Key Takeaways

- Securing new health plan customers and expanding existing ones promises revenue growth as partnerships mature and engagement increases.

- Transition to a value-based model may improve net margins by aligning incentives with medical cost savings.

- Ontrak faces challenges with declining revenue, gross margins, and customer retention, indicating potential instability and negative impacts on financial health and investor confidence.

Catalysts

About Ontrak- Operates as an artificial intelligence powered, telehealth-enabled, and virtualized healthcare company that provides in-person services to third-party payors in the United States.

- Ontrak has secured three new regional health plan customers and four health plan expansions in the last 14 months, which is expected to positively impact revenue growth as these new partnerships mature and engagement levels increase.

- The introduction of the WholeHealth+ solution with new customers, such as Intermountain Health, indicates a potential for increasing member enrollment and corresponding revenue growth as this solution proves its clinical and financial success.

- There are active discussions with six additional health plan prospects, including a significant opportunity with a large Midwest plan, which could more than double Ontrak's run rate revenue if agreements are finalized, thereby substantially increasing future earnings potential.

- Ontrak’s transition to being recognized as a value-based provider rather than a vendor is expected to reshape its economic model, potentially improving net margins by aligning financial incentives with medical cost savings.

- Robust sales pipeline development and new customer expansions present a path to double revenue in 2025 and again in the subsequent year, reflecting strong forward momentum in revenue growth and potential improvement in earnings.

Ontrak Future Earnings and Revenue Growth

Assumptions

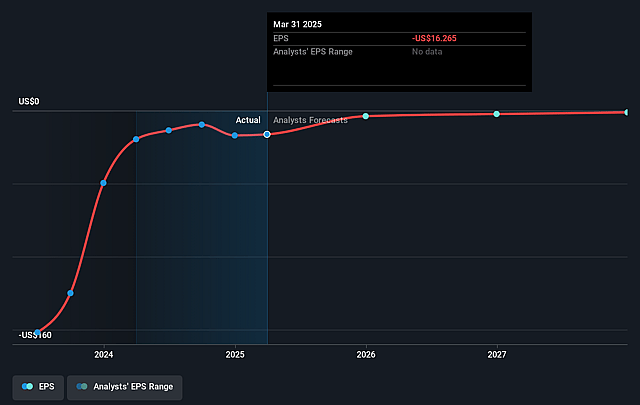

How have these above catalysts been quantified?- Analysts are assuming Ontrak's revenue will grow by 67.0% annually over the next 3 years.

- Analysts are not forecasting that Ontrak will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Ontrak's profit margin will increase from -799.8% to the average US Healthcare industry of 5.4% in 3 years.

- If Ontrak's profit margin were to converge on the industry average, you could expect earnings to reach $2.6 million (and earnings per share of $0.32) by about August 2028, up from $-81.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.6x on those 2028 earnings, up from -0.0x today. This future PE is lower than the current PE for the US Healthcare industry at 21.3x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.18%, as per the Simply Wall St company report.

Ontrak Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ontrak experienced an 11% decrease in Q4 revenue compared to the same period last year due to the loss of a key customer, which could impact future revenue stability and growth if customer churn continues.

- The company is facing a downward trend in gross margins, expected to decrease to the mid-50s, which could negatively impact their net margins and overall financial health.

- Higher disenrollment rates in the current quarter compared to previous quarters may affect the sustainability of revenue streams and customer retention, potentially leading to reduced earnings.

- Negative operating cash flow of $4.3 million in Q4 and decreasing cash reserves highlight cash flow challenges that could impact their ability to operationalize strategic opportunities and affect earnings negatively.

- The upcoming revenue drop anticipated in Q1 2025, with projections 27% to 36% lower than Q4, suggests potential volatility and unpredictability in revenue, which could influence investor confidence and market valuation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $3.0 for Ontrak based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $47.5 million, earnings will come to $2.6 million, and it would be trading on a PE ratio of 12.6x, assuming you use a discount rate of 10.2%.

- Given the current share price of $0.37, the analyst price target of $3.0 is 87.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.