Key Takeaways

- Expansion into premium international markets and rising demand for low-carbon products support revenue growth and margin improvement.

- Cost-cutting initiatives and operational upgrades enhance profitability, competitiveness, and long-term cash flow stability.

- Operational inefficiencies, regulatory risks, rising competition, export volatility, and required capital outlays threaten Alto Ingredients’ margins, revenue growth, and competitiveness in core markets.

Catalysts

About Alto Ingredients- Produces, distributes, and markets specialty alcohols, renewable fuel, and essential ingredients in the United States.

- Entry into higher-margin international markets for certified renewable fuels (such as ISCC-certified exports to Europe) enables Alto to access premium pricing and diversify revenue streams, directly supporting top-line growth and improved net margins.

- Anticipated permanent nationwide and California-specific adoption of E15 ethanol blends—driven by legislative and regulatory momentum—would structurally increase U.S. ethanol demand, reduce excess industry capacity, and provide greater sales volume and margin stability.

- Cost reduction initiatives, including the integration of the liquid CO2 plant and a 16% workforce reduction, are expected to realize ~$8 million in annual expense savings (starting Q2 2025), enhancing EBITDA margins and overall profitability.

- Operational efficiency projects and ongoing plant modernization (water, energy, and carbon optimization) are positioning Alto to lower its cost base and carbon footprint, strengthening both competitiveness and cash flow generation long-term.

- Growth in demand for low-carbon and bio-based products, combined with Alto’s strategic flexibility and expanding range of higher-value offerings (such as beverage-grade CO2 and specialty alcohols), supports revenue resilience and the potential for higher average selling prices over time.

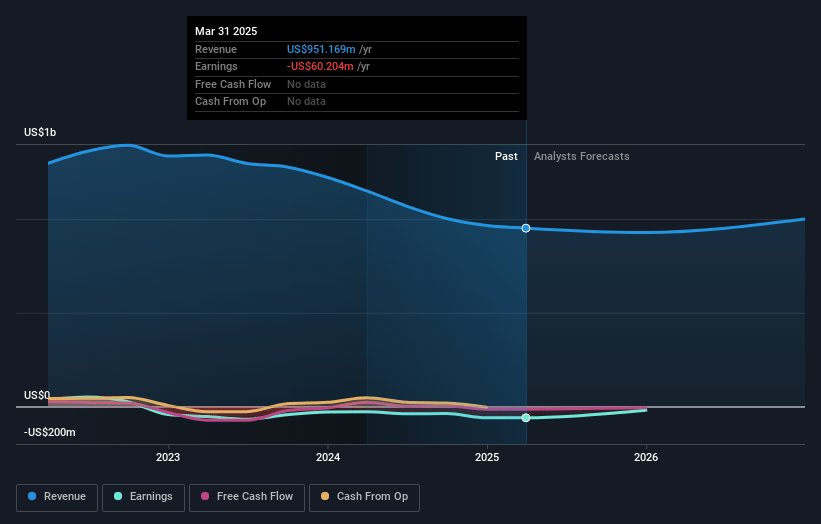

Alto Ingredients Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Alto Ingredients's revenue will grow by 1.4% annually over the next 3 years.

- Analysts are not forecasting that Alto Ingredients will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Alto Ingredients's profit margin will increase from -6.3% to the average US Chemicals industry of 7.8% in 3 years.

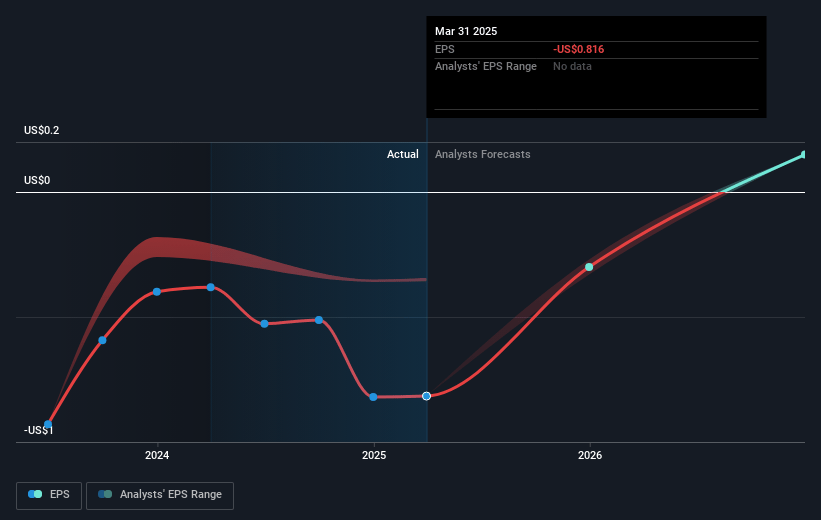

- If Alto Ingredients's profit margin were to converge on the industry average, you could expect earnings to reach $77.2 million (and earnings per share of $0.98) by about May 2028, up from $-60.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 5.5x on those 2028 earnings, up from -1.1x today. This future PE is lower than the current PE for the US Chemicals industry at 23.2x.

- Analysts expect the number of shares outstanding to grow by 0.95% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.47%, as per the Simply Wall St company report.

Alto Ingredients Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The shutdown (cold idling) of the Magic Valley plant illustrates Alto’s ongoing exposure to uncompetitive plant locations, especially those dependent on costly and limited corn logistics, leading to reduced total production, underutilization of assets, and persistent revenue pressure from unfavorable commodity spreads.

- Intensifying competition in key high-margin product lines, specifically premium domestic alcohols and essential ingredients, has led to declining sales premiums and margins, while oversupply and high inventory levels in the ethanol market limit the potential for robust margin expansion, directly impacting net margins and earnings.

- Regulatory risks, such as Illinois Bill SB1723, threaten Alto’s carbon capture and sequestration (CCS) initiatives at the Pekin Campus, potentially causing costly project delays, relocation expenses, and lost opportunity for future carbon credit revenue streams, which could constrain long-term earnings growth and return on capital.

- Persistent export uncertainty driven by global events—including tariff concerns and Chinese vessel restrictions—creates volatility in international demand for ISCC-certified ethanol, undermining revenue diversification efforts and exposing Alto to abrupt declines in export sales volume and profitability.

- Required significant capital expenditures for plant repairs (e.g., Pekin load-out dock failure), aging infrastructure, and integration of newly acquired assets may divert resources from strategic R&D investments and modernization needed to remain competitive against next-generation biofuel producers, constraining future margin improvement and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $4.0 for Alto Ingredients based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $5.5, and the most bearish reporting a price target of just $2.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $993.1 million, earnings will come to $77.2 million, and it would be trading on a PE ratio of 5.5x, assuming you use a discount rate of 10.5%.

- Given the current share price of $0.86, the analyst price target of $4.0 is 78.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.