Last Update08 Aug 25Fair value Increased 13%

The upward revision in Beauty Health’s consensus price target to $1.75 is primarily driven by a substantial increase in revenue growth forecasts and a lower discount rate, signaling improved growth expectations and a more favorable risk profile.

What's in the News

- Company updated earnings guidance, projecting Q3 net sales of $65–$70 million and full-year net sales of $285–$300 million, citing strong first half performance.

- Filed a Certificate of Correction amending its Certificate of Incorporation.

- Announced addition to multiple Russell Value benchmark indices, including Russell 2000, 2500, 3000, Microcap, Small Cap Comp, and 3000E Value indices.

- Launched Hydrafacial HydraFillic with Pep9 Booster, a new proprietary clinical skin treatment aimed at anti-aging and hydration, reinforcing innovation in non-invasive aesthetics.

- Entered into privately negotiated exchange agreements to swap $413.2 million of 1.25% convertible senior notes due 2026 for $250 million of new 7.95% senior secured convertible notes due 2028, plus $143.4 million in cash.

Valuation Changes

Summary of Valuation Changes for Beauty Health

- The Consensus Analyst Price Target has risen from $1.66 to $1.75.

- The Consensus Revenue Growth forecasts for Beauty Health has significantly risen from 0.8% per annum to 3.6% per annum.

- The Discount Rate for Beauty Health has fallen from 12.32% to 11.29%.

Key Takeaways

- Overreliance on premium offerings and Hydrafacial leaves the company vulnerable to shifting consumer trends, economic pressures, and evolving competitive dynamics.

- Rising regulatory and sustainability demands may increase costs and suppress margins, hampering long-term revenue and earnings growth.

- High recurring revenue from consumables, successful product innovation, expanding global reach, strong operational discipline, and industry-leading brand loyalty support sustainable growth and profitability.

Catalysts

About Beauty Health- Designs, develops, manufactures, markets, and sells esthetic technologies and products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

- Investor expectations may be too optimistic regarding the company's ability to maintain strong growth in premium beauty device and consumable sales, overlooking the risk that lower birth rates and an aging population in developed markets could stagnate or slow long-term demand for new discretionary beauty treatments, potentially capping future revenue growth.

- The stock could be overvalued if the current price reflects an assumption that Beauty Health will continue expanding its addressable market across all demographics, even though persistent economic inequality and macro pressures limit consumer spending on premium and elective beauty procedures, creating headwinds for both revenue and margin expansion.

- Increased global scrutiny on environmental impacts and regulatory requirements-especially as governments raise standards on product safety, efficacy, and sustainability-may lead to higher operational costs, limiting margin improvements and potentially dampening demand, which would negatively impact net margins and earnings over time.

- A reliance on the Hydrafacial franchise for the majority of revenues increases the risk to top-line growth if consumer tastes evolve or if new at-home or digital skin health solutions reduce demand for in-office treatments, leading to revenue volatility and limiting the company's longer-term growth trajectory.

- Competitive threats from large multinational beauty companies and innovative indie brands investing in high-tech and personalized skincare could intensify, driving price pressures and eroding Beauty Health's market share, ultimately weighing on future revenue and profit growth.

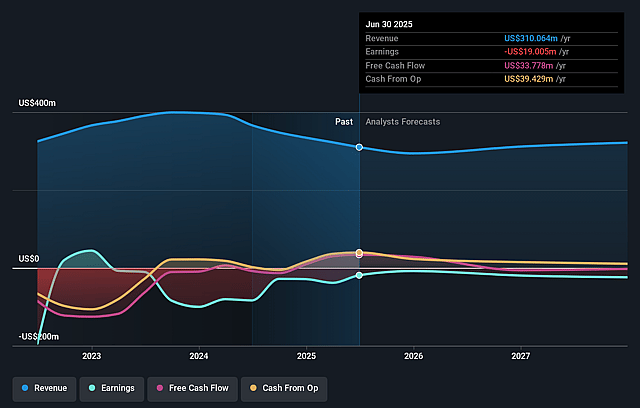

Beauty Health Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Beauty Health's revenue will grow by 3.2% annually over the next 3 years.

- Analysts are not forecasting that Beauty Health will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Beauty Health's profit margin will increase from -6.1% to the average US Personal Products industry of 5.6% in 3 years.

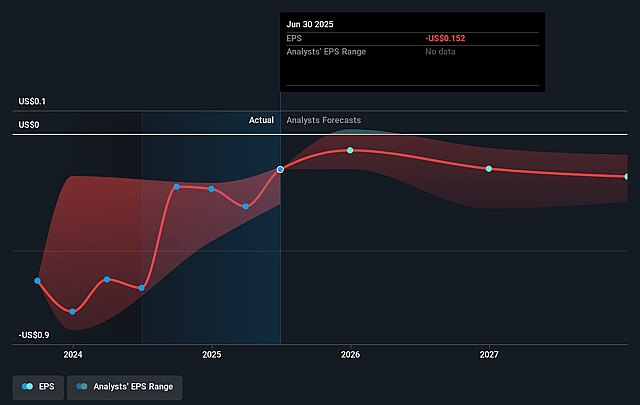

- If Beauty Health's profit margin were to converge on the industry average, you could expect earnings to reach $19.1 million (and earnings per share of $0.14) by about August 2028, up from $-19.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.9x on those 2028 earnings, up from -14.5x today. This future PE is lower than the current PE for the US Personal Products industry at 21.0x.

- Analysts expect the number of shares outstanding to grow by 2.26% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.6%, as per the Simply Wall St company report.

Beauty Health Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong, growing recurring revenue from consumables: The company reported that over 70% of revenue now comes from consumables (razor-razor blade model), with year-over-year growth in Americas and EMEA, high loyalty among providers, and successful, clinically-backed product launches. This recurring, sticky revenue stream underpins gross margin expansion and earnings resilience.

- Successful innovation pipeline and launch cadence: The rapid launch and adoption of new boosters (e.g., HydraFillic with Pep9), planned introduction of backbar and skincare lines, and continued investment in clinically-validated innovation indicate robust product development that can drive both device utilization and consumables growth, positively impacting future revenue and margins.

- Expanding global footprint and diversified revenue: The installed base of devices has grown (35,000+ active devices), with ongoing international market penetration, double-digit consumables growth in EMEA, and strategic reorganization in China positioning the company for future stable sales and reduced overreliance on North America, supporting long-term revenue growth and earnings stability.

- Operational improvements and cost discipline: The company has delivered three consecutive quarters of exceeding revenue and adjusted EBITDA guidance, achieved a significant increase in gross margins (GAAP 62.8%, adjusted 65.9%), reduced operating expenses by nearly 18%, and managed inventory efficiently, resulting in improved profitability and potential for stronger net margins.

- Strong brand leadership and channel loyalty: HydraFacial remains one of the most in-demand, recognized treatments globally, driving high patient and provider engagement. The company excels in provider partnerships, boasts a high Net Promoter Score, and is rolling out strategic loyalty and engagement programs, which should boost customer lifetime value and support long-term recurring revenue and earnings visibility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $1.875 for Beauty Health based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $2.0, and the most bearish reporting a price target of just $1.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $341.2 million, earnings will come to $19.1 million, and it would be trading on a PE ratio of 17.9x, assuming you use a discount rate of 10.6%.

- Given the current share price of $2.17, the analyst price target of $1.88 is 15.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.