Narratives are currently in beta

Key Takeaways

- Expansion in small business commercial underwriting and strategic use of advanced tools are expected to enhance growth, reduce risk, and improve earnings.

- Systems modernization and ongoing expense reduction initiatives are set to boost operational efficiency, leading to better net margins.

- Exposure to weather-related losses and market challenges may threaten Donegal Group's profitability, requiring strategic adjustments in policy renewals and pricing strategies.

Catalysts

About Donegal Group- An insurance holding company, provides property and casualty insurance to businesses and individuals.

- Expansion into small business commercial underwriting across all operating regions is expected to drive momentum and growth, impacting future revenue positively.

- The systems modernization project, with the final software releases facilitating automated conversion of legacy policies, is likely to enhance operational efficiency, positively impacting net margins.

- Ongoing expense reduction initiatives, including staffing and incentive program adjustments, are projected to decrease the expense ratio by 2 points by 2025, enhancing net margins.

- Strategic use of advanced underwriting tools, including AI-enhanced imagery and catastrophe modeling, aims to improve risk assessment and underwriting quality, thus potentially reducing the loss ratio and increasing net income.

- The shift in investment strategy towards higher-yielding corporate debt and increased equity holdings is aimed at improving investment income and overall earnings.

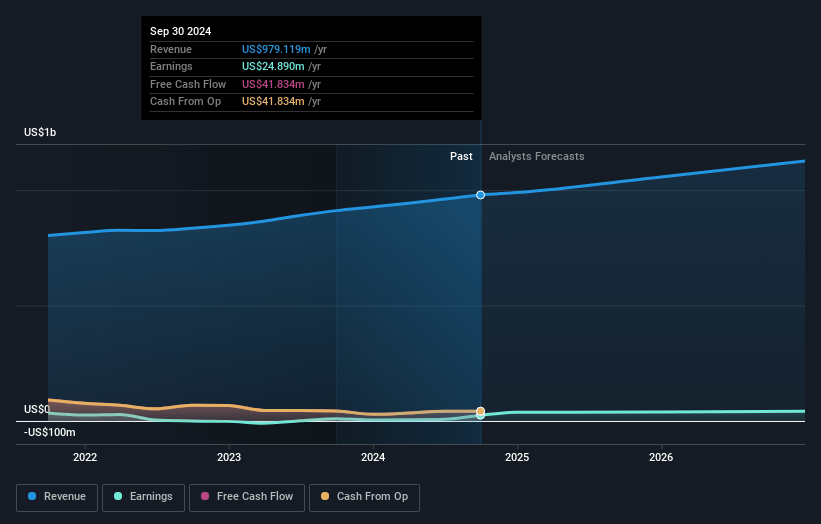

Donegal Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Donegal Group's revenue will grow by 6.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.5% today to 4.0% in 3 years time.

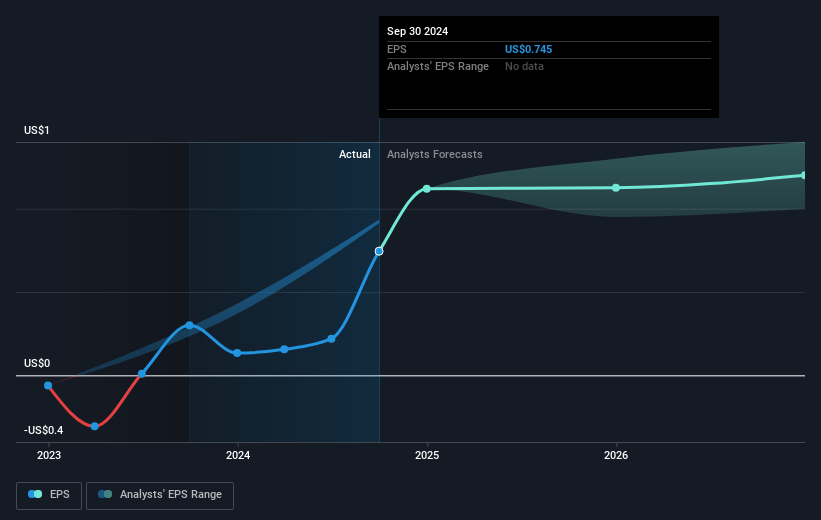

- Analysts expect earnings to reach $47.6 million (and earnings per share of $1.37) by about November 2027, up from $24.9 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $32.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.2x on those 2027 earnings, down from 21.6x today. This future PE is lower than the current PE for the US Insurance industry at 13.5x.

- Analysts expect the number of shares outstanding to grow by 0.83% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.93%, as per the Simply Wall St company report.

Donegal Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Donegal Group's exposure to weather-related losses, such as Hurricane Helene, which caused significant financial impact, poses a risk to future earnings stability.

- The strategic nonrenewal of commercial policies in Georgia and Alabama may indicate challenges in maintaining profitability, potentially affecting future revenue growth.

- The current competitive state of the workers' compensation market, with decreasing rate pressure, could impact future revenue and margins due to pricing constraints.

- Ongoing expense reductions, although positive for margins, may indicate underlying pressure to improve profitability amidst rising operational costs, possibly impacting future earnings.

- Potential increases in liability severity driven by factors such as social inflation and litigation trends could threaten future profitability and margins, necessitating continued rate adjustments.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $15.5 for Donegal Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.2 billion, earnings will come to $47.6 million, and it would be trading on a PE ratio of 13.2x, assuming you use a discount rate of 5.9%.

- Given the current share price of $15.89, the analyst's price target of $15.5 is 2.5% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives