Narratives are currently in beta

Key Takeaways

- Strategic investments in production and differentiated nylon offerings may boost revenues and margins by enhancing competitive standing and leveraging regional sales.

- Robust agricultural demand and favorable industry dynamics provide a platform for revenue growth and improved earnings stability amid optimized manufacturing execution.

- Operational challenges, market vulnerabilities, competitive pressures, and required infrastructure spending could strain AdvanSix's profitability and revenue growth.

Catalysts

About AdvanSix- Engages in the manufacture and sale of polymer resins in the United States and internationally.

- AdvanSix's SUSTAIN program is set to expand production capacity for premium-grade Ammonium Sulfate, backed by a $12 million USDA grant, potentially boosting future revenues and margins through increased sales volume and enhanced product pricing.

- The company's investment in differentiated nylon offerings, including a focus on regional and product sales mix, supports expectations of improved margins and revenues by leveraging its competitive position in the North American market.

- Positive sulfur nutrition demand, evidenced by higher Ammonium Sulfate sales and premiums, indicates resilient agricultural end-market conditions, potentially driving revenue growth and improved earnings through sustained product demand.

- AdvanSix anticipates improved manufacturing execution, targeting a $10 million opportunity by reducing downtime and optimizing planned plant turnaround strategies, which could enhance future net margins and earnings stability.

- Favorable industry dynamics, such as strong acetone margins over propylene due to tight global supply, suggest potential earnings growth as the company capitalizes on pricing and volume benefits in its Chemical Intermediates portfolio.

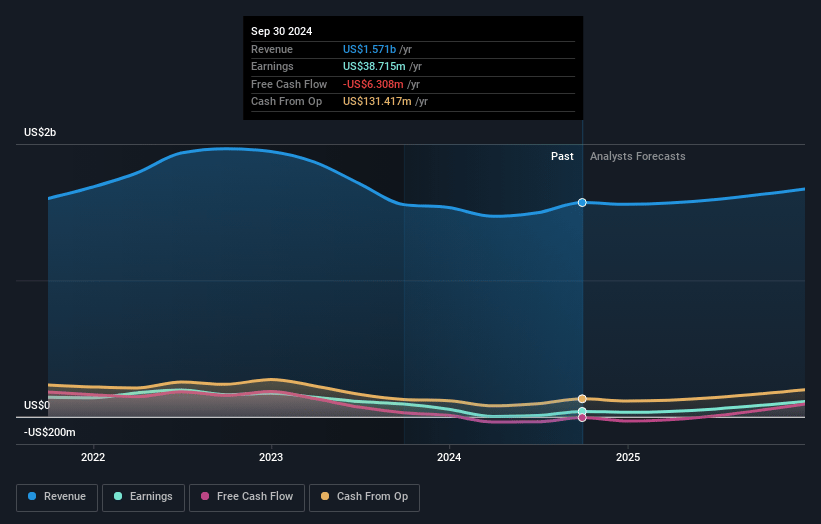

AdvanSix Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AdvanSix's revenue will grow by 4.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.5% today to 17.1% in 3 years time.

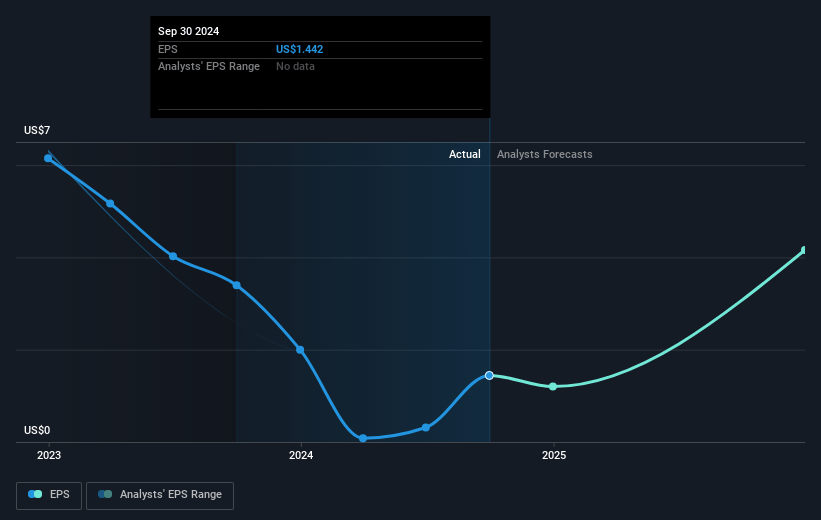

- Analysts expect earnings to reach $307.8 million (and earnings per share of $11.93) by about November 2027, up from $38.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 3.5x on those 2027 earnings, down from 20.5x today. This future PE is lower than the current PE for the US Chemicals industry at 25.5x.

- Analysts expect the number of shares outstanding to decline by 1.17% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 7.13%, as per the Simply Wall St company report.

AdvanSix Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A delayed ramp in operating rates at AdvanSix's Hopewell facility resulted in an approximate $17 million unfavorable impact to pretax income, signaling potential ongoing operational issues that could affect future earnings.

- While the overall environment for acetone spread is presently constructive, reliance on persistent lower global phenol operating rates poses a vulnerability if conditions change, potentially affecting future revenue stability.

- The potential impact of varying regional dynamics, including competitive intensity and trade flows in the nylon market, could lead to pricing and supply chain challenges that may compress margins or revenue.

- China's peak export levels of ammonium sulfate may create competitive pressures in international markets, such as South America and Central America, which could influence pricing power and affect revenue growth for AdvanSix.

- The need for significant future capital expenditures for water permit compliance and other infrastructure upgrades could strain financial resources and profitability in the short term, impacting net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $35.5 for AdvanSix based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.8 billion, earnings will come to $307.8 million, and it would be trading on a PE ratio of 3.5x, assuming you use a discount rate of 7.1%.

- Given the current share price of $29.64, the analyst's price target of $35.5 is 16.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives