Key Takeaways

- Expansion projects at Malartic and Detour aim for top-tier gold mine status, significantly boosting production and revenue.

- Strong cost control and exploration investments enhance margins and earnings potential, while deleveraging improves financial flexibility and shareholder returns.

- Agnico Eagle's ambitious growth projects face execution risks, inflationary cost pressures, and labor competition, potentially squeezing margins and impacting future earnings.

Catalysts

About Agnico Eagle Mines- A gold mining company, engages in the exploration, development, and production of precious metals.

- Agnico Eagle Mines is planning to expand production dramatically, with projects like Malartic and Detour targeting over 1 million ounces of annual gold production, potentially becoming two of the top six gold mines globally. This expansion is set to boost revenue significantly as these large-scale operations lead to higher production volumes.

- The company is investing heavily in exploration, with record levels of spending justified by promising drill results. An expanded resource base with new discoveries can lead to increased reserves and future production, further enhancing revenue and earnings potential.

- Significant projects like Upper Beaver and Hope Bay are on track to become major gold producers by early next decade, contributing to a 50% growth in the Ontario platform alone. This expected increase in output will positively impact revenue growth and earnings over time.

- Cost control initiatives and leveraging a high gold price environment have already resulted in strong cash flows and earnings. Continued best-in-class cost management will contribute to margin stability or improvement, further boosting net margins and earnings.

- Agnico Eagle Mines has been rapidly deleveraging and is expected to achieve a net cash position shortly. This financial flexibility, coupled with a strong project pipeline, positions the company to take advantage of growth opportunities and deliver increased shareholder returns through dividends and buybacks, positively impacting earnings per share.

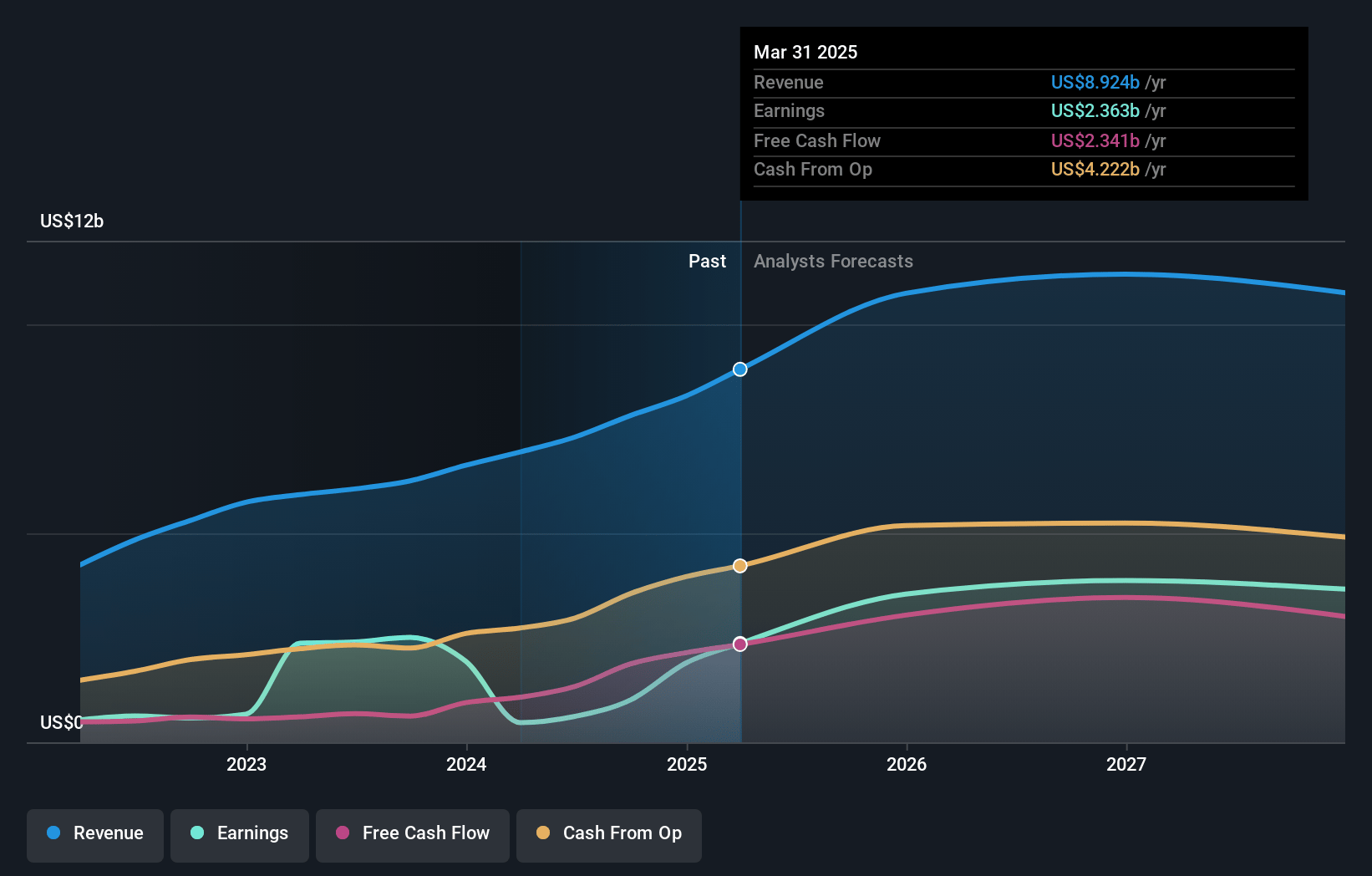

Agnico Eagle Mines Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Agnico Eagle Mines compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Agnico Eagle Mines's revenue will grow by 11.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 22.9% today to 30.0% in 3 years time.

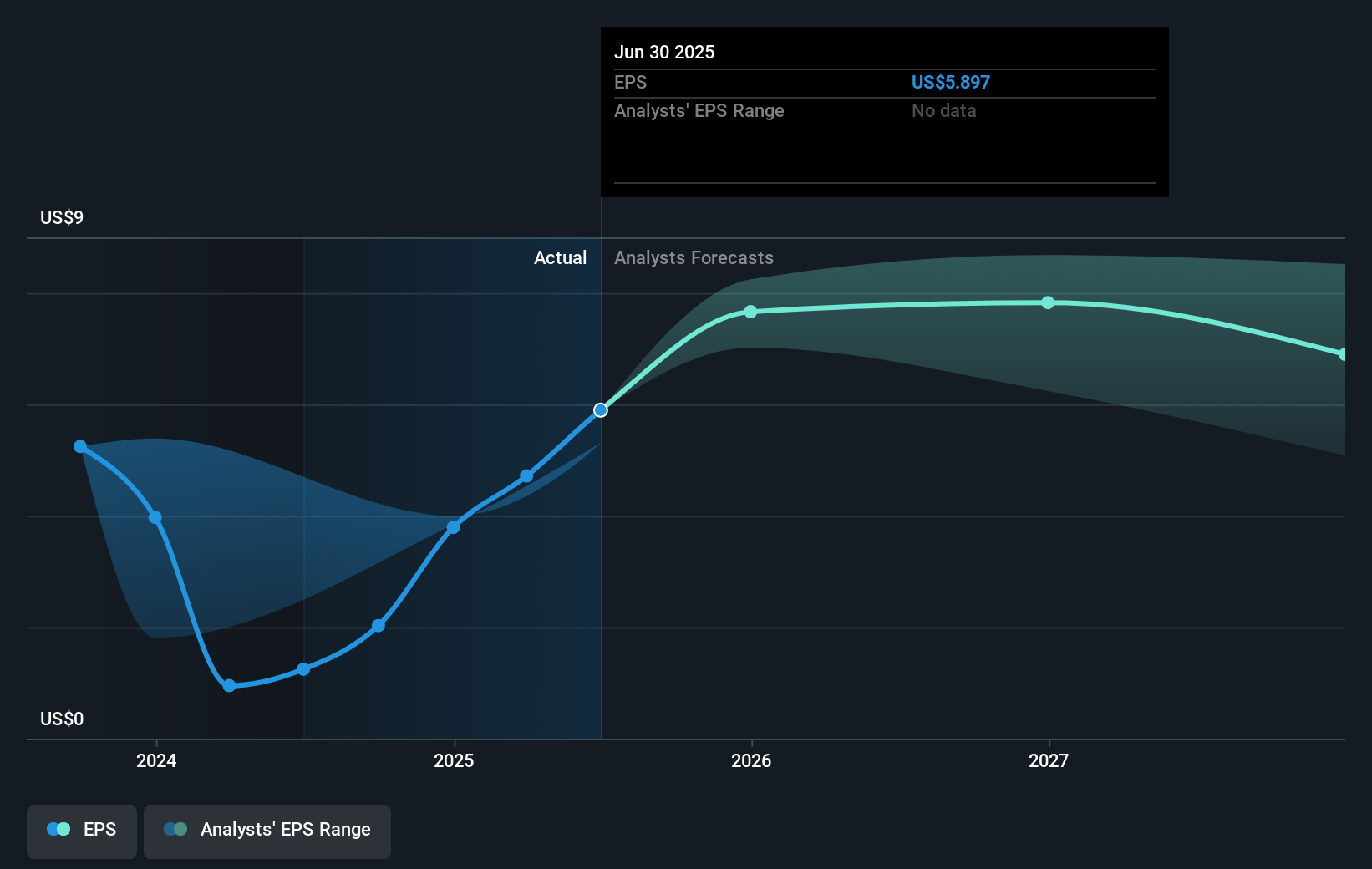

- The bullish analysts expect earnings to reach $3.4 billion (and earnings per share of $7.84) by about April 2028, up from $1.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 26.1x on those 2028 earnings, down from 31.9x today. This future PE is greater than the current PE for the US Metals and Mining industry at 21.5x.

- Analysts expect the number of shares outstanding to grow by 0.81% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.24%, as per the Simply Wall St company report.

Agnico Eagle Mines Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Agnico Eagle's production guidance for 2025 to 2026 is down marginally by about 2.9% from previous estimates, primarily due to ground conditions at Pinos Altos and deferral of processing low-grade stockpiles at Malartic, potentially impacting future revenues.

- While the company has ambitious growth projects, the transition of projects such as Meadowbank to underground mining, and potential delays in projects like Hope Bay, could pose execution risks and affect future earnings.

- Agnico Eagle's costs are forecasted to increase by 5% due to inflation, and tariffs could further impact the one-third of costs not insulated, potentially squeezing net margins despite efforts on cost control.

- The company faces competition for skilled labor, potentially impacting operational efficiency and productivity, which could lead to higher operational costs and affect profitability.

- Agnico Eagle’s future production growth heavily relies on new project developments that have long lead times and require significant capital investment, introducing risks related to project execution, cost overruns, and timely completion, impacting future earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Agnico Eagle Mines is $140.59, which represents one standard deviation above the consensus price target of $119.6. This valuation is based on what can be assumed as the expectations of Agnico Eagle Mines's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $142.0, and the most bearish reporting a price target of just $62.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $11.4 billion, earnings will come to $3.4 billion, and it would be trading on a PE ratio of 26.1x, assuming you use a discount rate of 7.2%.

- Given the current share price of $120.57, the bullish analyst price target of $140.59 is 14.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:AEM. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.