Narratives are currently in beta

Key Takeaways

- Strategic investments and new financial protections could strengthen James River's equity position, enhancing earnings potential while stabilizing financial performance.

- Growth in submissions and underwriting changes aim to boost profitability, focusing on stronger risk management and targeted business strategies.

- Significant net losses from reserves and reinsurance indicate challenges with profitability, potential dilution of shareholder value, and ongoing financial stability risks.

Catalysts

About James River Group Holdings- Through its subsidiaries, provides specialty insurance services.

- James River Group Holdings received significant investments from Enstar Group and Gallatin Point Capital, which help strengthen their common equity base and reduce preferred dividends. This positions the company to capitalize on attractive opportunities, potentially boosting future earnings growth.

- The company implemented a $75 million limit top-up adverse development cover with Enstar on E&S reserves, further protecting against future reserve volatility and allowing for more predictable financial performance, which can improve net margins.

- James River's E&S business continues to experience strong submission growth and significant rate increases, with new submissions up 10% and renewal submissions up 12%. This robust pipeline of new and renewal businesses is expected to enhance revenue and earnings.

- The company made numerous underwriting changes aimed at improving future profitability, such as taking compounded rate increases and focusing on more profitable segments. This can result in higher net margins and earnings over the long term.

- With enhancements in risk management and reserve review processes, James River aims to mitigate legacy balance sheet issues, enabling a refocused business strategy. This simplification and derisking is expected to support steady growth in earnings and potentially improve revenue consistency.

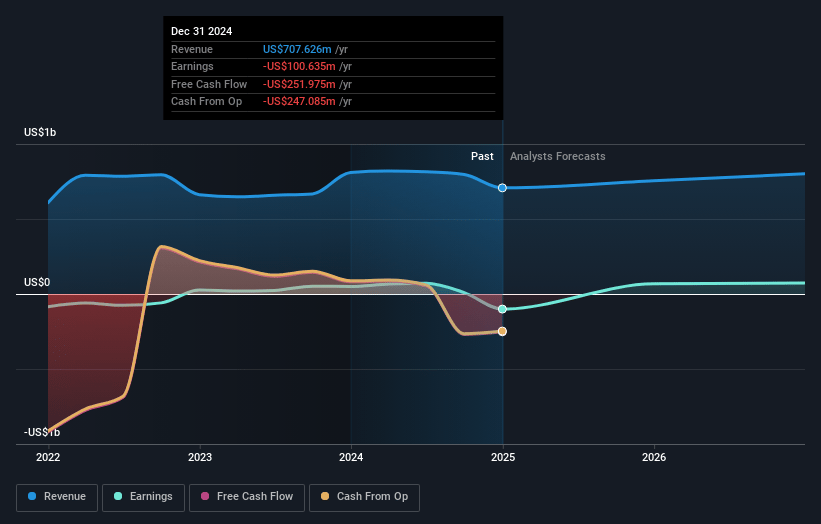

James River Group Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming James River Group Holdings's revenue will grow by 1.4% annually over the next 3 years.

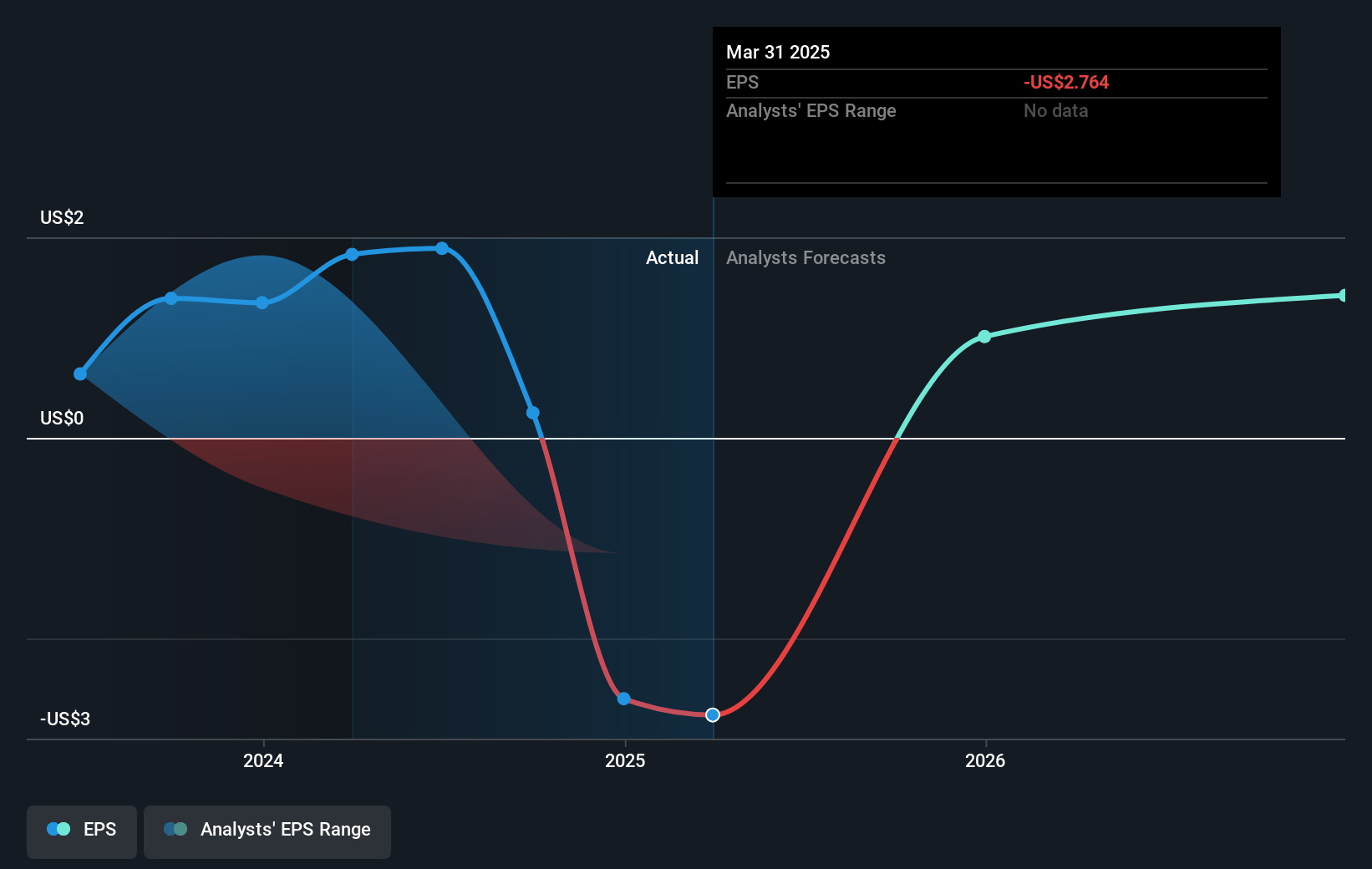

- Analysts assume that profit margins will increase from 1.2% today to 20.8% in 3 years time.

- Analysts expect earnings to reach $173.1 million (and earnings per share of $3.81) by about November 2027, up from $9.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 2.5x on those 2027 earnings, down from 18.0x today. This future PE is lower than the current PE for the US Insurance industry at 13.5x.

- Analysts expect the number of shares outstanding to grow by 6.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.95%, as per the Simply Wall St company report.

James River Group Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company recently reported a significant net loss from continuing operations and adjusted net operating loss, driven by reserve charges and previous reinsurance transactions. These losses could negatively affect future earnings.

- The reserve charge of $76 million reflects increased loss trend assumptions, particularly for severity in certain liability lines. These adjustments could indicate potential challenges in managing future combined ratios and net margins.

- Elevated general and administrative expenses have increased the expense ratio, affecting the overall profitability and indicating potential future financial strain impacting net margins.

- The impact of past legacy issues and reserve development pressures could suggest ongoing risks to financial stability, which may affect the company's earnings outlook.

- The issuance of new common equity and reduced quarterly common dividends may dilute existing shareholders and implies measures to address current financial strains, which could impact shareholder value and net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $8.15 for James River Group Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $11.0, and the most bearish reporting a price target of just $6.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $830.5 million, earnings will come to $173.1 million, and it would be trading on a PE ratio of 2.5x, assuming you use a discount rate of 5.9%.

- Given the current share price of $4.51, the analyst's price target of $8.15 is 44.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives