Key Takeaways

- Strategic mergers and acquisitions boost international growth and product offerings, supporting long-term profitability through synergies.

- Investment in talent and technology alongside operational efficiency initiatives bolsters profitability and maintains strong revenue growth.

- Property market uncertainties, competition, reliance on acquisition growth, social inflation, and macroeconomic factors present significant risks to revenue, profitability, and net margins.

Catalysts

About Ryan Specialty Holdings- Operates as a service provider of specialty products and solutions for insurance brokers, agents, and carriers in the United States, Canada, the United Kingdom, Europe, and Singapore.

- Ryan Specialty Holdings is poised to drive future revenue growth through robust organic revenue expansion, achieving 11.8% in the latest quarter. This growth is supported by the firm's ability to capture market share in new and renewal business, particularly in the E&S market, despite challenges like property rate deterioration.

- The company's strategic focus on mergers and acquisitions (M&A) is expected to enhance revenue growth and profitability. Recent acquisitions, such as US Assure and Innovisk, expand their product offerings and international footprint, contributing to long-term earnings growth through synergies and enhanced capabilities.

- Operational initiatives like ACCELERATE 2025 are set to improve net margins over time by driving sustainable operational efficiencies, with projected savings of approximately $60 million in 2025. This ongoing focus on expense management positions the company for improved profitability.

- The firm's investment in talent, technology, and specialized expertise paves the way for continued industry-leading organic growth. Their focus on maintaining a strong recruitment pipeline and rewarding top talent is likely to bolster both revenue and margin growth as operational excellence is enhanced.

- Evolving industry trends such as delegated underwriting authority and panel consolidation create a robust environment for Ryan Specialty to leverage its unique business model, driving up revenue. The company's commitment to innovative solutions and a client-first strategy enhances its competitive position for a sustained increase in earnings.

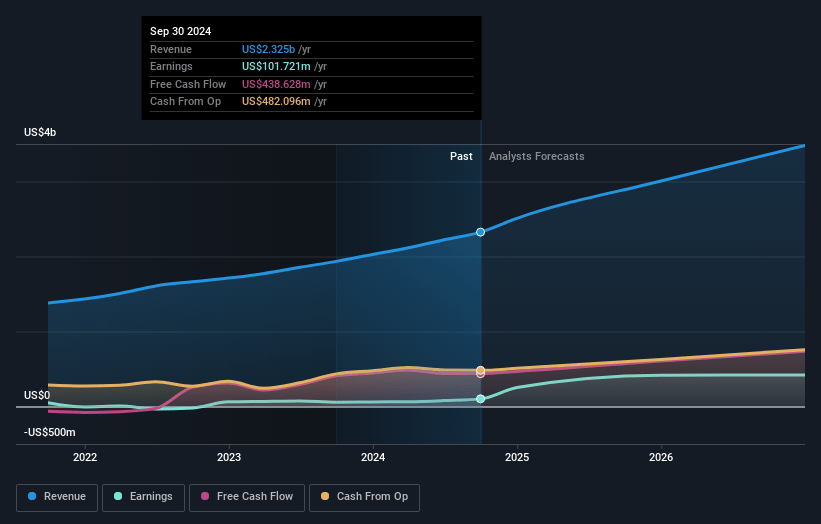

Ryan Specialty Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ryan Specialty Holdings's revenue will grow by 19.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.4% today to 14.7% in 3 years time.

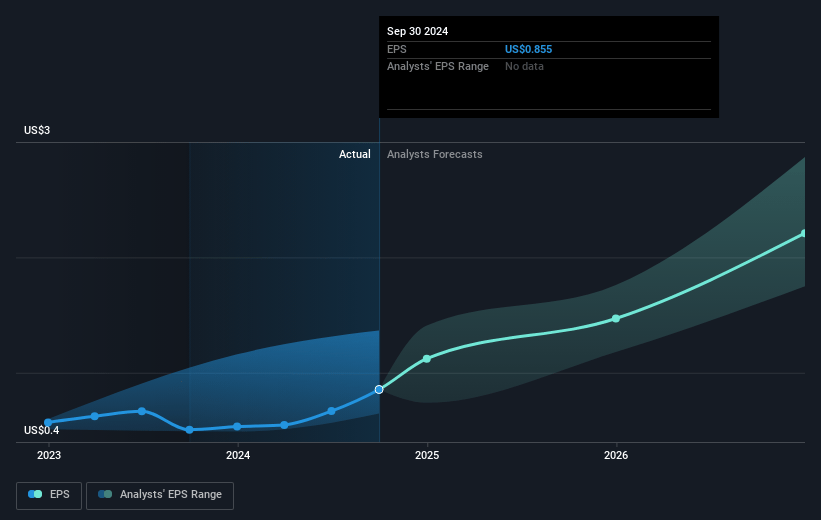

- Analysts expect earnings to reach $581.4 million (and earnings per share of $2.95) by about January 2028, up from $101.7 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $193.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.8x on those 2028 earnings, down from 80.6x today. This future PE is greater than the current PE for the US Insurance industry at 12.8x.

- Analysts expect the number of shares outstanding to decline by 9.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.16%, as per the Simply Wall St company report.

Ryan Specialty Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The acceleration of property rate deterioration, especially prior to hurricanes Helene and Milton, poses a risk to the revenue and profitability of the company as the property market's response remains uncertain.

- Increased competition and entry of additional capacity in the market could exert pressure on Ryan Specialty's pricing power, potentially impacting net margins.

- The company's reliance on acquisition growth brings integration risks and challenges, which could affect earnings if not managed effectively.

- Social inflation and increased litigation could drive up loss costs in the casualty division, impacting profitability and net margins.

- The ongoing economic conditions and macro factors, including inflation in building materials and complex risk environments, may increase unpredictability in underwriting results, potentially affecting revenue stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $73.98 for Ryan Specialty Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $89.0, and the most bearish reporting a price target of just $56.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.0 billion, earnings will come to $581.4 million, and it would be trading on a PE ratio of 29.8x, assuming you use a discount rate of 6.2%.

- Given the current share price of $65.46, the analyst's price target of $73.98 is 11.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives