Key Takeaways

- An improved supply chain and global expansion are set to reduce risk, diversify revenue, and ensure steadier long-term growth.

- Operational restructuring and efficiency gains will enhance margins, cash flow, and return on capital.

- Margin compression, product portfolio contraction, operational risks, higher financing costs, and external market volatility threaten profitability, stability, and growth prospects.

Catalysts

About American Vanguard- Through its subsidiaries, develops, manufactures, and markets chemical, biological and biorational products for agricultural, commercial, and consumer uses in the United States and internationally.

- Channel inventories are at historic lows after an 18-24 month industry-wide destocking period, setting the stage for a significant volume and potential pricing rebound as distributors and customers replenish supplies. This scenario directly supports near-term revenue growth and an eventual margin recovery.

- Global population growth and heightened food security needs amid historically high corn and peanut acreage are increasing the application of crop protection products, which favors demand for American Vanguard's key offerings and should support predictable growth in core product revenues.

- The company is restructuring its business with an emphasis on operational efficiency, resulting in lower OpEx, improved working capital management, and strong free cash flow-all pointing to sustainable improvements in net margins and return on capital.

- Efforts to optimize the portfolio and strengthen supply chain practices, along with U.S.-based manufacturing, provide insulation from possible long-term tariff disruptions and position the company as a preferred supplier for more sustainable, locally-sourced agricultural solutions. This de-risks supply and supports earnings consistency.

- Expansion of commercial operations in high-growth international markets like Brazil and ongoing transformation activities are projected to outperform industry growth rates, diversifying revenue and reducing dependency on North American markets-ultimately supporting long-term earnings and revenue stability.

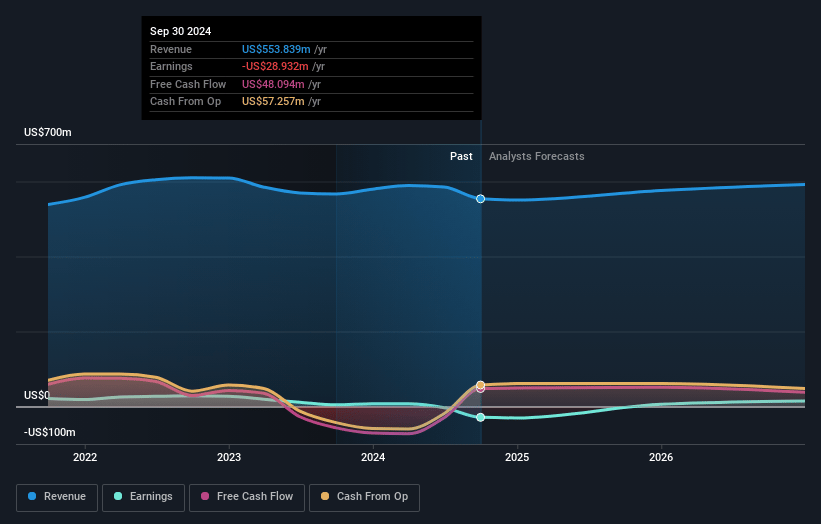

American Vanguard Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming American Vanguard's revenue will grow by 2.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from -25.8% today to 1.3% in 3 years time.

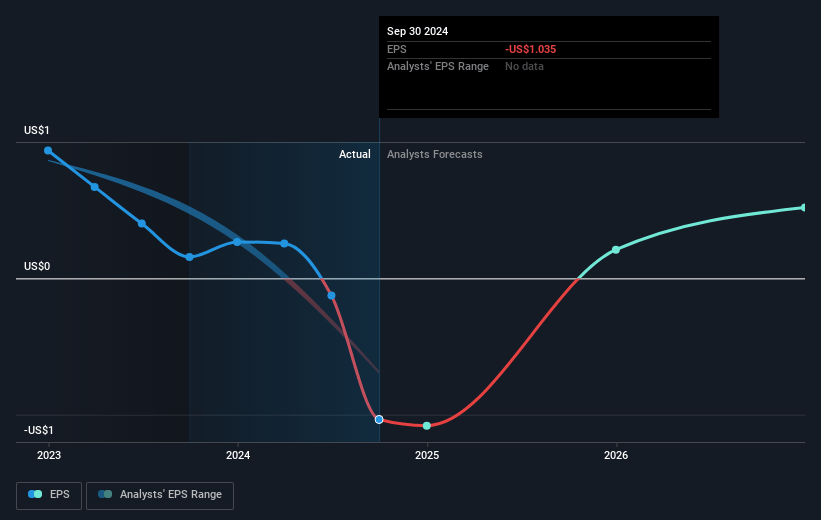

- Analysts expect earnings to reach $7.7 million (and earnings per share of $0.26) by about July 2028, up from $-136.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 56.4x on those 2028 earnings, up from -0.8x today. This future PE is greater than the current PE for the US Chemicals industry at 22.7x.

- Analysts expect the number of shares outstanding to decline by 1.68% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.19%, as per the Simply Wall St company report.

American Vanguard Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heightened competitive pressures and increased generic competition are forcing American Vanguard to discount products, particularly in key categories like Folex, resulting in gross margin compression and risking sustained lower pricing power over time (negative for gross profit and net margins).

- The company is experiencing product portfolio contraction, including the voluntary cancellation of a key herbicide (Dacthal) and market-specific weakness (Bromacil in Mexico, drought impact in Australia), indicating over-dependence on a narrow range of products and vulnerability to regulatory or market-driven product losses (revenue stability and long-term growth risk).

- Material weaknesses in internal controls, delayed financial reporting, and recent ERP implementation problems expose the company to operational and compliance risk, potentially increasing SG&A costs and deterring investor confidence (threat to net earnings and cost structure).

- The need to refinance debt in a challenging interest rate environment could lead to higher future financing costs, while current transformation efforts require capital allocation toward debt paydown instead of R&D or growth initiatives (future net income and growth investment risk).

- Sustained agricultural market uncertainty-including destocking trends, reliance on cyclical recovery, unpredictable weather, and possible new trade/tariff barriers-means operational performance is highly exposed to external shocks, with significant volatility in revenue and EBITDA outlooks.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $12.0 for American Vanguard based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $572.3 million, earnings will come to $7.7 million, and it would be trading on a PE ratio of 56.4x, assuming you use a discount rate of 10.2%.

- Given the current share price of $3.63, the analyst price target of $12.0 is 69.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.