Key Takeaways

- Expanding ready-to-drink and powder products in a low-penetration market shows untapped revenue potential with strategic investments improving market presence and brand margins.

- International growth, capacity increases, and marketing campaigns promise to boost sales and expand market share for brands like Premier Protein and Dymatize.

- Rising input costs and increased marketing expenditures could pressure margins, while dependence on Premier Protein and limited scalability pose growth risks.

Catalysts

About BellRing Brands- Provides various nutrition products in the United States.

- BellRing Brands is experiencing significant growth potential in the convenient nutrition category, especially with ready-to-drink shakes and powders, which have delivered double-digit growth over the last four years. The low household penetration of 48% compared to other mature categories indicates a large untapped market that could drive future revenue growth.

- The company is preparing to launch national advertising campaigns, increasing their marketing spend considerably to drive awareness and demand for their brands like Premier Protein. This strategic investment is expected to lift sales, which will likely offset increased input and marketing costs, thereby potentially improving net margins in the long term.

- BellRing has successfully increased its shake production capacity, which was previously a constraint. With constraints removed, the company can now pursue aggressive sales strategies, potentially increasing volumes, and ultimately driving revenues higher.

- The Premier Protein brand has demonstrated strong growth in metrics such as household penetration and market share, with plans for continued expansion in distribution and new product offerings. This expansion is anticipated to significantly boost the brand's revenue and, consequently, the company's earnings.

- Dymatize's international sales continue to grow robustly, with net sales up 30% this past quarter. The strong performance in international markets, coupled with new product launches and marketing campaigns, is expected to bolster revenue growth across global markets for BellRing.

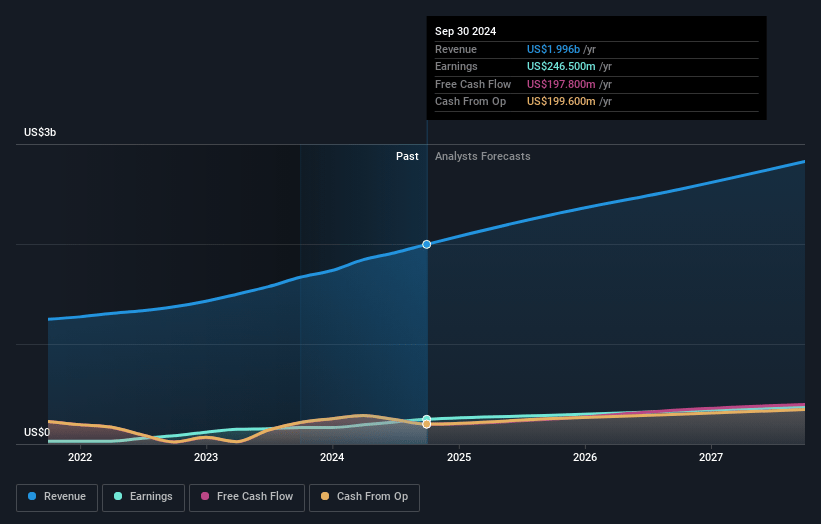

BellRing Brands Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming BellRing Brands's revenue will grow by 12.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.3% today to 13.1% in 3 years time.

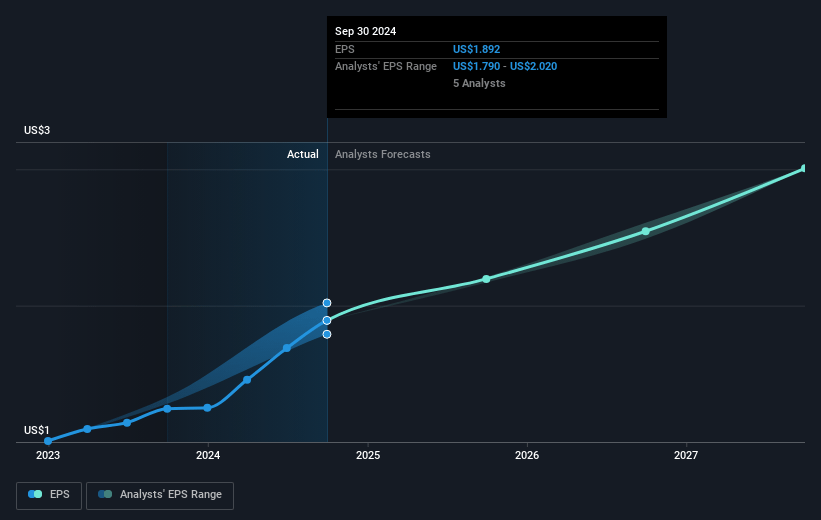

- Analysts expect earnings to reach $371.1 million (and earnings per share of $3.01) by about January 2028, up from $246.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.0x on those 2028 earnings, down from 40.9x today. This future PE is greater than the current PE for the US Personal Products industry at 26.2x.

- Analysts expect the number of shares outstanding to decline by 1.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.85%, as per the Simply Wall St company report.

BellRing Brands Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising input cost inflation, particularly in the powder business with projected increases as high as 50% in Q1, could pressure net margins and profitability if not managed effectively.

- Increased marketing and advertising expenditures, while aimed at driving future growth, represent a near-term headwind and may lower EBITDA margins if sales growth does not materialize as expected.

- There are risks associated with assumed demand for new innovations and expansions in distribution; failure to meet growth targets or misjudging consumer interest could negatively impact net sales growth expectations.

- Significant dependence on Premier Protein’s continued robust performance; any lapse in its dominance or any inefficiencies in the rollout of its initiatives could result in lowered revenue projections.

- The expanded capacity planning through existing networks without new lines might limit longer-term scalability; if demand accelerates beyond current projections, it could restrain production and revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $84.14 for BellRing Brands based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $92.0, and the most bearish reporting a price target of just $75.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.8 billion, earnings will come to $371.1 million, and it would be trading on a PE ratio of 34.0x, assuming you use a discount rate of 6.8%.

- Given the current share price of $78.15, the analyst's price target of $84.14 is 7.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives