Narratives are currently in beta

Key Takeaways

- Investment in talent acquisition and franchise expansion drives potential revenue growth, but increases operational costs and adversely impacts net margins.

- Volatile product availability and market uncertainties may lead to fluctuating revenues, affecting investor perception and potential overvaluation fears.

- Goosehead Insurance is enhancing franchise productivity, expanding geographically, achieving strong premium growth, stabilizing client retention, and reducing franchise turnover for potential revenue and earnings growth.

Catalysts

About Goosehead Insurance- Operates as a holding company for Goosehead Financial, LLC that engages in the provision of personal lines insurance agency services in the United States.

- Goosehead Insurance is opening a new corporate office in Phoenix, which is expected to expand and diversify their footprint, potentially increasing their headcount and geographic distribution, which could strain expenses initially and impact net margins.

- The company is heavily investing in a talent acquisition function to recruit corporate agents from college campuses, leading to significant headcount growth from 276 in Q2 2023 to 458 in Q3 2024, which, while boosting revenue potential, may also increase compensation expenses, affecting net margins and earnings.

- Goosehead is focusing on franchise expansion and increasing the average agents per franchise, supported by a doubled franchise development team. This could lead to higher operational costs in the short term, impacting net margins while aiming for future revenue growth.

- The company is dealing with volatile product availability, especially in home and auto insurance markets, which impacts pricing and client retention. This uncertainty could lead to fluctuating revenues and earnings, affecting investor perception of overvaluation.

- Although the company anticipates contingency improvements and potential margin expansion, the variability in contingent commissions and the hedged nature of the business amidst market changes could result in unexpected impacts on revenue and earnings growth.

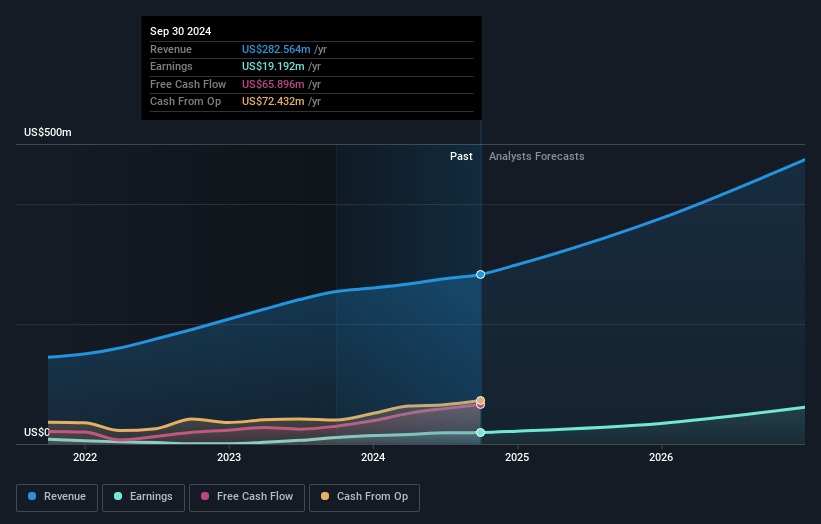

Goosehead Insurance Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Goosehead Insurance's revenue will grow by 25.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.8% today to 14.9% in 3 years time.

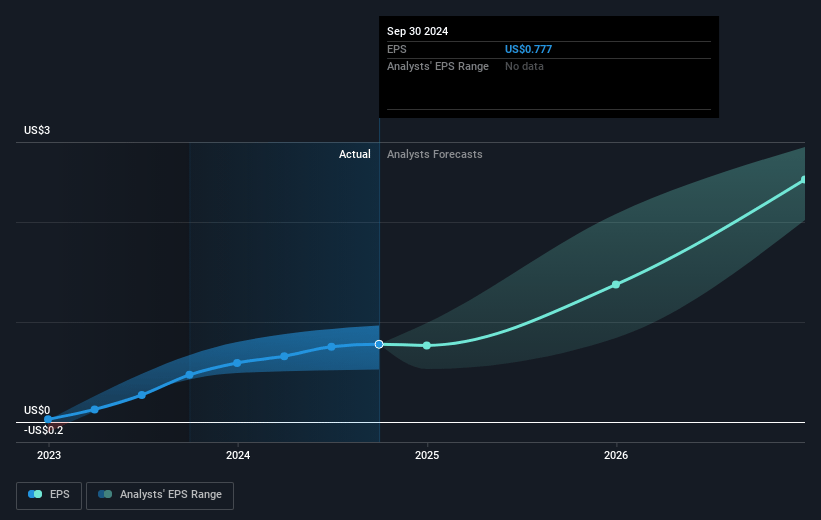

- Analysts expect earnings to reach $82.8 million (and earnings per share of $3.31) by about October 2027, up from $19.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.0x on those 2027 earnings, down from 139.4x today. This future PE is greater than the current PE for the US Insurance industry at 13.5x.

- Analysts expect the number of shares outstanding to decline by 12.34% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 5.8%, as per the Simply Wall St company report.

Goosehead Insurance Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Goosehead Insurance has shown significant improvement in franchise productivity, with a 52% year-over-year increase, driven by enhanced referral partner marketing and converting top-performing corporate agents into franchise owners. This improvement suggests potential for increased revenue and net margins.

- The company has reached a milestone of $1 billion in premium for a single quarter, a tenfold increase since its IPO, indicating strong growth momentum and potential for higher earnings.

- Goosehead Insurance is expanding its corporate footprint with a new office in Phoenix, which is expected to diversify its geographic presence and drive future revenue growth through increased agent capacity.

- Client retention rates have stabilized at 84% after consecutive quarters of decline. Stable retention can improve earnings predictability and revenue streams as it indicates customer satisfaction and loyalty.

- The company is experiencing a significant reduction in franchise turnover, improving franchisee financial health, and consequently driving stable revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $95.22 for Goosehead Insurance based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $125.0, and the most bearish reporting a price target of just $44.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $554.7 million, earnings will come to $82.8 million, and it would be trading on a PE ratio of 34.0x, assuming you use a discount rate of 5.8%.

- Given the current share price of $109.71, the analyst's price target of $95.22 is 15.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives