Key Takeaways

- Breakthrough product launches, provider-focused innovation, and loyalty programs are positioned to drive recurring high-margin sales and expand market reach amid a shift to non-invasive self-care.

- Streamlined operations, centralized manufacturing, and adoption of digital channels could boost profitability, customer retention, and accelerate efficient global expansion beyond current analyst expectations.

- Overdependence on a single product line and shifting consumer preferences threaten Beauty Health's market share, margins, and long-term earnings amid intensifying competition and macroeconomic pressures.

Catalysts

About Beauty Health- Designs, develops, manufactures, markets, and sells esthetic technologies and products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

- Analyst consensus sees improved sales execution and pricing as drivers of modest future growth, but with the rapid adoption of new boosters like HydraFillic-with Pep9 instantly becoming the top-selling SKU-Beauty Health could achieve breakthrough consumable and device growth, materially accelerating revenue beyond current expectations as new products continue to outperform targets.

- While analysts broadly expect manufacturing consolidation and the China distributor shift to incrementally boost margins, the company's relentless operational streamlining, cost discipline, and centralized US manufacturing could deliver a step-change in gross and net margins, resulting in structurally higher profitability as tariff exposure and production overhead fall ahead of schedule.

- Beauty Health's increasingly provider-centric innovation pipeline-including rapid launches in boosters, treatment back bar, and dedicated skincare-positions the brand to leverage the ongoing global consumer shift toward non-invasive, elevated self-care experiences, unlocking recurring revenue streams and expanding total addressable market as preferences tilt further toward healthy aging and in-clinic wellness.

- The expanding installed base of over 35,000 active devices, robust double-digit growth in EMEA, and newly designed loyalty programs point to significantly enhanced customer retention and cross-selling opportunities, setting the stage for both higher customer lifetime value and sticky, high-margin recurring sales that boost earnings predictability.

- Beauty Health's infrastructure is primed for a digital-first consumer landscape, and as telehealth, influencer-driven education, and online booking converge, the company's lead generation, customer engagement, and scalable commercial model could allow for increased market penetration and accelerated global adoption, improving both top-line growth and efficiency of customer acquisition over the long term.

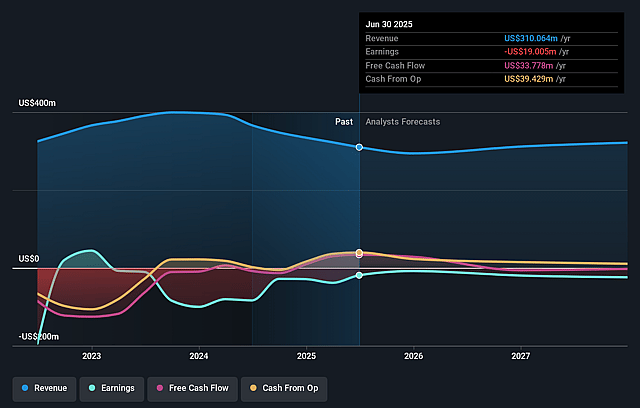

Beauty Health Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Beauty Health compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Beauty Health's revenue will grow by 3.0% annually over the next 3 years.

- Even the bullish analysts are not forecasting that Beauty Health will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Beauty Health's profit margin will increase from -6.1% to the average US Personal Products industry of 5.6% in 3 years.

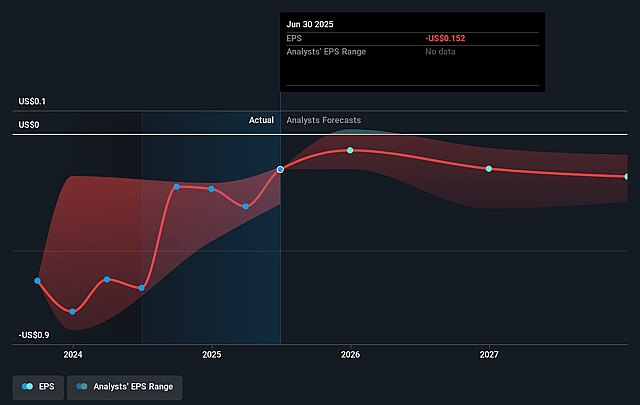

- If Beauty Health's profit margin were to converge on the industry average, you could expect earnings to reach $19.0 million (and earnings per share of $0.14) by about August 2028, up from $-19.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 19.4x on those 2028 earnings, up from -14.4x today. This future PE is lower than the current PE for the US Personal Products industry at 19.8x.

- Analysts expect the number of shares outstanding to grow by 2.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.88%, as per the Simply Wall St company report.

Beauty Health Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's overreliance on a narrow product portfolio, especially the HydraFacial platform and associated consumables, exposes it to the risk of competitive disruption or technological shifts toward natural, at-home, or multifunctional skincare solutions, which could negatively impact future revenue growth and gross margins.

- Intensifying competition from both large personal care conglomerates and emerging direct-to-consumer brands, combined with growing consumer scrutiny favoring natural, organic, and DIY beauty solutions over device-based in-clinic treatments, threatens Beauty Health's ability to maintain pricing power and market share, putting pressure on both revenue and profitability.

- Ongoing macroeconomic headwinds and income polarization are already pressuring discretionary spending on beauty services, contributing to a significant year-over-year device revenue decline of 36.5 percent and raising concerns about the longer-term growth of Beauty Health's addressable market, ultimately impacting total earnings potential.

- Regional shifts such as the transition to a distributor model in China, tariff exposure, and ASP pressure (with distributor business seeing 30 to 40 percent discounts) point to future compressions in gross margins and gross profit, especially as international expansion efforts may not immediately offset these near-term financial headwinds.

- The rising trend toward telehealth, at-home diagnostics, and digital beauty regimens, combined with churn among providers and the risk of weakening spa and clinic relationships, could dampen device placement and recurring consumable sales, reducing customer lifetime value and the company's ability to drive sustainable long-term net margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Beauty Health is $2.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Beauty Health's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $2.0, and the most bearish reporting a price target of just $1.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $338.4 million, earnings will come to $19.0 million, and it would be trading on a PE ratio of 19.4x, assuming you use a discount rate of 10.9%.

- Given the current share price of $2.16, the bullish analyst price target of $2.0 is 8.0% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.