Narratives are currently in beta

Key Takeaways

- Strategic expansion in ambulatory and hospital operations is driving revenue growth through M&A and new facilities.

- Effective cost management and capital strategies aim to enhance margins and shareholder value through share repurchases.

- Divestiture and procedural volume uncertainties, along with potential natural disasters, create risks to revenue growth and margin stability.

Catalysts

About Tenet Healthcare- Operates as a diversified healthcare services company in the United States.

- Tenet Healthcare anticipates significant growth in its ambulatory surgical business through M&A and the development of de novo facilities. This is expected to drive revenue and earnings growth.

- The company is expanding its hospital operations, having opened a new hospital in Westover Hills with more facilities under construction, aimed at meeting increasing demand and improving revenue per admission.

- Tenet's strategic shift to a portfolio with enhanced return profiles and more attractive geographies is expected to generate higher returns on invested capital, potentially boosting net margins and earnings.

- Efficient cost management and strong volume growth are anticipated to continue, keeping EBITDA margins robust, which would support earnings growth.

- Tenet is leveraging capital flexibly to return excess cash to shareholders through share repurchases, enhancing earnings per share as the company believes its stock remains undervalued.

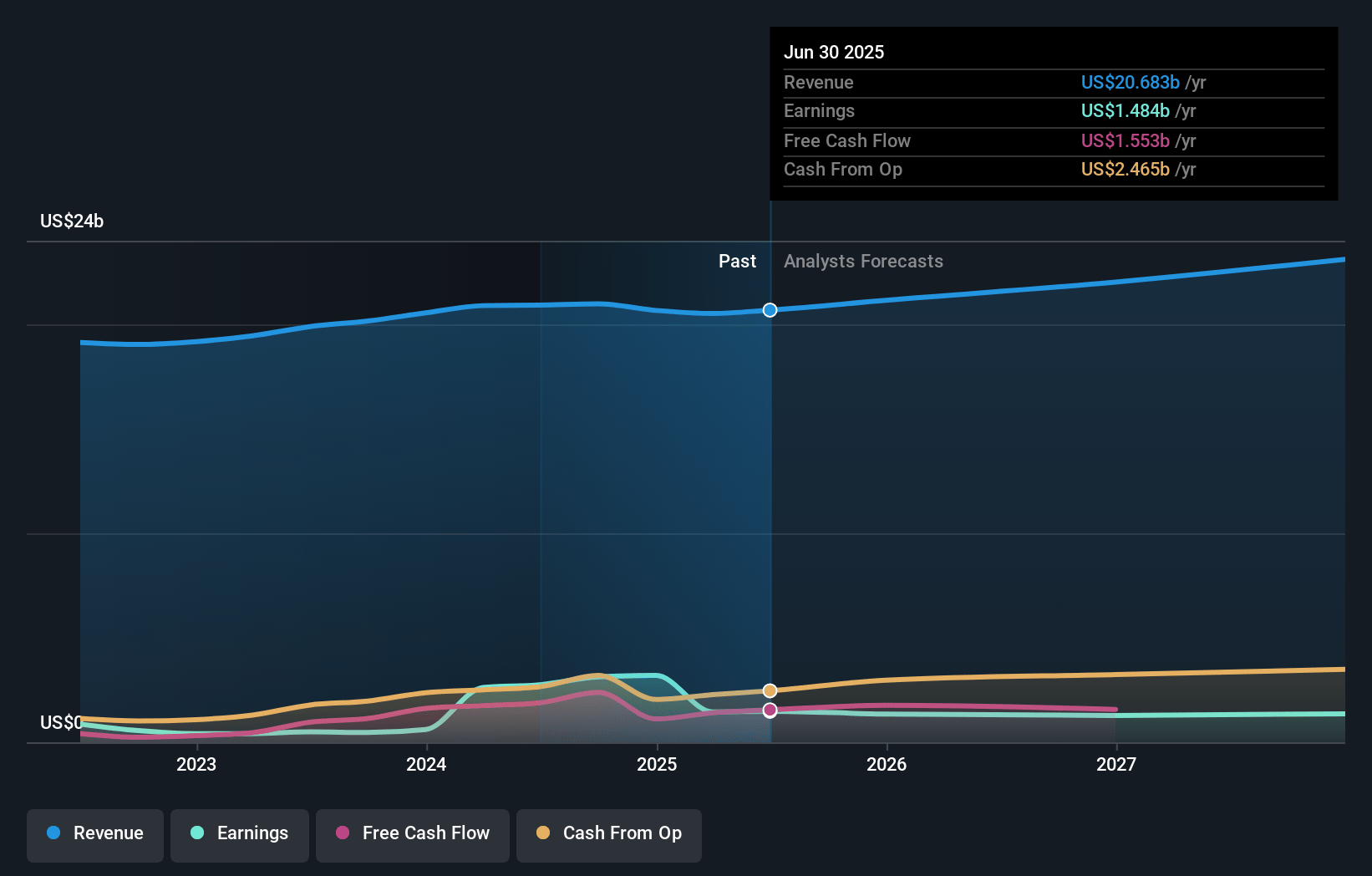

Tenet Healthcare Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Tenet Healthcare's revenue will grow by 3.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 14.9% today to 5.2% in 3 years time.

