Key Takeaways

- Strong cash position and no debt enable flexibility for acquisitions, dividends, and buybacks, supporting long-term earnings and shareholder returns.

- Focus on cleaner fuel technologies and surface-active chemistry innovations could improve margins and drive sustained revenue growth globally.

- Persistent revenue decline in oilfield services, alongside competition and operational challenges, may threaten Innospec's margins, income, and growth prospects.

Catalysts

About Innospec- Develops, manufactures, blends, markets, and supplies specialty chemicals in the Americas, Europe, the Middle East, Africa, and Asia-Pacific.

- Recent improvements in Performance Chemicals, including double-digit operating income growth and a significant increase in revenues and volumes, signal potential for continued revenue and earnings growth driven by acquisitions such as QGP and diversified market presence.

- The company's commitment to advancing Fuel Specialties with a focus on technology for cleaner fuels and efficiency improvements could lead to sustained margin improvement and operating income growth, supporting overall earnings.

- Sequential quarterly recovery in oilfield services is expected, particularly with growth in core U.S. operations and potential recovery in Latin American activity later in the year, indicating a path to improved revenues and margins in the segment.

- Innospec's strong cash position and lack of debt provide significant flexibility for further M&A, dividend growth, and share repurchases, which could enhance shareholder returns and support long-term earnings growth.

- Sustained focus on innovation in surface-active chemistry technologies and strong customer relationships may drive operational efficiencies, higher margins, and sustained revenue growth across global markets.

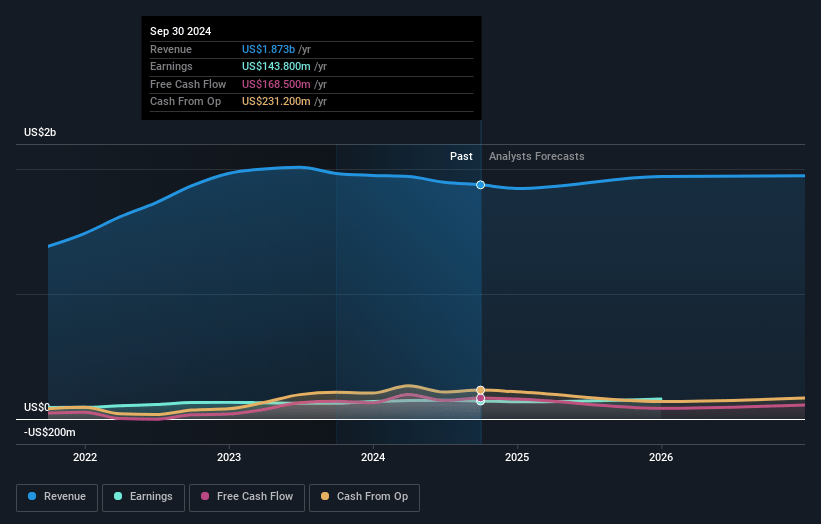

Innospec Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Innospec's revenue will grow by 5.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.9% today to 11.6% in 3 years time.

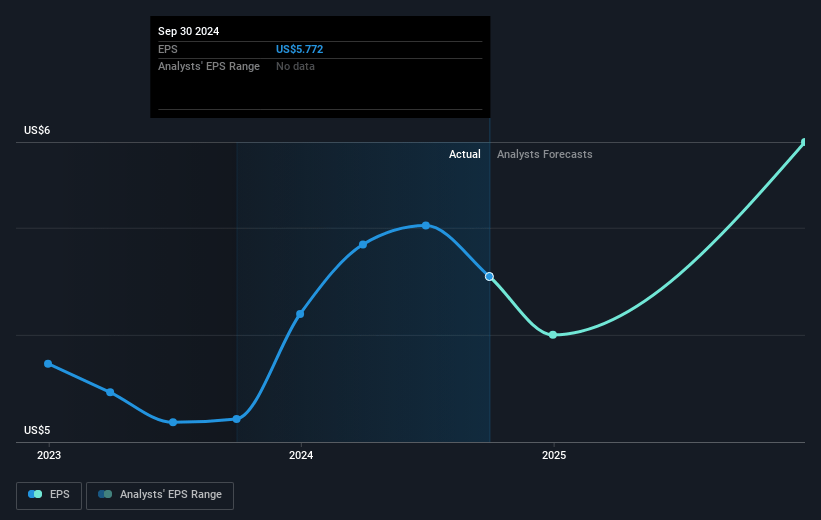

- Analysts expect earnings to reach $248.6 million (and earnings per share of $9.76) by about April 2028, up from $35.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.4x on those 2028 earnings, down from 62.4x today. This future PE is lower than the current PE for the US Chemicals industry at 17.6x.

- Analysts expect the number of shares outstanding to grow by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.74%, as per the Simply Wall St company report.

Innospec Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decrease in oilfield services revenue and operating income due to lower production activity in Latin America presents a risk to revenue and overall profit margins if this situation persists longer than expected.

- Overall gross margin fell by 2.3 percentage points to 29.2%, which, if it continues, could adversely affect net income and earnings.

- The company reported a net loss for the quarter due to a significant non-cash settlement charge related to a pension scheme buyout, which, despite being a one-off event, highlights potential vulnerabilities in managing financial obligations.

- A decrease in total revenues for both the fourth quarter and full year compared to the previous year may indicate underlying demand weaknesses, which could affect future revenue and growth potential.

- Increased competition or changes in crude oil quality and refining capabilities could challenge Innospec's oilfield division, impacting the division's ability to recover and sustain its revenue and operating income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $126.0 for Innospec based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.1 billion, earnings will come to $248.6 million, and it would be trading on a PE ratio of 15.4x, assuming you use a discount rate of 6.7%.

- Given the current share price of $88.44, the analyst price target of $126.0 is 29.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.