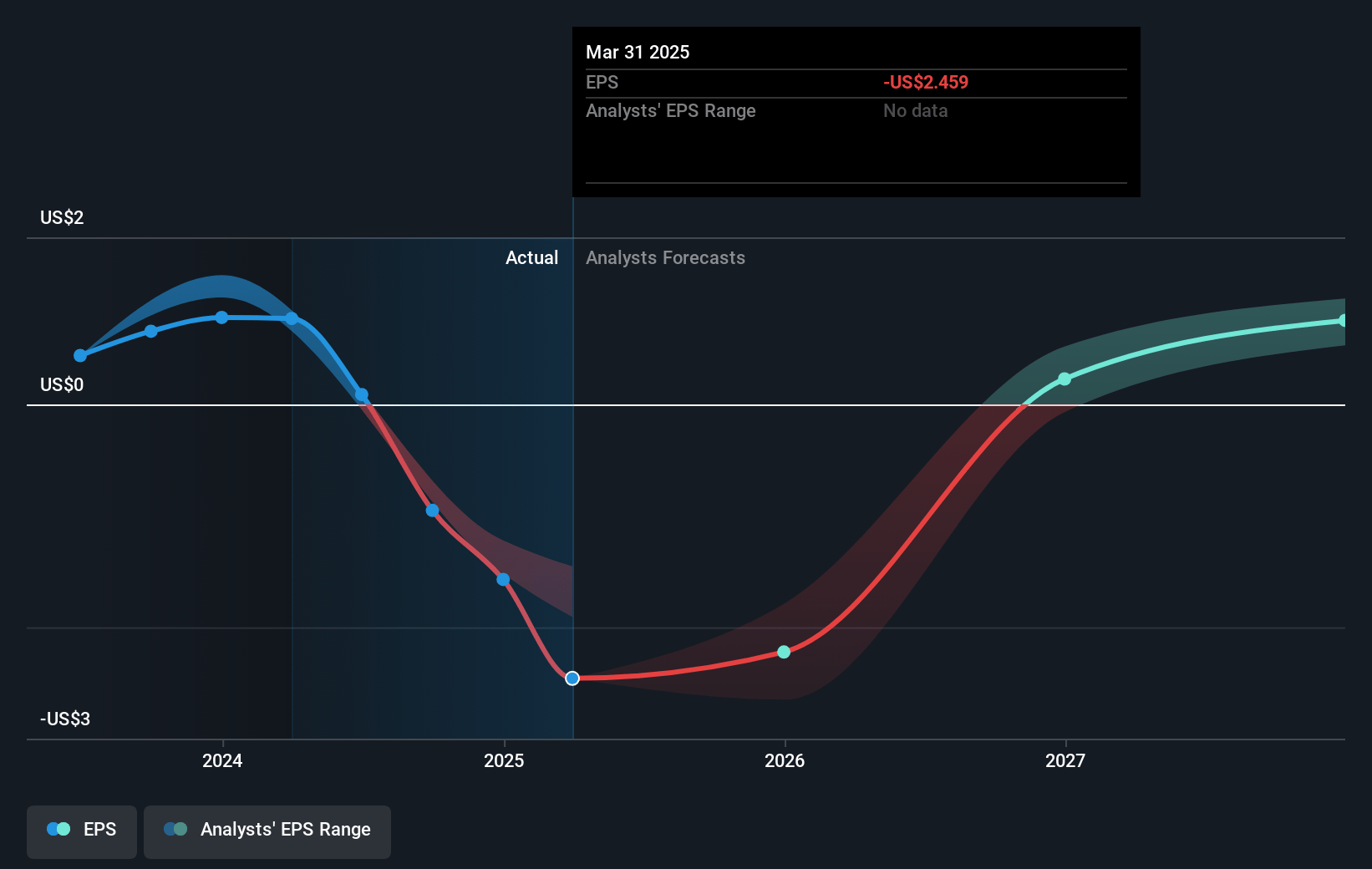

- The bullish analysts expect earnings to reach $690.1 million (and earnings per share of $1.57) by about July 2028, up from $-1.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 16.1x on those 2028 earnings, up from -3.4x today. This future PE is lower than the current PE for the US Metals and Mining industry at 23.2x.

- Analysts expect the number of shares outstanding to grow by 6.39% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.06%, as per the Simply Wall St company report.

Cleveland-Cliffs Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Cleveland-Cliffs' heavy reliance on traditional blast furnace steelmaking and the explicit decision not to pursue hydrogen-based decarbonization projects at Middletown expose the company to accelerating global decarbonization mandates and carbon taxes, which could significantly increase production costs and reduce net earnings in the long run.

- The company's core business model is positioned at the intersection of steel and automotive, yet the long-term shift toward lightweight materials such as aluminum and composites in vehicle manufacturing threatens to erode Cleveland-Cliffs' addressable market, weighing on future revenue growth as automakers diversify away from steel.

- Cleveland-Cliffs' financial strategy involves leveraging up for acquisitions and relying on subsequent free cash flow to deleverage, but elevated debt levels and the substantial, ongoing capital expenditures required to maintain and upgrade an aging asset base could compress margins and reduce financial flexibility, especially during cyclical downturns when steel demand weakens.

- The optimistic outlook on U.S. automotive and appliance manufacturing reshoring is heavily dependent on the permanence and strict enforcement of Section 232 tariffs; any rollback or negotiated exemptions in future trade agreements could invite global overcapacity back into North America, driving down steel prices and directly impacting revenues and profitability.

- The rapid emergence of technological disruption from green steel methods, particularly electric arc furnaces supported by hydrogen or renewable energy, is already drawing major foreign investment and could structurally lower costs for competitors; Cleveland-Cliffs risks falling behind if it does not modernize, threatening its long-term earnings power as the market shifts toward lower-emission steel products.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Cleveland-Cliffs is $14.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Cleveland-Cliffs's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $14.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $24.1 billion, earnings will come to $690.1 million, and it would be trading on a PE ratio of 16.1x, assuming you use a discount rate of 10.1%.

- Given the current share price of $11.32, the bullish analyst price target of $14.0 is 19.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.