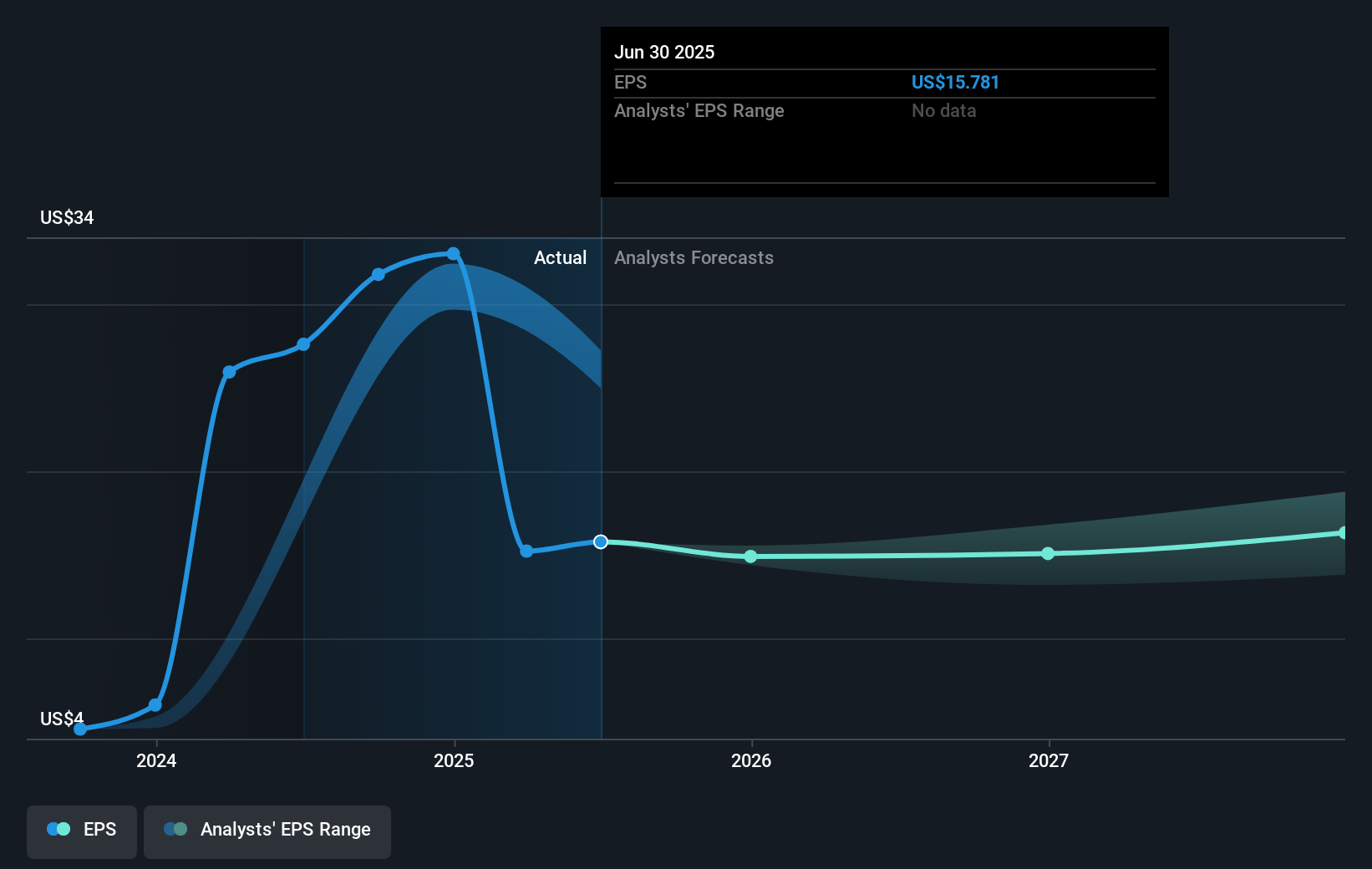

- Analysts expect earnings to reach $1.2 billion (and earnings per share of $12.4) by about January 2028, down from $3.1 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $1.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.3x on those 2028 earnings, up from 4.2x today. This future PE is lower than the current PE for the US Healthcare industry at 23.7x.

- Analysts expect the number of shares outstanding to grow by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.83%, as per the Simply Wall St company report.

Tenet Healthcare Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The sale of the Alabama hospitals could reduce overall revenue and earnings potential in the short term as the divested hospitals previously contributed to the financial results, impacting consolidated revenue growth.

- There is uncertainty in realizing expected gains from new Medicaid supplemental program payments in 2025, which could impact future revenue and earnings unpredictably.

- While the divestiture strategy aims to improve operational focus, there may be execution risks involved in fully achieving expected improvements in returns on invested capital, which can affect net margins.

- The impact of natural disasters like hurricanes on facilities and operations may disrupt revenue and regional earnings stability, particularly in affected regions.

- The continuation of high-margin procedural volumes such as orthopedic due to past growth trends might not sustain indefinitely, potentially impacting future revenue per case and adjusted EBITDA margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $177.21 for Tenet Healthcare based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $217.0, and the most bearish reporting a price target of just $140.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $23.2 billion, earnings will come to $1.2 billion, and it would be trading on a PE ratio of 17.3x, assuming you use a discount rate of 6.8%.

- Given the current share price of $139.67, the analyst's price target of $177.21 is 21.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives