Last Update07 May 25Fair value Decreased 3.35%

Key Takeaways

- Strategic focus on core industrial gases and operational efficiency aims to enhance margins and drive long-term revenue growth.

- Cautious investment in clean energy and project refocusing could boost substantial future earnings and improve capital efficiency.

- Higher-risk project involvement and market challenges may strain leverage, affect earnings, and slow growth, while fixed cost inflation could impact margins.

Catalysts

About Air Products and Chemicals- Provides atmospheric gases, process and specialty gases, equipment, and related services in the Americas, Asia, Europe, the Middle East, India, and internationally.

- Air Products plans to refocus on its core industrial gas business, particularly through on-site projects with take-or-pay agreements and regional merchant business, aiming to unlock significant value through cost productivity, pricing, and operational excellence. This strategy is expected to enhance operating margins and increase revenue.

- The company is progressing with two large projects in Saudi Arabia and Louisiana, projected to be the lowest cost producers of green and blue ammonia. Their success in scaling these projects while maintaining industrial gas focus could lead to significant revenue growth and improved earnings from 2027 onwards.

- Air Products intends to execute a capital allocation plan that reduces spending to sustain future growth, while rightsizing its workforce to the level before 2018. This should lead to improved net margins through operational efficiency and reduced overhead costs.

- Investment in clean energy projects like green hydrogen is being cautiously evaluated based on regulatory developments and market conditions, which could result in substantial revenue and earnings growth when global hydrogen markets mature post-2030.

- The company is strategically reducing or divesting riskier project components, such as carbon sequestration and ammonia production elements, focusing instead on core industrial gases, which will likely improve ROCE and facilitate reinvestment in higher-margin projects.

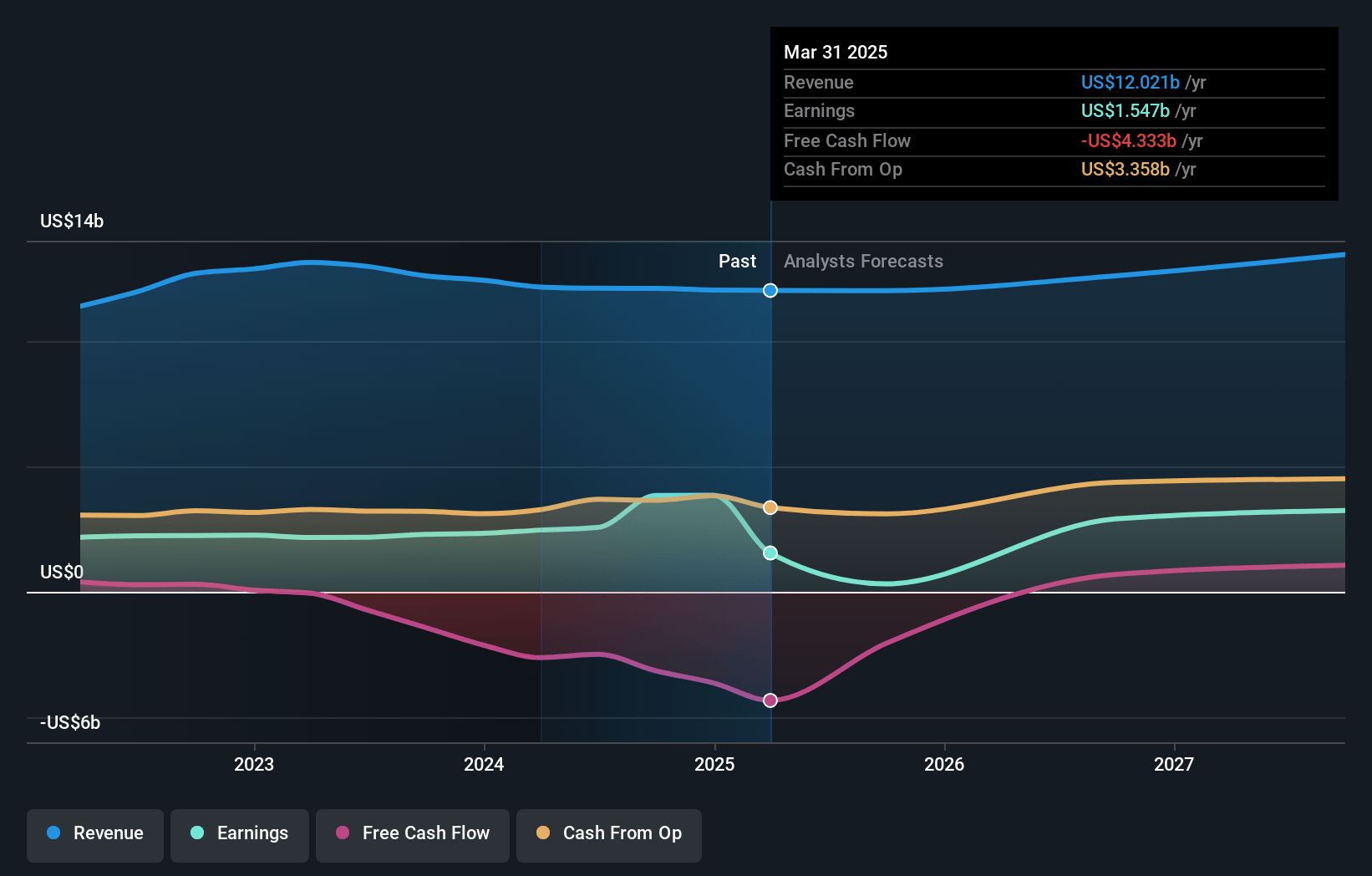

Air Products and Chemicals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Air Products and Chemicals's revenue will grow by 6.1% annually over the next 3 years.

