Key Takeaways

- Strong global demand and constraints on supply may drive higher aluminum prices, boosting revenue and U.S. operational earnings.

- Expansion projects and a new smelter, with grant support, aim to enhance production capacity, revenue, and margin improvements.

- Vulnerabilities in supply chain and rising energy costs pose challenges to net margins, while operational and trade uncertainties threaten future earnings for Century Aluminum.

Catalysts

About Century Aluminum- Produces and sells standard-grade and value-added primary aluminum products in the United States and Iceland.

- Strong global demand and constraints on new global aluminum supply are expected to move the market into a deficit, potentially leading to higher aluminum prices, which could boost revenue.

- The elimination of exemptions and increase of the U.S. Section 232 tariffs to 25% are expected to raise the Midwest premium for aluminum significantly, potentially increasing Century's U.S. operations earnings.

- The Jamalco expansion and operational optimizations aim to increase production capacity, positively impacting revenue and efficiency, thus potentially improving earnings and margins.

- Recent removal of power curtailments at Grundartangi and a recovery to full production levels are expected to enhance output and revenue from the facility by Q2.

- Progress on constructing a new U.S. aluminum smelter, supported by a $500 million Department of Energy grant, could significantly increase future production capacity and revenue streams.

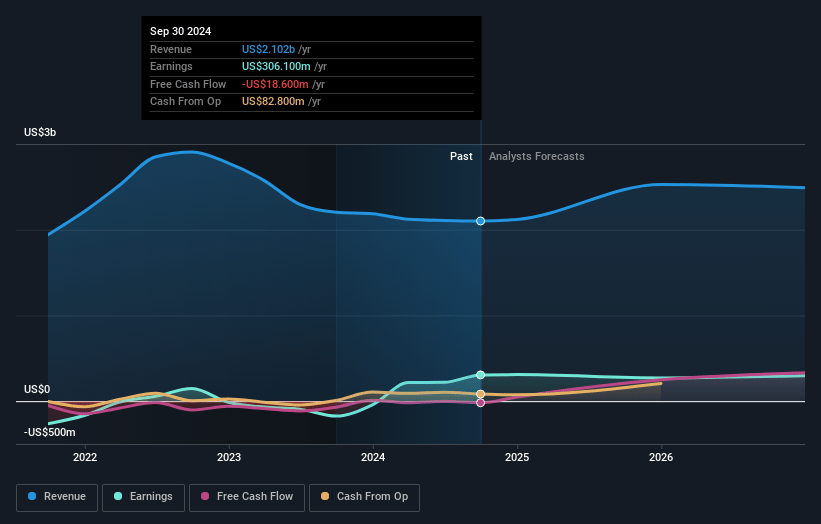

Century Aluminum Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Century Aluminum's revenue will grow by 6.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 14.4% today to 11.5% in 3 years time.

