Narratives are currently in beta

Key Takeaways

- By reducing quota share and leveraging reinsurance pricing, American Coastal is expected to improve net margins and earnings stability despite hurricane risks.

- Growth initiatives like policy takeouts and a new apartment program aim to boost revenue, supported by strong liquidity and capital strength.

- Weather-related events and increased operating expenses due to reinsurance and policy costs may pressure American Coastal Insurance's profitability and financial stability.

Catalysts

About American Coastal Insurance- Through its subsidiaries, primarily engages in the commercial and personal property, and casualty insurance business in the United States.

- American Coastal has reduced its quota share from 40% to 20%, meaning they are retaining more of the underwriting profit, which is expected to lead to increased net margins and earnings.

- The favorable reinsurance pricing and implementation of a strong business continuity plan may help ensure efficient operations during hurricanes, resulting in improved margins and earnings stability.

- Successful participation in policy takeout from Citizens, adding to American Coastal’s condo book and launching a new apartment program, is expected to boost future revenue growth.

- Retaining lower net hurricane losses compared to peers, and a robust reinsurance tower to protect against future hurricane events, positions the company for operational resilience and maintains net margin stability.

- Increased cash and investments, resulting from strong underwriting results, boosts liquidity and capital strength, potentially enhancing the company's ability to respond to market opportunities, thus supporting future revenue and earnings growth.

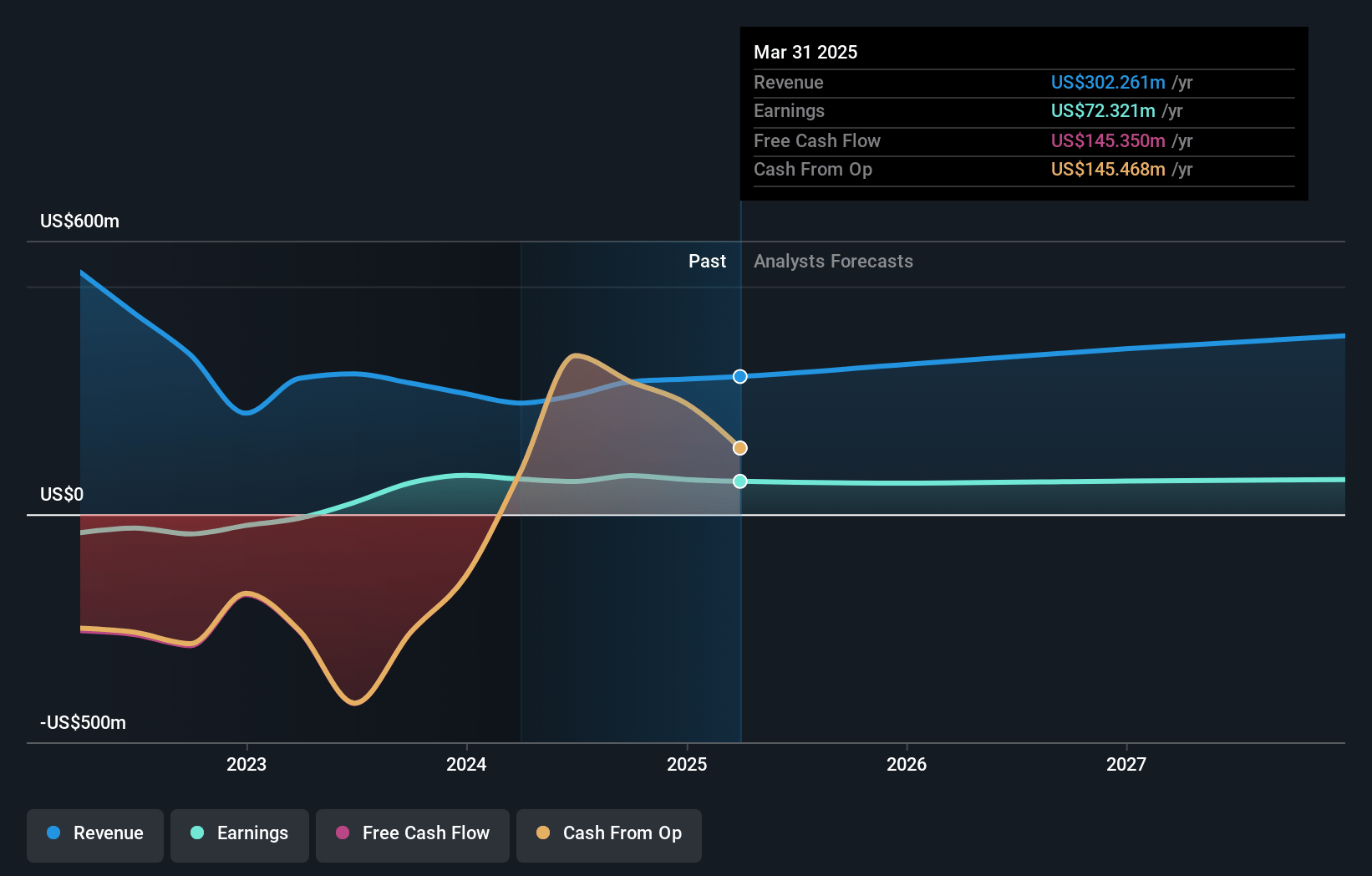

American Coastal Insurance Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming American Coastal Insurance's revenue will grow by 12.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 29.2% today to 18.9% in 3 years time.

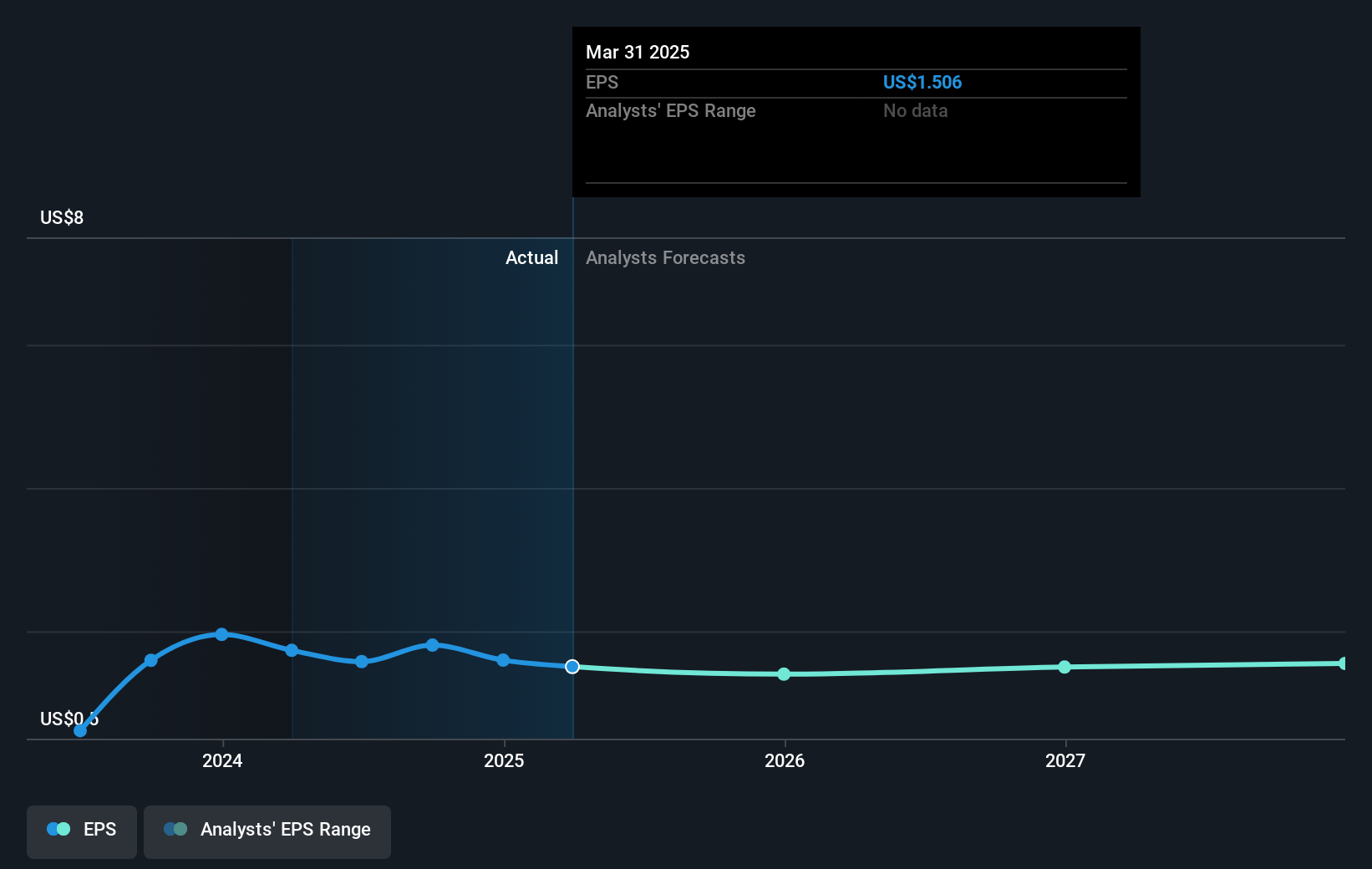

- Analysts expect earnings to reach $78.7 million (and earnings per share of $1.59) by about November 2027, down from $84.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.9x on those 2027 earnings, up from 7.4x today. This future PE is lower than the current PE for the US Insurance industry at 13.5x.

- Analysts expect the number of shares outstanding to grow by 0.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.19%, as per the Simply Wall St company report.

American Coastal Insurance Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The occurrence of multiple hurricanes, such as Milton, resulted in substantial after-tax losses, highlighting the risk of significant weather-related expenses that could adversely impact net margins and earnings.

- The need to pay approximately $13 million in additional ceded premiums to reinstate reinsurance limits following recent hurricanes may increase operating expenses and reduce net income.

- The company’s exposure to potential additional hurricanes in Florida this year, despite reinsurance, poses a risk of further losses, potentially impacting future earnings and financial stability.

- Increased policy acquisition costs and general administrative expenses, driven by decreased ceding commission income, may pressure operating margins and overall profitability.

- Comparisons to financial performance in prior periods show susceptibility to hurricane activity, as 2024 incurred significant hurricane losses while 2023 did not, indicating potential volatility in future revenue and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $16.0 for American Coastal Insurance based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $417.5 million, earnings will come to $78.7 million, and it would be trading on a PE ratio of 11.9x, assuming you use a discount rate of 6.2%.

- Given the current share price of $12.99, the analyst's price target of $16.0 is 18.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives