Key Takeaways

- Margin and earnings growth are pressured by tariffs, regulatory scrutiny, reimbursement uncertainty, and rising global competition despite innovation and select product strength.

- Emerging market challenges, mature product reliance, and pricing pressures threaten topline growth and heighten risk to future earnings stability.

- Tariff exposure, product declines, OEM concentration, pricing pressure, and corporate restructuring risks threaten revenue growth, margin stability, and future earnings performance.

Catalysts

About Teleflex- Designs, develops, manufactures, and supplies single-use medical devices for common diagnostic and therapeutic procedures in critical care and surgical applications worldwide.

- While Teleflex benefits from increasing global procedure volumes as populations age and chronic disease prevalence rises, significant headwinds from recently enacted and potential future tariffs create uncertainty around cost structure and are expected to compress gross margins by up to 180 basis points in 2025, directly impacting near-term operating margins and earnings.

- Although Teleflex is advancing product innovation in vascular access and interventional cardiology, with launches like the Ringer PBC catheter and the imminent acquisition of BIOTRONIK Vascular Intervention, persistent pricing pressures from hospitals and providers seeking cost-effective solutions—especially under global cost constraints and reimbursement reductions—could limit the uplift in overall revenue growth from these innovative offerings.

- While growth in emerging markets and APAC is a longer-term positive, the company is currently contending with volume-based procurement in China, which resulted in a nearly 10% revenue decrease in Asia in the first quarter and a projected $100 million headwind to 2025 revenue, with risks that government budget constraints and procurement dynamics continue to challenge revenue recovery in the region.

- Despite an active portfolio optimization strategy and planned business separation to unlock value, continued heavy reliance on mature core product categories and exposure to product-specific reimbursement changes (such as in UroLift) present risk of slow topline growth and could weigh on both RemainCo and SpinCo’s future earnings profiles.

- While robust demand for high-growth franchises like PICCs and intra-aortic balloon pumps highlights pockets of strength, accelerating industry-wide regulatory scrutiny, ongoing need for costly compliance, and rising global competition may extend product approval timelines and drive up costs, putting sustained pressure on Teleflex's ability to expand net margins over the longer term.

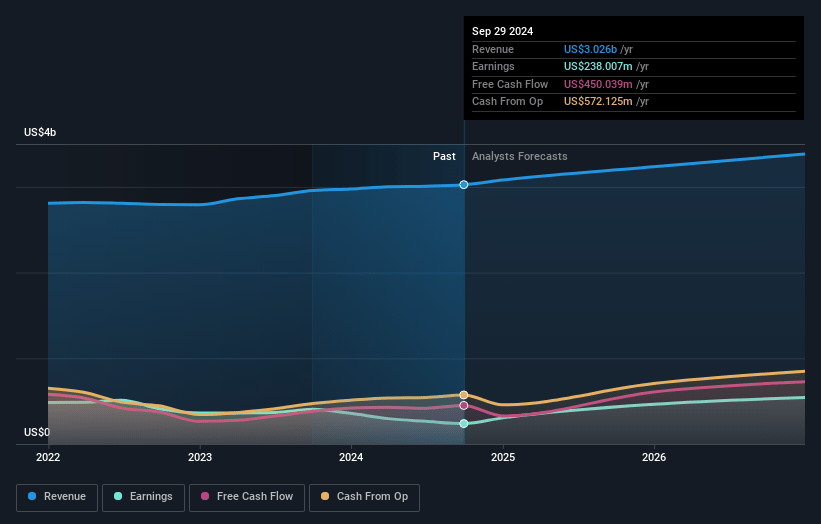

Teleflex Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Teleflex compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Teleflex's revenue will grow by 3.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 5.0% today to 9.7% in 3 years time.