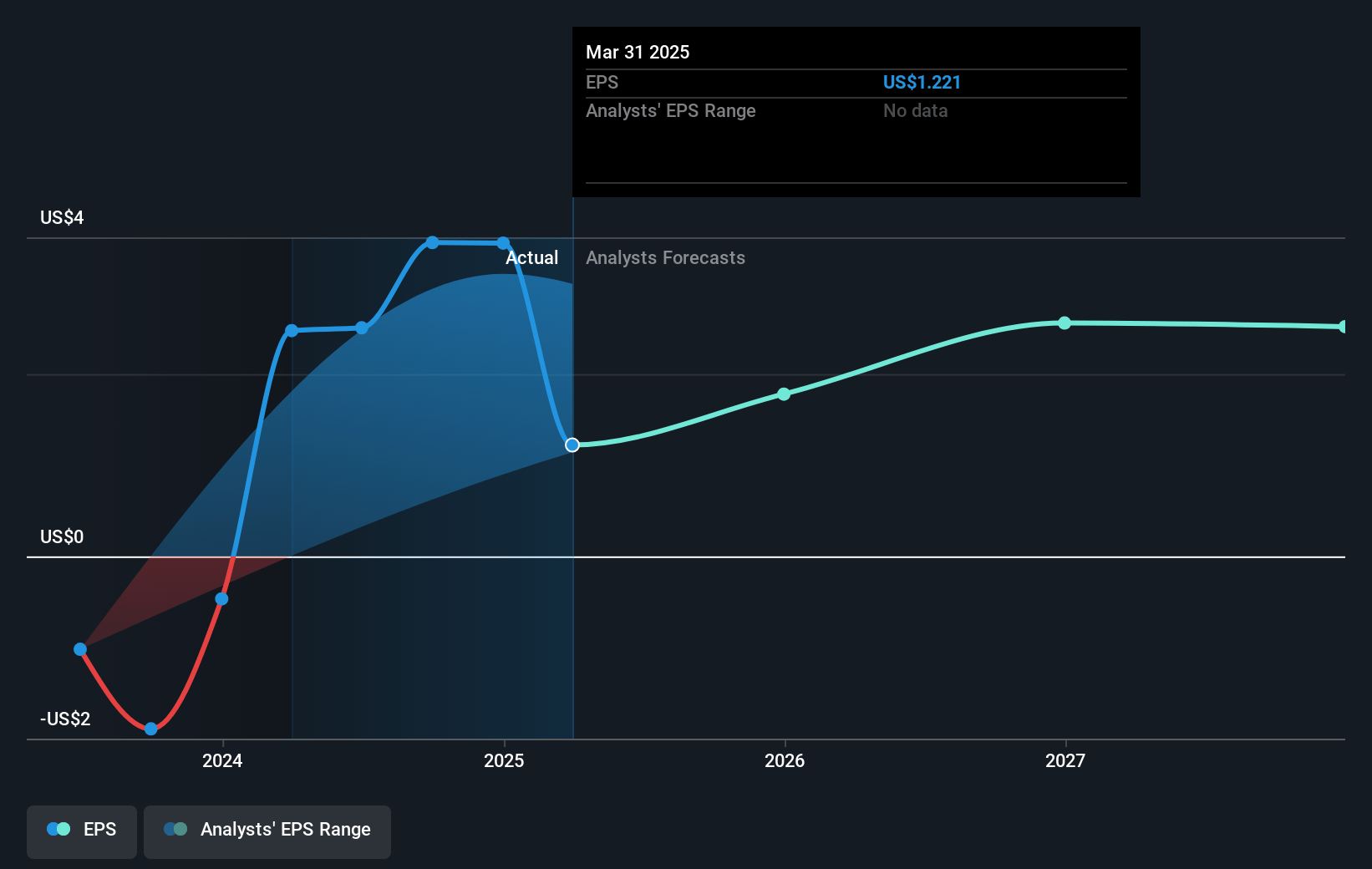

- Analysts expect earnings to reach $305.5 million (and earnings per share of $3.15) by about April 2028, down from $318.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.8x on those 2028 earnings, up from 4.6x today. This future PE is lower than the current PE for the US Metals and Mining industry at 21.5x.

- Analysts expect the number of shares outstanding to decline by 0.44% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.1%, as per the Simply Wall St company report.

Century Aluminum Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A force majeure from a major alumina supplier required Century Aluminum to source alumina at spot prices, highlighting supply chain vulnerabilities that could affect cost management and consequently impact net margins.

- Operational instability at the Mt. Holly smelter led to increased costs and slightly lower production in Q4, posing a risk to achieving optimal production levels and impacting future earnings.

- Rising energy prices in 2025, influenced by cold snaps in the U.S. and Europe, present a risk to maintaining low production costs, potentially affecting net margins.

- The potential for additional tariffs or trade barriers in response to Section 232 adjustments may disrupt market dynamics, causing fluctuations in revenue dependent on demand elasticity.

- Any delays or financial misestimations in the development of the new U.S. smelter project, with the complexity of site selection and energy negotiations, could increase capital expenditures and impact future earnings expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $23.333 for Century Aluminum based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.7 billion, earnings will come to $305.5 million, and it would be trading on a PE ratio of 8.8x, assuming you use a discount rate of 8.1%.

- Given the current share price of $15.79, the analyst price target of $23.33 is 32.3% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.