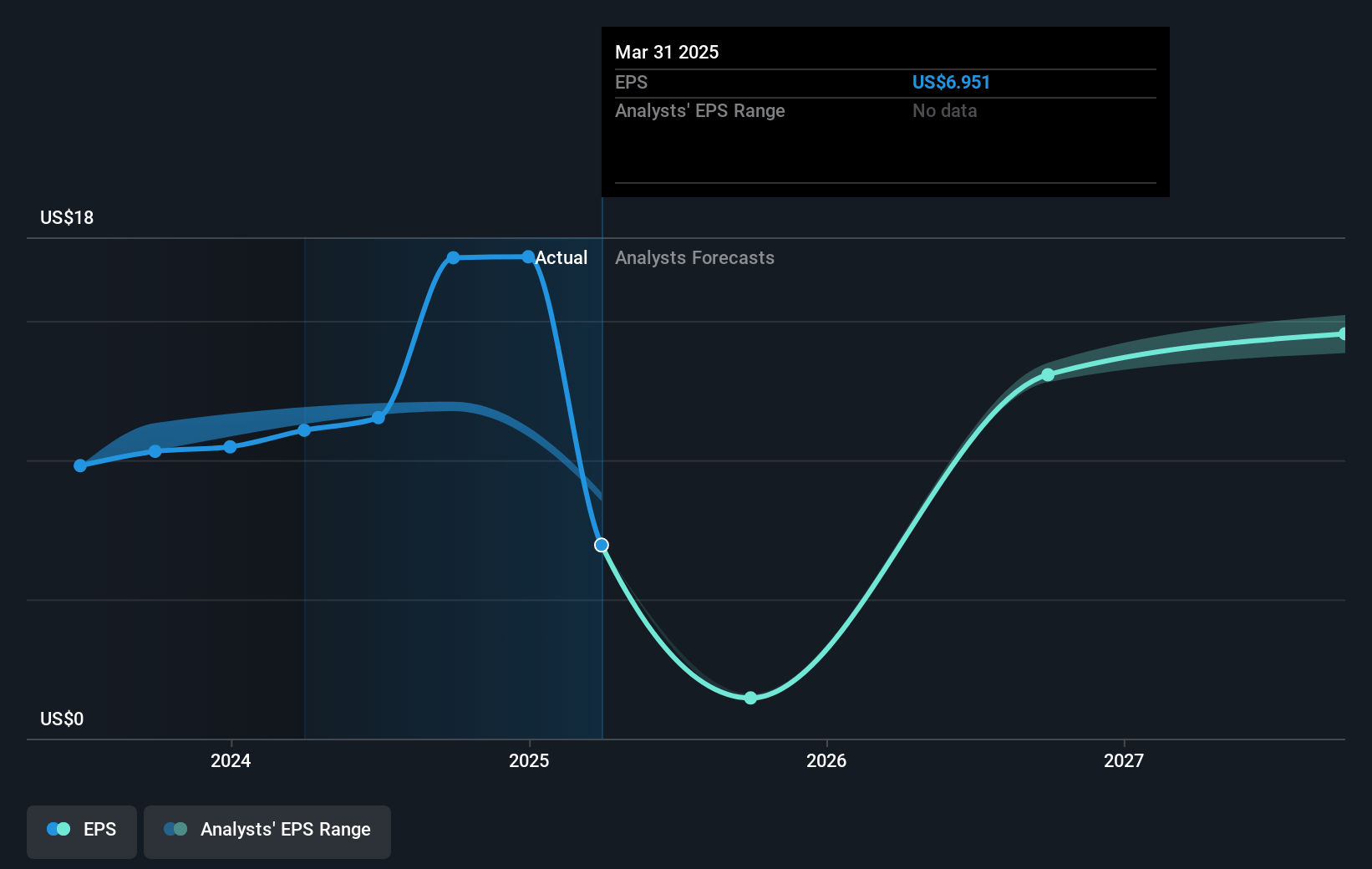

- Analysts assume that profit margins will increase from 12.9% today to 25.2% in 3 years time.

- Analysts expect earnings to reach $3.6 billion (and earnings per share of $16.25) by about May 2028, up from $1.5 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.3x on those 2028 earnings, down from 38.5x today. This future PE is greater than the current PE for the US Chemicals industry at 20.2x.

- Analysts expect the number of shares outstanding to grow by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.26%, as per the Simply Wall St company report.

Air Products and Chemicals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The pivot toward complex, higher-risk projects without committed offtake agreements may strain financial leverage and affect earnings due to potential project delays and cost overruns.

- Investments in first-of-a-kind energy transition projects experiencing cost overruns ($5 billion in CapEx) and underperformance could negatively impact net margins and operating income.

- Fixed cost inflation and unfavorable developments in certain segments, such as the helium market, could impact unit costs and hit operating margins and earnings.

- Canceled projects and a conservative approach toward large-scale undertakings, such as the Louisiana project, indicate potential revenue downsides if the firm cannot secure firm customer commitments.

- Delays in regulatory clarity and investments, especially in Europe, paired with tariff challenges, may slow down growth in emerging markets, impacting future revenue streams and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $320.202 for Air Products and Chemicals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $375.0, and the most bearish reporting a price target of just $260.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $14.4 billion, earnings will come to $3.6 billion, and it would be trading on a PE ratio of 24.3x, assuming you use a discount rate of 7.3%.

- Given the current share price of $267.62, the analyst price target of $320.2 is 16.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.