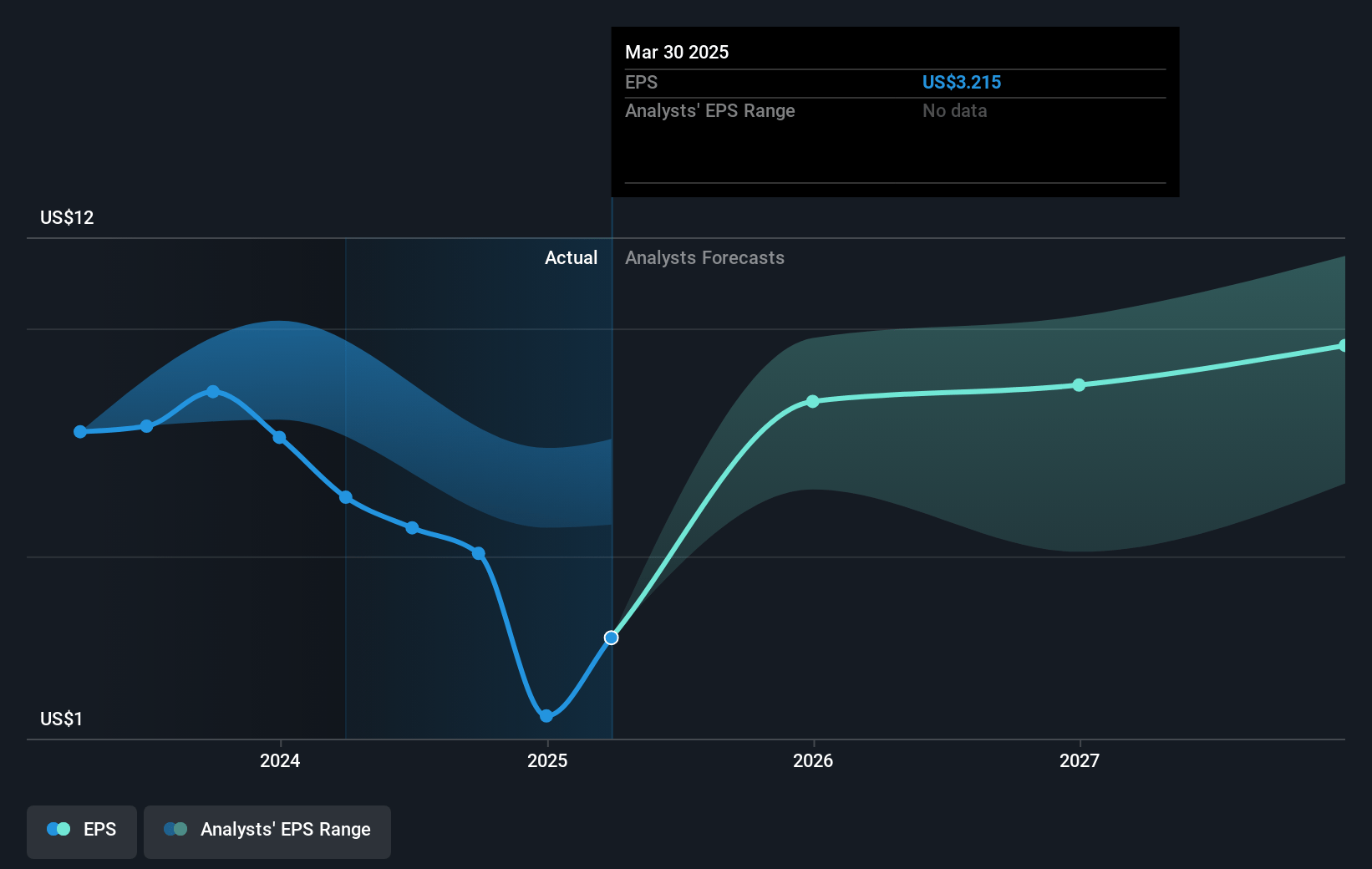

- The bearish analysts expect earnings to reach $322.9 million (and earnings per share of $7.32) by about July 2028, up from $149.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 17.2x on those 2028 earnings, down from 34.6x today. This future PE is lower than the current PE for the US Medical Equipment industry at 31.1x.

- Analysts expect the number of shares outstanding to decline by 6.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.89%, as per the Simply Wall St company report.

Teleflex Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent and significant tariff exposure, especially to China and Mexico, is resulting in a projected $55 million gross margin headwind in 2025, with mitigation strategies taking time to implement and continued policy uncertainty creating ongoing risk to operating margins and net earnings.

- Core product categories such as interventional urology (notably UroLift) and anesthesia are experiencing year-over-year revenue declines due to reimbursement changes, tough comps, and market dynamics, indicating long-term growth stagnation within mature segments and threatening topline revenue growth.

- The OEM business is highly concentrated, suffered from major customer contract losses and sustained inventory management issues, which are expected to create approximately $100 million in revenue headwinds in 2025, and exposes the company to customer concentration risk affecting future revenues.

- Intensifying pricing pressure from hospitals, global reimbursement changes, and value-based care adoption undermine Teleflex's ability to take aggressive pricing action to offset cost inflation and tariffs, potentially compressing both revenue and net margins over the long term.

- Execution risk and uncertainty surrounding the proposed corporate separation, potential sale of NewCo, and integration of BIOTRONIK Vascular Intervention may distract management and lead to integration challenges, transition costs, and disruption across commercial and R&D activities, which could impair both revenue growth and earnings delivery in the coming years.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Teleflex is $123.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Teleflex's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $200.0, and the most bearish reporting a price target of just $123.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $3.3 billion, earnings will come to $322.9 million, and it would be trading on a PE ratio of 17.2x, assuming you use a discount rate of 7.9%.

- Given the current share price of $117.24, the bearish analyst price target of $123.0 is 4.7% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.