Narratives are currently in beta

Key Takeaways

- Strong international growth and digital channel acceleration are expected to boost revenue and enhance net margins.

- U.S. retail expansion with major partners and ongoing innovation strategy support market penetration and sustained revenue growth.

- Reliance on the Chinese supply chain and increased inventory may expose e.l.f. Beauty to tariff risks, liquidity issues, and pressure on margins.

Catalysts

About e.l.f. Beauty- Provides cosmetic and skin care products under the e.l.f.

- E.l.f. Beauty's strong international growth, driven by expansion into new markets and increasing market share in existing ones, is expected to significantly boost future revenue.

- The acceleration of digital channels, including enhancements to the Beauty Squad loyalty program, supports higher average order values and purchase frequency, likely enhancing net margins due to the higher efficiency of digital sales.

- Planned expansions in U.S. retail space, notably with major partners like Target, Walgreens, and Dollar General, are set to drive further market penetration and sales growth, impacting overall revenue positively.

- E.l.f.'s ongoing innovation strategy, which includes launching top-performing new products, is anticipated to support sustained market share gains and revenue growth, while maintaining competitive pricing could also protect or enhance net margins.

- Initiatives to diversify supply sourcing and expand international distribution may offset potential tariff impacts and enhance gross margins, while e.l.f.'s share repurchase program could bolster earnings per share (EPS) in the long run.

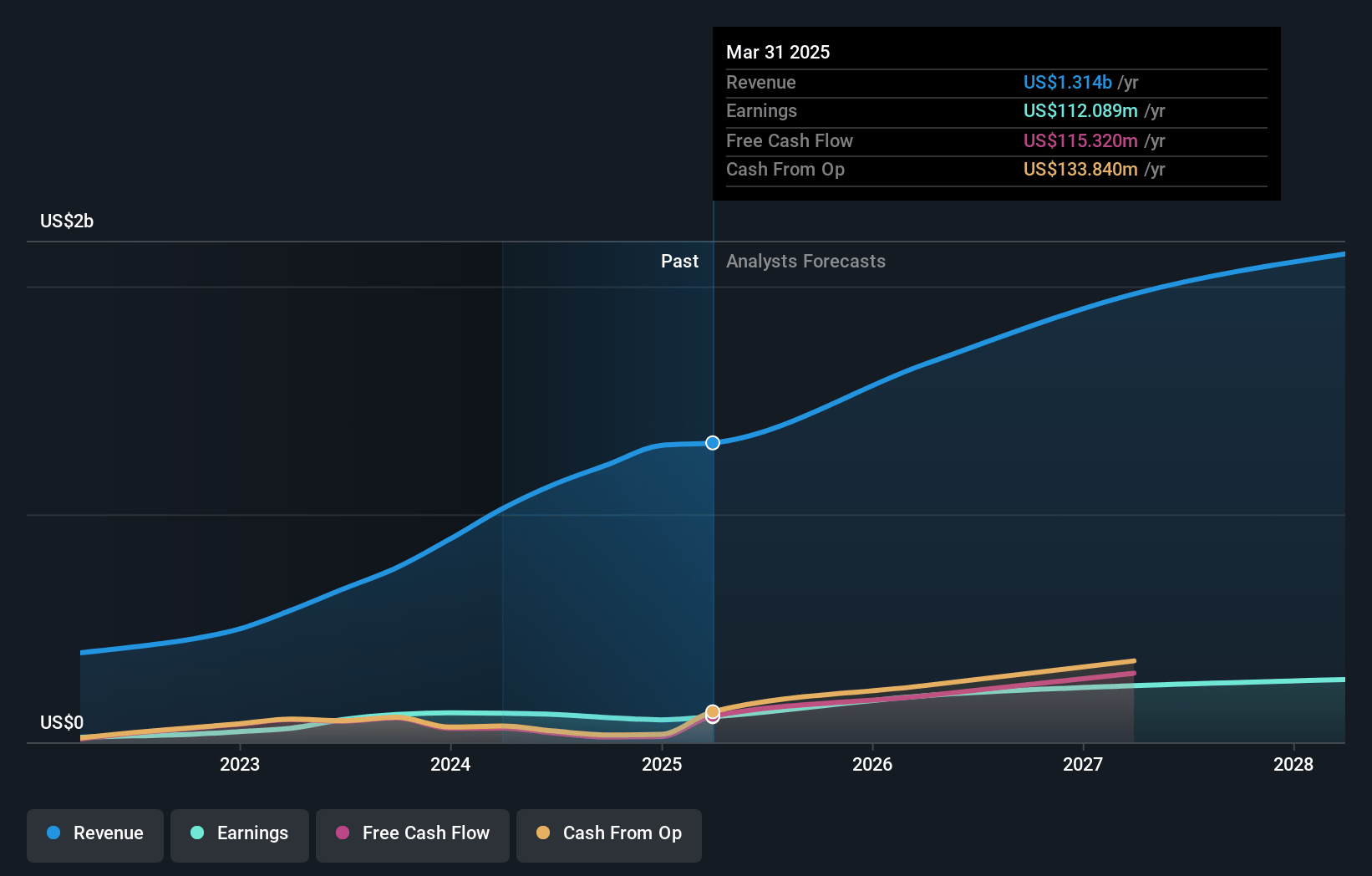

e.l.f. Beauty Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming e.l.f. Beauty's revenue will grow by 16.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.9% today to 16.0% in 3 years time.

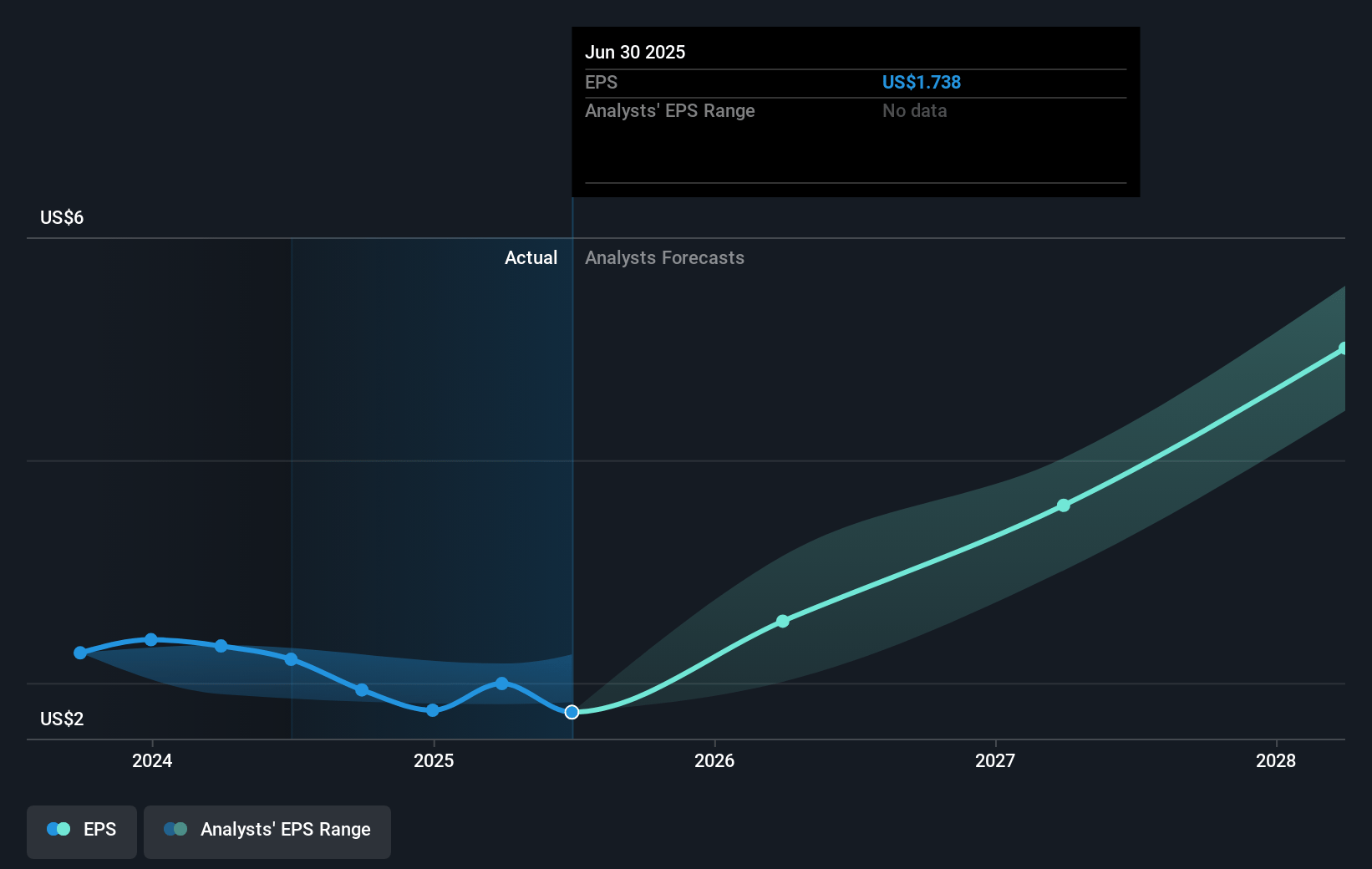

- Analysts expect earnings to reach $307.9 million (and earnings per share of $4.29) by about November 2027, up from $108.0 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $174.6 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 44.5x on those 2027 earnings, down from 68.5x today. This future PE is greater than the current PE for the US Personal Products industry at 26.8x.

- Analysts expect the number of shares outstanding to grow by 8.42% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.76%, as per the Simply Wall St company report.

e.l.f. Beauty Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The overall color cosmetics category showed a larger-than-expected decline, with trends contracting by 5% in Q2, potentially impacting e.l.f. Beauty's future revenue growth despite market share gains.

- Dependency on the Chinese supply chain continues, with 80% of products still coming from China, which exposes the company to tariff risks and could affect net margins and profitability.

- Accelerated marketing and digital expenditures increased SG&A as a percentage of net sales from 45% to 53%, which may put pressure on earnings if these investments do not yield expected returns.

- e.l.f. Beauty's significant inventory increase may lead to cash flow issues, and potential obsolescence risks if demand forecasts are incorrect, impacting liquidity and net margins.

- The company's expansion into new international markets requires careful execution and may involve risks related to unexpected costs or regulatory challenges, which could affect future earnings and financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $158.5 for e.l.f. Beauty based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $200.0, and the most bearish reporting a price target of just $115.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.9 billion, earnings will come to $307.9 million, and it would be trading on a PE ratio of 44.5x, assuming you use a discount rate of 6.8%.

- Given the current share price of $131.33, the analyst's price target of $158.5 is 17.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

US$251.03

FV

51.7% undervalued intrinsic discount16.16%

Revenue growth p.a.

1users have liked this narrative

0users have commented on this narrative

1users have followed this narrative

4 months ago author updated this narrative