Narratives are currently in beta

Key Takeaways

- Strengthening casualty reserves and a strategic focus on underwriting should lead to sustainable, profitable growth and improved future earnings in North America.

- Growing consistent return areas and efficient international expansion aim to enhance portfolio balance, revenue, and margins, boosting bottom line results.

- Increased U.S. casualty risk exposure and social inflation could strain margins and earnings, while lack of detailed guidance adds uncertainty to financial stability.

Catalysts

About Everest Group- Through its subsidiaries, provides reinsurance and insurance products in the United States, Europe, and internationally.

- Everest Group's aggressive action to strengthen its casualty reserve position, combined with a comprehensive review of its underwriting performance and the onboarding of new leadership, is expected to lead to more sustainable and profitable underwriting in North America. This should impact future earnings positively.

- The company's strategic focus on one renewal standard for casualty accounts aims to quickly return these accounts to profitability, which could improve net margins as unprofitable business is eliminated.

- By growing in areas where consistent returns have been historically achieved, such as the first-party book, Everest aims to rebalance its overall portfolio and improve revenue and profitability.

- The international insurance segment's excellent performance and efforts to gain scale should reduce expense ratios and expand net margins over time, contributing positively to the bottom line results.

- The decisive reserve action, along with predicted industry trends and Everest’s reinforcing of their management practices, positions the company for a trajectory toward mid-teens total shareholder return, signaling expected future growth in earnings.

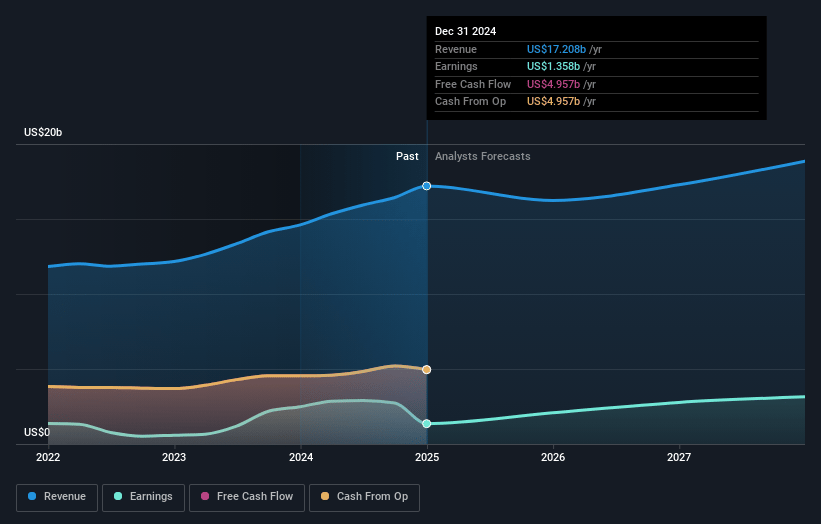

Everest Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Everest Group's revenue will grow by 4.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.7% today to 17.1% in 3 years time.

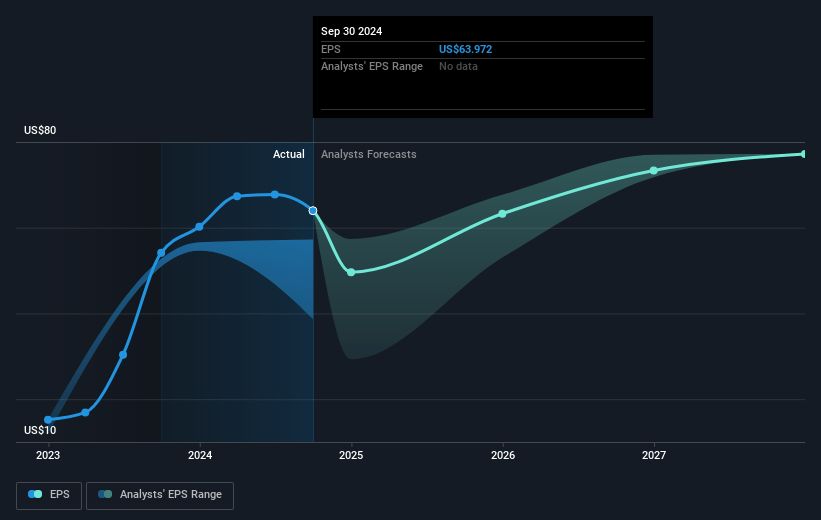

- Analysts expect earnings to reach $3.2 billion (and earnings per share of $75.52) by about January 2028, up from $2.7 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $3.5 billion in earnings, and the most bearish expecting $2.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.7x on those 2028 earnings, up from 5.8x today. This future PE is lower than the current PE for the US Insurance industry at 12.8x.

- Analysts expect the number of shares outstanding to decline by 0.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.23%, as per the Simply Wall St company report.

Everest Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The concentration in U.S. casualty classes, particularly in real estate and large auto fleets, has led to increased risk exposure, which could negatively impact future revenue and earnings if these segments underperform.

- The phenomenon of social inflation, driven by legal system abuse and rising attorney involvement, increases loss severities and could continue to pressure margins and elevate loss ratios, impacting net margins and earnings.

- The backlog of claims from the COVID pandemic has masked the impact of social inflation, introducing volatility in loss development patterns and potentially leading to reserve deficiencies, affecting the company's financial forecasts and margins.

- The decision to strengthen reserves by $1.7 billion, particularly in the U.S. casualty line, highlights the challenges in past underwriting, suggesting potential future impacts on profitability and capital adequacy.

- The company's strategic decision to not provide detailed forward guidance creates uncertainty about its future performance and could lead to volatility in investor perceptions and stock price, impacting overall financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $421.35 for Everest Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $490.0, and the most bearish reporting a price target of just $354.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $18.6 billion, earnings will come to $3.2 billion, and it would be trading on a PE ratio of 6.7x, assuming you use a discount rate of 6.2%.

- Given the current share price of $367.47, the analyst's price target of $421.35 is 12.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives