Narratives are currently in beta

Key Takeaways

- Successful exploration and disciplined capital allocation strategies could boost long-term revenue growth and margin improvements.

- Strong financial management with debt reduction and shareholder returns is likely to enhance EPS and shareholder value.

- Technical challenges and unforeseen costs could compress earnings, while expansion plans and market risks may impact future revenue and margin stability.

Catalysts

About Agnico Eagle Mines- A gold mining company, exploration, development, and production of precious metals.

- Continued optimization of operations is a key focus, with initiatives to improve productivity and efficiency at various sites leading to strong cost control, which could positively impact net margins and earnings.

- Successful exploration and pipeline projects, such as outstanding exploration results at Detour, Odyssey, and Hope Bay, have the potential to increase mineral resources and reserves, contributing to long-term revenue growth.

- The company's disciplined capital allocation strategy includes reinvesting in business improvements and productivity enhancements while maintaining cost control, supporting future revenue expansion and margin improvements.

- Strong financial management, including significant debt reduction and high returns to shareholders via dividends and share buybacks, is expected to improve earnings per share (EPS) and overall shareholder value.

- Growth potential in regions like Nunavut and the ongoing development of promising projects like Hope Bay provide opportunities for future revenue increases, supported by exploration successes and operational efficiencies.

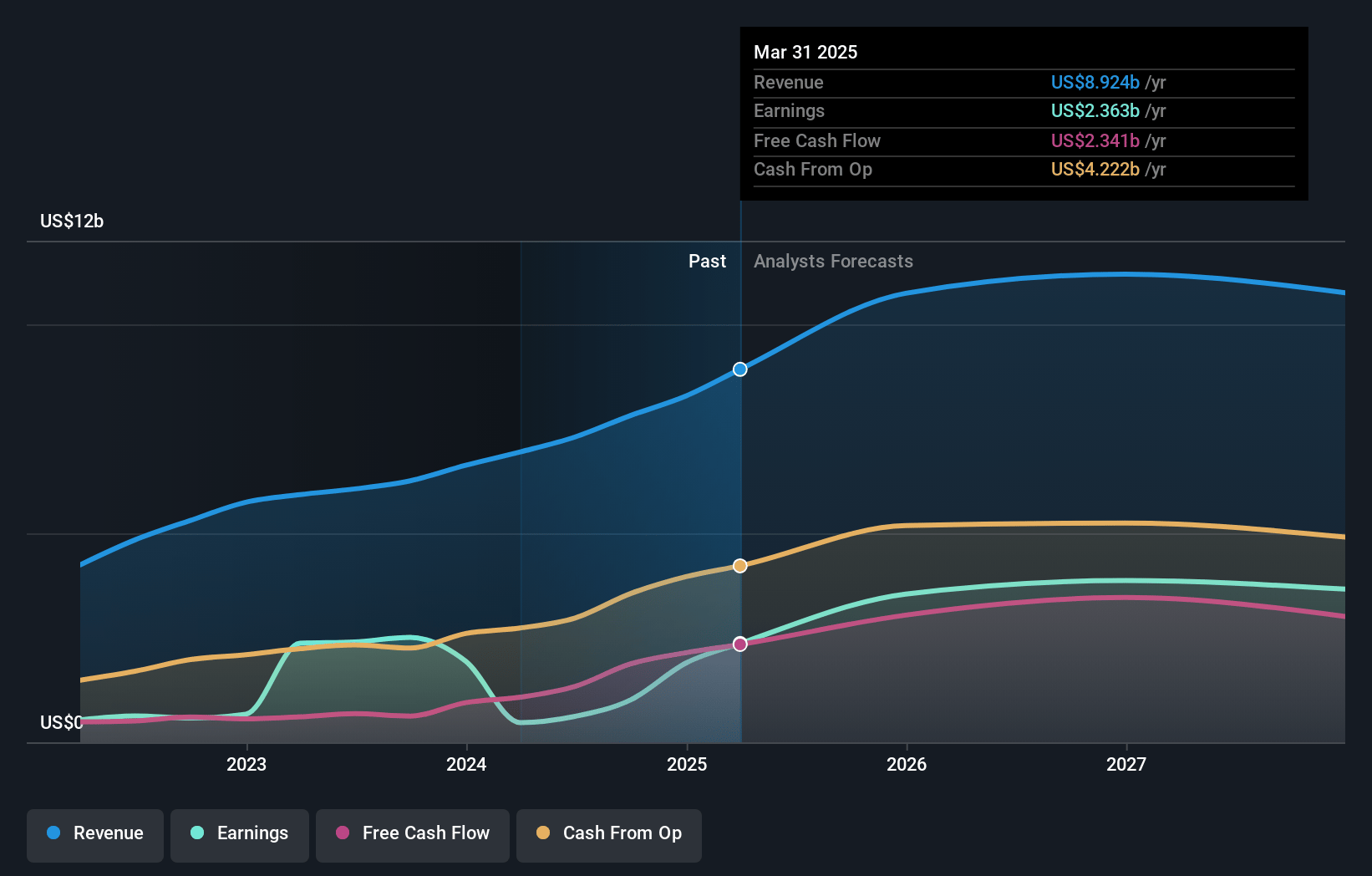

Agnico Eagle Mines Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Agnico Eagle Mines's revenue will grow by 5.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.9% today to 24.8% in 3 years time.

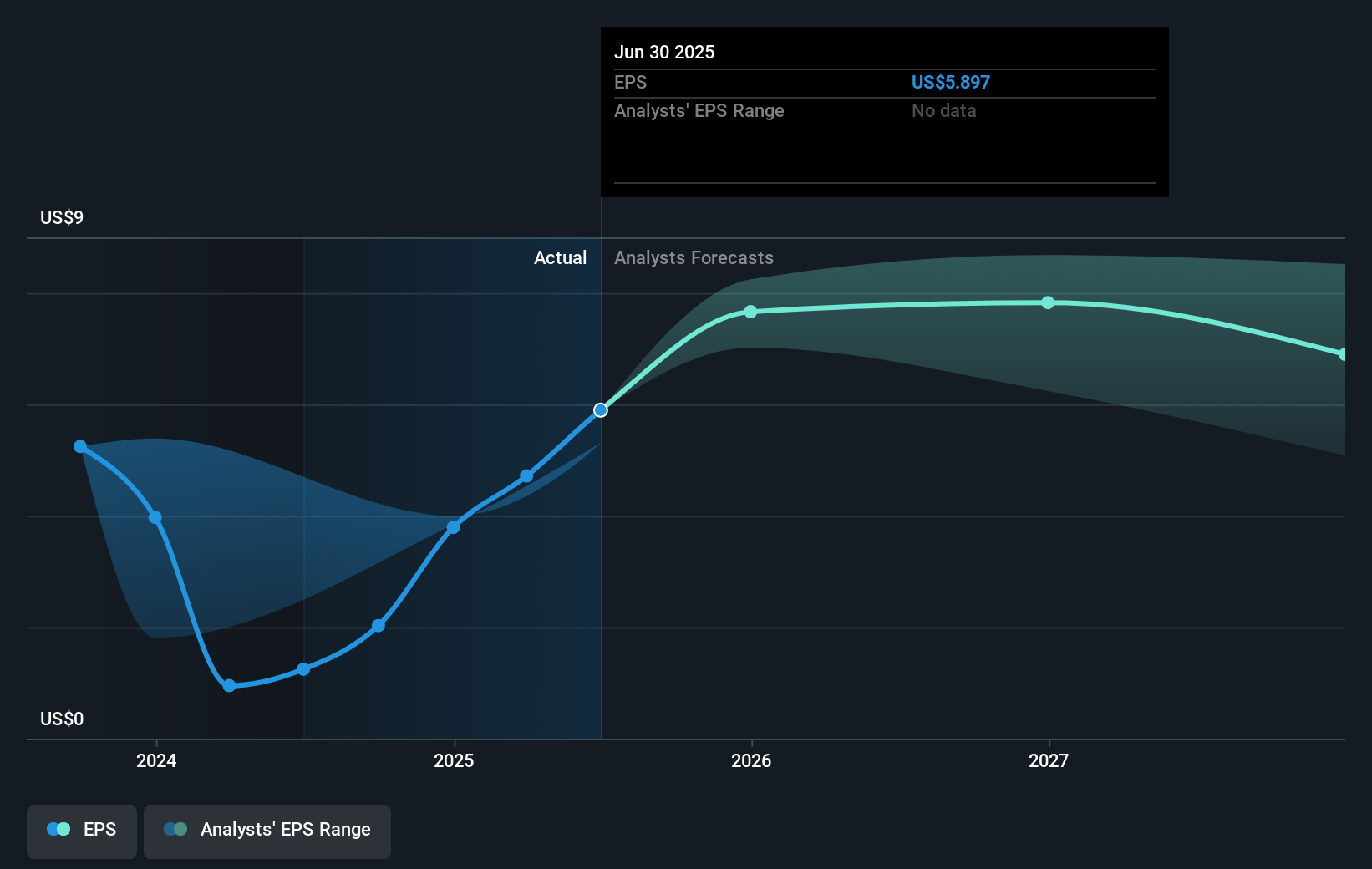

- Analysts expect earnings to reach $2.3 billion (and earnings per share of $4.04) by about November 2027, up from $1.0 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $2.8 billion in earnings, and the most bearish expecting $1.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.1x on those 2027 earnings, down from 42.4x today. This future PE is greater than the current PE for the US Metals and Mining industry at 16.5x.

- Analysts expect the number of shares outstanding to grow by 4.43% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 7.06%, as per the Simply Wall St company report.

Agnico Eagle Mines Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increased royalty payments due to higher gold prices have impacted cash costs, potentially compressing margins if gold prices fluctuate. This could impact net margins and earnings.

- Production costs remain tightly managed, but any deviation or unexpected cost inflation in consumables, energy, or labor could affect future net margins.

- The company faces execution risks related to its expansion plans, including the exploration and ramp-up efforts at various sites, which could impact future revenue expectations if targets are not met.

- The depth and complexity of new projects, such as deeper exploration at Detour Lake, could pose technical challenges and require significant capital expenditure, potentially impacting net earnings.

- Market and geopolitical risks, although managed by Agnico's strategic location choices, still pose potential threats, which could affect long-term production and revenue consistency.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $95.71 for Agnico Eagle Mines based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $127.86, and the most bearish reporting a price target of just $56.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $9.3 billion, earnings will come to $2.3 billion, and it would be trading on a PE ratio of 29.1x, assuming you use a discount rate of 7.1%.

- Given the current share price of $85.79, the analyst's price target of $95.71 is 10.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives