Key Takeaways

- Capacity expansion in ammonium sulfate production and strong market position bolster revenue growth and future earnings potential.

- Carbon capture tax credits and insurance settlements enhance net income, cash flow, and financial outlook.

- Rising costs and market pressures are challenging AdvanSix's revenue and profitability, necessitating careful management of investments and operations to maintain growth and stability.

Catalysts

About AdvanSix- Engages in the manufacture and sale of polymer resins in the United States and internationally.

- The ammonium sulfate capacity expansion is expected to increase AdvanSix's production capability, which could support higher pricing and revenue as demand for sulfur nutrition in crops grows. This investment in capacity may lead to improved earnings in the future.

- The positive impact of the 45Q carbon capture tax credits significantly reduces AdvanSix's effective tax rate, boosting net income and cash flow. These credits, based on CO2 capture, are expected to continue providing a financial advantage over the medium to long term, improving margins.

- AdvanSix's strong order book and market position in ammonium sulfate provide a favorable setup into 2025, with expected higher grain and nitrogen fertilizer prices supporting top-line revenue growth.

- Final insurance settlements related to past operational disruptions, specifically the 2019 PES cumene supplier shutdown, provide an immediate cash flow and earnings boost, enhancing 2025 financial outlook and contributing to net income.

- Operational excellence initiatives and ongoing investments in key growth programs, such as the SUSTAIN program and regional sales mix optimization, aim to improve through-cycle profitability and enhance earnings stability moving forward.

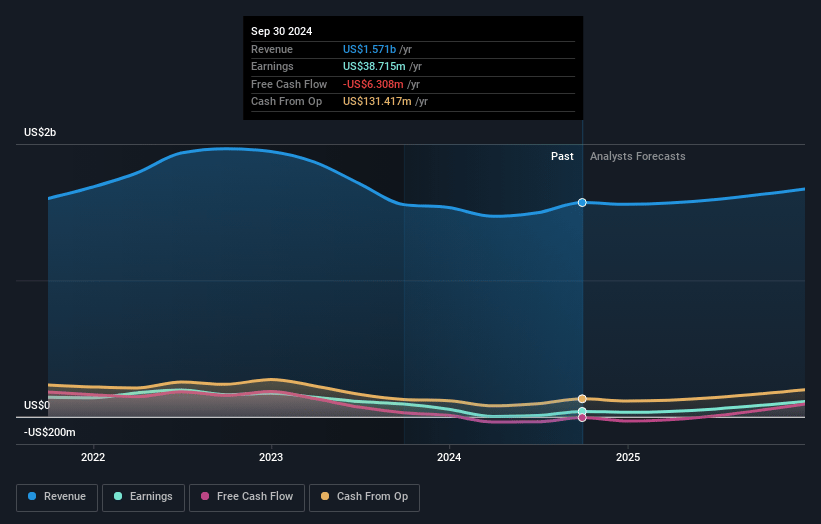

AdvanSix Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AdvanSix's revenue will grow by 4.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.9% today to 8.1% in 3 years time.

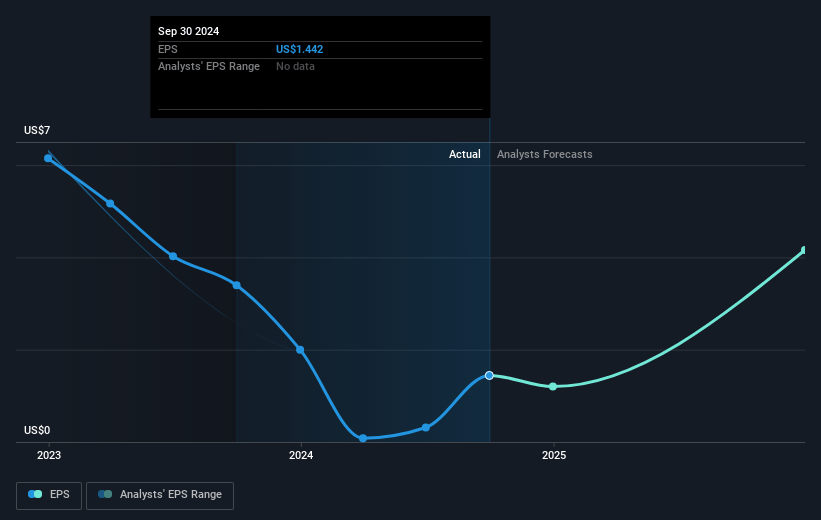

- Analysts expect earnings to reach $139.8 million (and earnings per share of $5.12) by about May 2028, up from $44.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.7x on those 2028 earnings, down from 13.0x today. This future PE is lower than the current PE for the US Chemicals industry at 19.3x.

- Analysts expect the number of shares outstanding to decline by 0.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.95%, as per the Simply Wall St company report.

AdvanSix Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's sales in the fourth quarter of 2024 decreased by approximately 14% year-over-year, primarily due to a delayed ramp to full operating rates, which significantly impacted sales volume and could affect future revenue stability.

- Global nylon markets are under pressure due to persistent oversupply, leading to continued pricing and spread challenges, which may negatively impact revenue and profitability within this segment.

- Rising raw material prices, particularly for natural gas and sulfur, are expected to create headwinds in 2025, which could compress margins and hinder earnings growth.

- Competition from Chinese exports in the ag chemical space is putting pressure on the amines business, potentially affecting sales volume and overall revenue growth in that sector.

- The company's growth capital expenditures are increasing due to ongoing investments in projects like the SUSTAIN program, which could strain cash flow if not matched by corresponding growth in revenues.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $33.0 for AdvanSix based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $40.0, and the most bearish reporting a price target of just $26.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.7 billion, earnings will come to $139.8 million, and it would be trading on a PE ratio of 7.7x, assuming you use a discount rate of 8.0%.

- Given the current share price of $21.45, the analyst price target of $33.0 is 35.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.